The Weekly View (7/9/18)

What’s On Our Minds:

Steps to Estate Planning

Setting up an expansive and secure estate plan can be difficult, time consuming and incredibly confusing. With such large values of property at stake, everyone wants to make sure their wishes are set in stone and that minimal money is lost in the process. Contrary to popular belief, a detailed estate plan is not about huge taxes and massive trust funds; many are as simple as a couple sheets of paper.

How much planning is enough? That depends on the goals you want to reach. Using a variety of methods, there is no limit to the amount of control you can put on your estate. And while not every estate requires every method of planning, it can be helpful to know the steps of planning available to you.

Benefits to Beneficiaries

The first and easiest step to planning an estate is establishing beneficiaries of private funds or policies, like life insurance policies, 401k plans and pensions.

This is the easiest step in estate planning because it is typically requested by most plans that a primary and secondary beneficiary be listed to receive funds in the event of a death. Though some plans, like life insurance, will require the beneficiary at signup, others may make it optional to do later. People often put off establishing beneficiaries, creating problems if they die suddenly. Whenever an option to name beneficiaries is offered, it should be handled immediately.

Wills

The next major step in estate planning is establishing a last will and testament. While a person who dies without a will (dying “intestate”) still has his or her property divided up among family, there are no guarantees over who gets what. A will is a simple way to make sure specific items get to the people who ought to have them.

Handing Over Power

Potentially as difficult as a death, the medical incapacitation of an individual can cause huge amounts of stress for a family. Living wills give instructions for the medical care of an individual given they are in an incapacitated, terminal condition. Though limited to these specific situations, living wills can spare a surviving family from difficult decisions and prevent conflict between members who have different views on treatment.

The creation of a “power of attorney” is a much more in depth document that gives a named individual the ability to act on behalf of the disabled in legal matters.

Trusts

Though many people think trusts are financial bodies that are only meant for the wealthy, the truth is they can be used by most people to create detailed control over an estate. A trust is simply a legal entity that holds property for the benefit of a few named individuals.

Gifting

Individuals looking to reduce their estate before death should consider simply giving money away to loved ones later on in life. Each year, a person can give up to $15,000 tax-free to each unique individual or institution they choose. As long as the gifts stay below this amount, they will remain tax-free and still not count against the lifetime gift tax exemption. There are no transfer taxes on gifts made to public charities, regardless of size.

Securing Estate Documents

After necessary estate documents are prepared, they should be adequately stored and protected. Wills are the most difficult to protect. Most states recognize only the original signed document as having any legal power. If the original is destroyed, a new will must be drafted. Typically, the law firm where the document was created will offer to keep the will in an extremely secure safe.

Other documents, such as living wills and power of attorney, can typically be copied and notarized to create duplicates that carry the same legal power as the original. As with wills, loved ones should be informed of the documents’ location so they can be accessed when needed.

Conclusion

Estate planning can be a difficult process for people. The concept of preparing property for an accident or death is hardly something people want to spend time considering. Though its creator will never see it used, a well-written, well-conceived estate plan can make all the difference for friends and family.

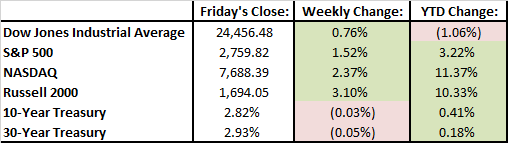

Last Week’s Highlights:

Last week marked the first week of the third quarter, and opened up the start of the second half of the fiscal year. June’s job report expressed strong results in the labor market, as unemployment is hovering around 17-year lows, despite ticking up slightly to 4% in the month of June due to increases in the labor market. Further, the economy added 213,000 jobs during the month, marking nearly eight straight years of monthly gains. Job increases were coupled with wage growth, as hourly earnings grew 0.2% during the month and are up 2.7% for the year. On the international front, trade tensions escalated as the 25% tariff on the first $34 billion of Chinese goods and corresponding retaliatory tariffs went into effect on Friday.

Looking Ahead:

This is the first full business week of Q3 2018, coinciding with the first effective week of new tariffs on Chinese imports. After months of back-and-forth rhetoric and posturing, we will finally see how significant their impact will be on the economy. President Trump is expected to announce his pick for Supreme Court Justice at 9 PM on Monday. The Bureau of Labor Statistics is set to release inflation data on Thursday, amidst concerns the Consumer Price Index may have seen its highest year-over-year rise since 2012. Earnings season is ramping up for companies reporting their second quarter results, and with it we should be able to gain a clearer picture of how effectively businesses have been using their extra cash from the tax cut.