The Weekly View (4/2/18)

What’s On Our Minds:

Investor sentiment continues to swing between optimism and pessimism as new information about the technology sector, global trade, and monetary policy is released. Over the past two weeks, investors have not taken kindly to the data privacy controversy engulfing Facebook which, up until recently, was one of the most popular stocks on Wall Street. Recent turbulence in the tech industry adds another element of uncertainty to an existing combination of worries: that inflation might bubble up and prompt the Federal Reserve to hike interest rates faster than expected, and that President Trump’s protectionist views on trade could spark a trade war.

What does Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks. It is in the stock market’s nature to fluctuate sharply during the short term as market participants receive and digest new information. However, unless an investor is involved with buying or selling options, a brief increase in volatility (measured by the VIX) is unlikely to require any changes to his or her investments. A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company. Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

So, what is an investor to do?

For starters, remember that success in the market does not depend on predicting the future over the short term and that timing the market’s ups and downs is nearly impossible. Instead, focus on staying diversified, understand your risk tolerance and stick to a long-term plan.

Above all, remember that market returns are driven by economic and earnings growth, and both continue to appear positive, in our view.

Last Week’s Highlights:

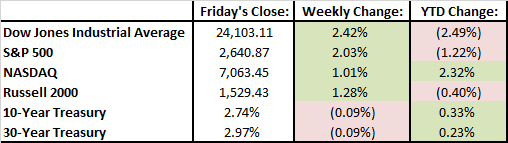

It was a shortened week of trading due to the holiday on Friday but equity markets rallied by more than 2% to close out the first quarter of 2018. Even though the week’s numbers ended up in the green, it was another volatile week where the S&P 500 moved by more than 1.5% on three of the four trading days. Concerns about privacy issues and regulatory scrutiny in the tech sector sent a ripple effect throughout the broader market.

Looking Ahead:

A good amount of economic data will be released this week, with the Purchasing Managers Index on Monday, vehicle sales on Tuesday, and a very important jobs report on Friday. The jobs report should provide clarity on the state of the U.S. labor market and levels of wage growth. The jobs report number will be watched closely by investors who have become cautious about the level of inflation in the economy, and whether the Federal Reserve might become more aggressive in raising rates to suppress a spike in inflation.