The Weekly View (5/14/18)

What’s On Our Minds:

5-Point Portfolio Checkup

The goal of investing is to see your money grow over time. However, even though you can’t control how your investments rise and fall, your portfolio is anything but automatic. Like most things, it’s important to check up on your portfolio to make sure nothing is out of date and that its goals are still in line with your own. Tufton Capital’s portfolio managers are always available to help guide you through a quick “portfolio checkup”.

Update Your Goals

Naturally, your investment goals will change as you get closer to retirement. The first thing to do is determine where you want your investments to be headed. Do you have a new goal, like a child’s college fund, or have you decided to aim for higher retirement income?

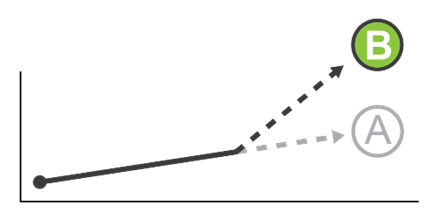

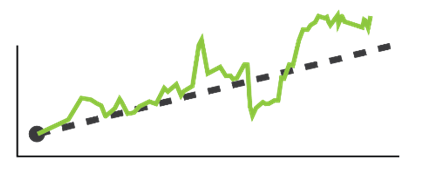

Check Your Performance

Are your investments on track to meet your goals? Do you need to aim for increased investment returns or start contributing more? If your portfolio is lagging behind the appropriate benchmarks over a long period of time, it is probably time to reconsider your investment strategy.

Review Assets

Over time, some assets may grow to be an oversized or undersized part of your portfolio, or perhaps your appetite for risk has changed. Often times, individuals inherit a large position in a single company and it’s necessary to diversify. Or, perhaps someone has worked hard over the course of their career and amassed a sizable equity stake with their company. Either way, re-balancing your assets is often a smart strategy as you plan for the future.

Check Your Beneficiaries

Do all of your investment accounts have listed beneficiaries? While it may not be fun to think about, it’s very important to plan ahead. In the event of your death, having direct beneficiaries for your accounts will keep them from passing through your estate and incurring unnecessary costs.

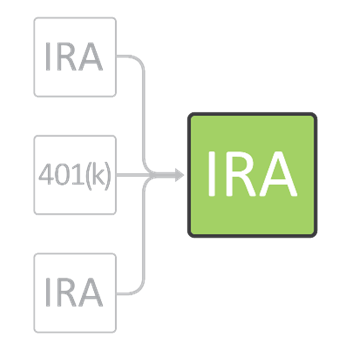

Consolidate Extra Accounts

Many people forget about old accounts (past IRAs, CDs and 401(k)s) and do not coordinate their holdings with the rest of their portfolio. Talk to your Tufton portfolio manager about rolling these accounts into a single IRA that will be easier to manage. Along with streamlining your investment strategy, you also may be able to lower your management fees by consolidating more assets with a single firm.

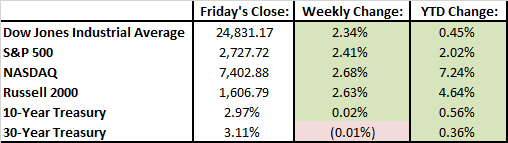

Last Week’s Highlights:

Investor sentiment turned bullish last week and stocks logged solid gains. Strong earnings results lifting the S&P 500 and Dow Jones by more than 2%. At this point, more than 90% of S&P 500 companies have reported earnings, and results from the quarter are on pace to be the strongest since the 3rd quarter of 2010. On average, we have saw an impressive 8.2% increase in revenue from S&P 500 companies in the first quarter.

Looking Ahead:

Earnings season begins to wrap up this week with only 10 companies in the S&P 500 reporting. Thus, investor attention will likely return to any pending political news and economic data. Retail sales figures are reported on Tuesday, housing starts on Wednesday, and the Leading Economic Index figure is released on Thursday.