The Weekly View (7/23/18)

What’s On Our Minds:

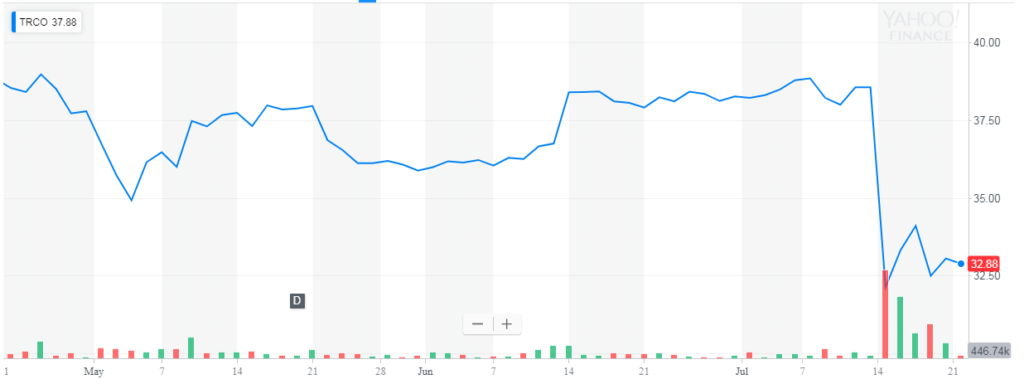

Last week, Hunt Valley, MD based Sinclair Broadcasting (SBGI) faced stern criticism from the FCC on their proposed $3.9 billion purchase of Tribune Media Co. (TRCO) The mega-merger appeared to be on track to close this summer until last week when FCC Chairman Ajit Pai raised “serious concerns” on whether the deal served the public’s best interest. Pai is an appointee of President Trump who had previously been viewed as friendly to Sinclair and such a merger.

The issue at the center of the FCC’s criticism is that, under current laws, a single media company is limited to reaching 39% of American homes. This acquisition would have extended SBGI’s reach to 72% of American homes and therefore would have put SBGI’s reach well above the FCC’s limits. To remedy this, Sinclair planned to sell off certain stations to get under the 39% limit. Instead of selling stations to competitors, Sinclair planned on selling the stations to people loosely associated with the company who could would then be able to hire Sinclair to run the stations. Critics call this a “side car” arrangement. In this case, Sinclair would continue operating the station for a fee, handling everything from advertising sales to news programming. Under these arrangements, Sinclair has historically been able to skirt around the FCC’s ownership rules employing similar tactics. Regulators have occasionally taken issue with this growth tactic, but many believed that Ajit Pai would be friendly to the arrangements.

Not this time. The regulatory tides appear to have shifted for the Sinclair and Tribune merger. Pai has referred the case to the FCC’s lone administrative law judge for an evidentiary hearing that could take upwards of a year. The consensus on Wall Street appears to be that Sinclair pushed the envelope with the deal structure and therefore put the FCC in a tough position as they were facing political backlash for allegedly favoring Sinclair with previous deregulatory moves. As you can see in the charts below, shares of both SBGI and TRCO have taken a hit on this news.

Last Week’s Highlights:

It was a busy week packed with political drama. Donald Trump spurned Presidential custom by railing against the Federal Reserve chairman Jerome Powell and the central bank’s recent rate hikes. Over the past 20 years there has been a “Chinese Wall” between the Fed and the executive branch of the government, and ironically it seems to be tensions with China that have brought it down. The dollar has been appreciating against the yuan since the tariff rhetoric began, a change that does not bode well for the U.S. trade deficit. The President argued higher rates threaten to erase progress on that front. The market, however, seems to be ignoring the headlines more and more each passing week, as most indices gained ever so slightly on the back of mostly solid but not earth-shattering Q2 corporate earnings. Netflix’s share price tumbled 14% after-hours after the streaming media king announced it had missed its own new subscriber expectations by over a million users, marking at least a pause, if not an end, for the stock’s incredible run these past few years.

Looking Ahead:

Following financial institutions reporting earnings last week, large technology companies will dominate the earnings calendar in the week ahead. Notable companies reporting this week include Alphabet, Verizon, AT&T, Facebook, Comcast, and Amazon. Ford and General Motors also announce their second quarter results on Wednesday, hopefully giving us some insight into how the tariffs on steel and aluminum have affected their bottom lines. Economists continue keep a close eye on the yield curve for U.S. Treasuries, though many are saying a flattening curve (when short-term lending becomes riskier than long-term lending) is not the same glaring recession indicator it once was. The President’s administration will begin investigating China’s central bank activity for evidence of currency manipulation, and although the U.S. has declined to officially declare the country a currency manipulator, that seems likely to change with trade war tensions ratcheting up.