The Weekly View (6/25/18)

What’s On Our Minds:

While much of the media’s attention lately has been focused on the possibility of a looming trade war, recent movements in the media space have set the stage for a battle royale in the industry. Headlines have been coming fast and furious these past few weeks, with the regulatory approval of AT&T’s acquisition of Time Warner and the escalating bidding war between Disney and Comcast to decide the fate of Twenty-First Century Fox’s entertainment assets. These deals have the potential to be the first dominoes to fall in an industry-wide restructuring of how content is created, distributed, and consumed. We think now is as good a time as any to break down what this means for the consumer, the companies involved, and the changing media landscape as a whole.

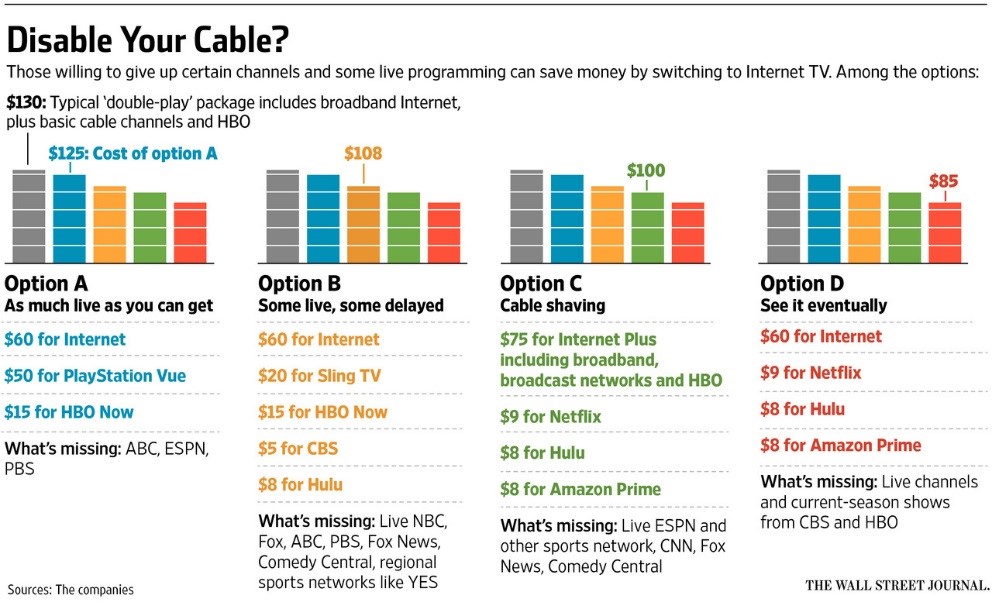

As you may know, cable and satellite television companies have seen a decline in pay-for-TV subscriptions in recent years. This is a result of what is known as the “cord-cutting” phenomenon. Much of this cord-cutting has been done in concert with the rise of Netflix and other direct-to-consumer over-the-top streaming services, which distribute streaming media through the internet. These platforms give viewers more choice in deciding what content they want to pay for and how, when, and where they consume it. However, much of Netflix’s incredible growth, to the point of being included in the prestigious FAANG (Facebook, Apple, Amazon, Netflix, and Google) group of tech stocks, has come at the expense of the very companies it now threatens to overthrow in the media landscape.

For years, Netflix relied on licensing content from media heavyweights, such as Disney, Fox, Comcast, and Time Warner, to build up its library and develop a viewer base. At the time, these industry titans were happy to sit back and take in the extra revenues provided to them by Netflix at little to no cost. Only recently have they realized that in doing so, they created their worst nightmare. However, traditional media companies are starting to strike back, with a vengeance.

The recent transactions involving Disney, Fox, AT&T, and Time Warner offer a glimpse into the future with regards to how these companies plan to compete with the 800-pound streaming gorilla of Netflix, as well as the direction media may go over the next few years. The main reasoning for these acquisitions was content; to attract viewers, you’ve got to have something worth watching. As Disney and AT&T bolster their creative ammunition with new studios and intellectual property, both companies also plan on pulling their content licenses from Netflix by the end of 2018 in hopes of weakening the behemoth by limiting its content selection to mostly original productions. This combined strategy will, ideally, drive consumers to their own over-the-top streaming services.

Last week, Disney successfully fended off Comcast’s best effort to buy Twenty-First Century Fox. The Fox acquisition allows them to combine their already-prolific library with box office heavyweights, such as Avatar and X-Men. After rolling out its first over-the-top platform in early 2018 with ESPN+, Disney plans to unveil another streaming service in early 2019 to directly compete with Netflix. Disney is counting on Fox’s assets strengthening its content offerings to the point of making its service indispensable. Furthermore, the 30% stake in Hulu Disney receives from Fox gives it a 60% controlling interest in the platform, affording them control over another established streaming service. With Hulu and its own proprietary over-the-top services in its back pocket, Disney can attack Netflix from multiple angles.

AT&T, on the other hand, has even grander plans for dominating the market. The company’s recent acquisition of Time Warner, combined with its prior acquisition of DirecTV, has effectively given the company a completely vertical supply chain in the industry. It can now produce its own content through Time Warner, distribute the content via DirecTV and its streaming service DirecTV Now, and provide high-speed internet service for its consumers to access the content. Arguably more important, however, is the fact that as the third largest internet provider in the country, AT&T will be getting its slice of the pie even if consumers choose not to use its distribution services. With regards to over-the-top services, a rising tide lifts all of AT&T’s boats, as its competitors in the streaming market are dependent on high-speed internet to provide their customers with a high-quality experience.

Despite Netflix’s rapid ascent in the industry, these recent transactions indicate that legacy media companies are not going anywhere anytime soon. In this sense, necessity is the mother of innovation, as traditional industry bulwarks have shown the ability to evolve in response to trends in technology. The only options to respond to a disruption on this scale are adapt or die, and Disney and AT&T have loudly declared they aren’t going anywhere any time soon. But, don’t expect Netflix to stop fighting back now as the company is putting on a full court press in the content game with recently-announced plans to invest $8 billion this year in original programming. However it shakes out in the end, the way we consume media is primed to undergo remarkable changes in the coming years. One thing’s for sure: this industry will be one to watch moving forward.

Last Week’s Highlights:

OPEC ministers met last Friday and agreed to raise oil output by an effective 600,000 barrels per day in an effort to curb rising oil prices. A Supreme Court ruling gave states the authority to require e-commerce companies to collect sales taxes on online purchases, marking a major victory for brick-and-mortar stores and states themselves. This reversed a 1992 ruling that required retailers to collect the tax only if they had a physical presence in the state. The nation’s biggest banks passed the first of the Fed’s annual stress tests, indicating that the banks have enough capital to survive a severe downturn in the economy, including recession, cratering housing prices, and double-digit unemployment.

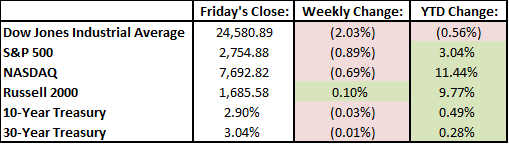

Most indices finished slightly down for the week, with the Dow taking the biggest hit. The Industrial Average index had a rough week, announcing it was dropping GE and adding Walgreens, and has now moved into negative territory for the year. Government bonds stayed relatively stable, hovering around 3%.

Looking Ahead:

The consumer confidence report for June is set to be released next week, measuring the degree of optimism consumers have in the economy through their saving and spending activities. A looming trade war has the potential to escalate due to the President’s threats to increase tariffs to $200 billion of Chinese products. The second quarter of the 2018 calendar year ends next week, setting the stage for earnings reports in the coming weeks.