The Week in Review: 10.11.10 – 10.15.10

This week was again a good one for stocks, with the Dow up .51% and the S&P up .95%. Meanwhile, the Nasdaq soared, up 2.77% for the week, helped along by positive earnings from Google (a personal favorite of this blog’s author) and Intel. In Ben Bernanke’s speech Friday morning, he made it clear that the Fed would stand ready to take further steps to help bolster the economy. However, the markets seemed largely to ignore his comments.

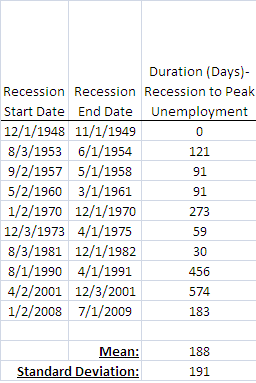

The recession ended June 30, 2009. There are some “talking heads” that say it’s been too long since then for unemployment still to be this high. They point to this fact as reason to fear further economic troubles. However, we can see by looking at some historical data (chart below) that there is no real “normal” amount of time that elapses before peak unemployment is reached. Since World War II, it has taken anywhere from 0 to 574 days to reach the unemployment peak after a recession. The average is 188 days, and our most recent recession gave us unemployment that peaked after 183 days. We say there is really nothing here to worry about yet.

Next week, we’ll look for numbers on industrial production, housing, and as always, weekly jobless claims.

Next week, we’ll look for numbers on industrial production, housing, and as always, weekly jobless claims.

This week’s factoid: The popular phrase “There’s the rub,” used when describing a key issue at the heart of a problem, actually comes to us from Shakespeare’s famous “To be or not to be” speech from Hamlet:

To die — to sleep.

To sleep — perchance to dream: ay, there’s the rub!

For in that sleep of death what dreams may come

When we have shuffled off this mortal coil,

Must give us pause.