The Weekly View (9/24/18)

Last Week’s Highlights:

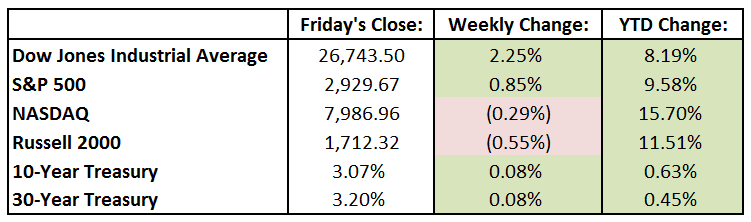

U.S. large-cap stocks edged higher Friday, finishing off their strongest two-week stretch since February. This recent strength in domestic equities reflects that inflation- and trade-related anxieties that have affected the markets in recent months may be abating. For the week, the Dow Jones Industrial Average gained 589 points, or 2.3%, to 26,743.50 – a record close. The S&P 500 rose 0.8% last week to 2929.67, narrowly missing a record of its own. It was an unusually weak week for the FAANG stocks (Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Alphabet (GOOGL)), as the tech-heavy NASDAQ dropped 0.3%, to 7886.96. There was an unusual move last week between the U.S. dollar and the 10-year treasury yield, as the two usually move up (or down) together. Last week, however, the yield on the 10-year rose to 3.068% (its sixth-highest close of the year), while the U.S. Dollar index fell 0.8%, its second consecutive weekly decline.

Looking Ahead:

The trade war heats up on Monday, as U.S. tariffs of $200 billion on Chinese goods are expected to take effect. China is also expected to impose tariffs of $60 billion on U.S. goods. The Federal Reserve meeting begins on Tuesday, and we’ll see earnings out of Nike (NKE) and comments from the General Mills (GIS) annual shareholder meeting in Minneapolis. On Wednesday, the Fed will announce its interest-rate policy decision: consensus estimates anticipate that the Fed will raise the federal-funds rate by a quarter percentage point, to 2%-2.25%. On Thursday, the Census Board reports durable-goods orders for August, and the National Association of Realtors releases its Pending Home Sales Index for last month. We’ll see earnings reports from McCormick (MKC), Accenture (ACN) and Conagra Brands (CAG) that day as well. The week ends with the Bureau of Economic Analysis’s release of personal income and outlays for August, as well as earnings reports from BlackBerry (BB) and Vail Resorts (MTN). The New York Film Festival officially opens on Friday.

The Tufton Capital Team hopes that you have a wonderful week!