The Weekly View (5/21/18)

What’s On Our Minds:

At Tufton Capital, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was “filling the buckets” by picking what they believed were the best funds for each category (large-cap, mid-cap, small-cap, international, etc.). It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

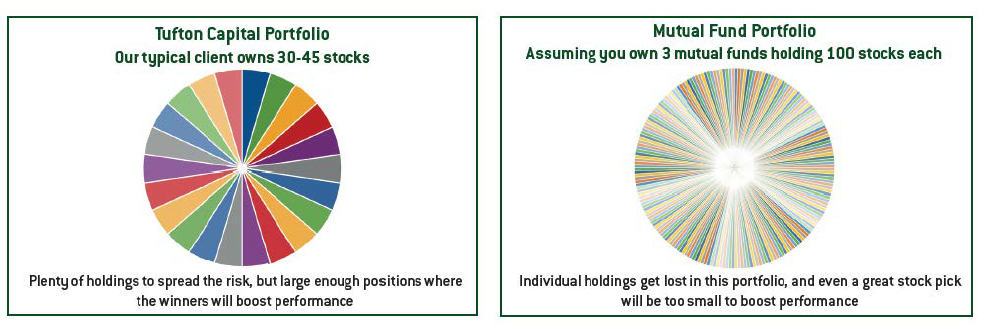

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets that have negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 45 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

Last Week’s Highlights:

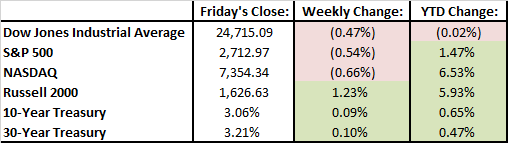

Stocks declined a bit last week as investors shifted their attention away from earnings and towards to interest rates, macroeconomic developments and global politics. The yield on the 10-year Treasury Note had a high during the week of 3.115%, after closing the previous week at 2.971%. Market pundits have been fixated on this 3% number as some believe investors may favor these bonds over stocks. On the other hand, borrowing costs are still low, and rates have not yet climbed to a level that will begin choking off economic growth.

Looking Ahead:

First quarter earnings season continues to wrap up this week and economic data will be on the light side. New home sales will be reported on Wednesday, existing home sales on Thursday, and then consumer sentiment will be reported on Friday.