The Weekly View (1/16/18)

What’s On Our Minds:

There’s a saying used this time of year as folks are diligently working on sticking to their new years’ resolution. – The trick of getting ahead is getting started. This phrase is especially true for saving for retirement. Below are our 10 tips that may help reach your retirement goals. Remember, it’s never too late to start and it doesn’t hurt to save more!

1. Start now

It’s a simple fact that the earlier you begin saving for retirement, the more time your money has to earn interest and grow. If you’ve put off saving until your 30s or later, make up for lost time now by stashing away 10 to 15 percent of your salary.Plan your retirement needs

2. Plan your retirement needs

If you want to retire at 55 and travel the globe or work for as long as you can but stick close to home, how much money you need to retire is unique to you. Rather than relying on figures that suggest you’ll need 80 percent of your preretirement income to live comfortably later in life, talk with your spouse and financial advisor to settle on an amount to save that’s tailored to you.

3. Learn about and contribute to your employer’s plan

If your employer offers a tax-sheltered plan, contribute at least enough to get the employer match. Your employer can provide you with a summary plan description, which recaps your plan and vesting eligibility, as well as an individual benefits statement.

4. Consider saving “on the side”

If you don’t have access to an employer-based plan, contributing to a traditional or Roth IRA allows you to get similar tax benefits for your retirement savings. Even if you do contribute to an employer-based plan, an IRA can supplement those savings.

5. Make saving as easy as possible

Eliminate the need to move money from one account to another by setting a monthly savings goal and automating a deposit to that amount. By making savings routine, you are more likely to see your retirement nest egg grow. To help boost your regular savings, funnel any extra cash windfalls, such as from a bonus or inheritance, directly to your retirement savings.

6. Increase savings as you near retirement

Your income will likely rise with age and experience, so it makes sense to save more as you earn more. After age 50, you will also be eligible for catch-up contributions, which allow you to contribute beyond the set limit. For 401(k)s, you can contribute an extra $6,000, while for IRAs you can contribute an extra $1,000.

7. Be an active participant in your plan

Automating your retirement savings and amount doesn’t mean you should “set it and forget it.” Examine your quarterly statements to ensure you are on track to meet your goals. Can you afford to contribute more? Are your investments still appropriate? Do you need to lower your exposure to risk? By taking active control now, you take control of creating the best retirement lifestyle possible.

8. Decide on your Social Security strategy

Social Security benefits may be available at age 62, but up until age 70, your retirement benefit will increase by a fixed rate (based on your year of birth) each year you delay retirement. Waiting means you may be able to take advantage of some extra cash. If you are married, you may also be able to receive spousal benefits, which boost the amount you and your spouse receive in Social Security as a couple. To learn more, visit www.socialsecurity.gov.

9. Be a savvy investor

It’s important to be smart about not only the amount you save but also how you save. To help insulate against market swings, diversify your investments within sectors and across asset classes and geographic regions. The more intentional you are about where your assets are invested, the more secure you can feel about them.

10. Don’t touch your savings until retirement

Dipping into your retirement savings is a last resort. In addition to harsh penalties, you lose principal, which in turn depletes interest earnings and tax benefits. Also, if you switch jobs, rollover your retirement account rather than “cashing out.” Preserving your retirement savings may be difficult when funds are tight, but will benefit you when you truly need it most.

Last Week’s Highlights:

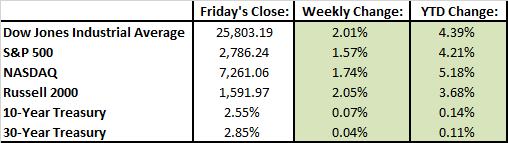

Stocks were up for the second week in a row. We have had a remarkable start to the year and major indexes are up more than 4%. Stocks have not recorded two consecutive weeks of 1% moves higher since July of 2016. Earnings season kicked off last week. Big banks reported losses due to the new tax code but had pre-announced so the loses had been baked into share prices.

Looking Ahead:

Markets were closed on Monday in observance of Martin Luther King Day. Along with earnings reports coming across the wire, investors will be eyeing some important economic data this week. Industrial production and capacity utilization is reported on Wednesday. Housing starts are reported on Thursday followed by consumer sentiment data on Friday.