The Weekly View (3/12/18)

What’s On Our Minds:

Warren Buffett recently announced that he’s offering up $1 million per year, for life, to one of his 377,000 employees if they can correctly predict the NCAA basketball teams that make it to the tournament’s Sweet Sixteen. A charitable gesture? Hardly. USA Today reminds us that the odds of predicting the sixteen bracket slots correctly is less than one in a million. Still, with 377,000 employees, someone at Berkshire Hathaway has a shot, right? Our own math suggests someone at the USA Today writing office is being lazy: the chances of randomly* picking those 48 games correctly is more like one in 281,400,000,000,000.

This is a great example of how Warren Buffett knows what Tufton knows: most people vastly overestimate their chances of being “right.” We all have a bias in thinking that we have special information, looking for that unique chance to make a million dollars (every year for life, in this case). A better route is to depend on two things: a time-tested, rational strategy, and other people consistently acting on their emotions— and being wrong.

Aside from his basketball wager, the billionaire investor also made headlines recently when he released his annual letter to Berkshire Hathaway shareholders on February 24th. His letter was shorter this year than in years past at “just” sixteen pages, but readers got a good idea of how Buffett is feeling about his business and the market.

For some perspective on Buffett’s success and why his annual letter draws so much attention from investors, let’s briefly consider what brought us here. When Warren Buffet acquired a controlling stake in Berkshire in 1965, the stock was trading at $18 per share. Since then, the stock has risen to $314,345 per share, a return of 1,600,000%. Comparatively, the S&P 500 has returned 3,000% over the same time. It’s no wonder that investors anticipate Buffet’s annual insights and are keen to hear how his company will move forward now that he is eighty-seven years old and his partner Charlie Munger is ninety four. They have had an amazing run, but they are not exactly spring chickens!

Buffett held his cards close to the chest when discussing a succession plan at Berkshire, noting “Our directors know my recommendations. All candidates currently work for or are available to Berkshire and are people in whom I have total confidence.” Many commentators have speculated that board members Gregory Abel and Ajit Jain could potentially be tapped to take the reins at Berkshire.

Buffett was also a bit vague on Berkshire’s plans to spend the company’s $116 billion in cash that it has amassed. For the most part, it sounds as if Buffett has had trouble finding anything to buy – at least at what he considers an attractive valuation. The company only spent $2.7 billion on acquisitions in 2017. By comparison, Berkshire spent $31 billion buying companies in 2016. There is speculation that moving forward Buffett may finally begin to pay a dividend to shareholders, instead of using all the company’s cash to make acquisitions. Buffett’s struggle to find businesses that are “affordable” according to his own strict calculations reminds us of his mentor, the fabled value investor Benjamin Graham.

As he has in years in the past, Buffet dedicated a portion of his letter criticizing the “helper” class of investment professionals (those who use products with high fees that deliver under performance over the long term). This year, Buffett wrote, “Performance comes, performance goes. Fees never falter.”

*Nitpicker’s note: The winners aren’t exactly random. For example, there’s a pretty good chance that in the first round, the #1 seed will beat the #16 seed in each of the four divisions. But those exact probabilities are largely a matter of opinion, so we used 50% for our calculations. The actual probability of choosing a correct bracket will be better than our number.

Last Week’s Highlights:

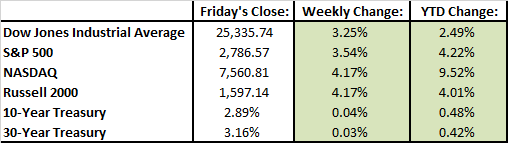

Stocks had a very strong week and closed out the week considerably higher. The Dow gained 3.5%, the S&P 500 rose 3.9%, and the Nasdaq increased 3.1%.

Stocks struggled on Wednesday after Gary Cohn announced late on Tuesday that he was planning on resigning as President Trump’s top economic adviser. Cohn has long been considered a free trade supporter and most are speculating that the President’s protectionist ideas in recent weeks brought about his exit. On Tuesday, fears of an impending trade war were tempered when the President announced Canada and Mexico would be excluded from steel and aluminum tariffs.

Friday’s Jobs Report revealed robust jobs gains which pushed the market higher. The US economy added 313,000 jobs in February, but wage growth came in below expectations. Friday’s data and reaction was a marked difference from January which showed a spike in hourly earnings. Lower wage growth in February quelled investors’ inflation fears on Friday.

Looking Ahead:

Information is light this week but investors will likely continue to focus on inflation and how it could weigh on the Federal Reserve’s interest rate decisions moving forward. We get indication of inflation this week, with an update on consumer prices due Tuesday. Retail sales are scheduled for release on Wednesday.