The Weekly View (1/14/19)

Last Week’s Highlights:

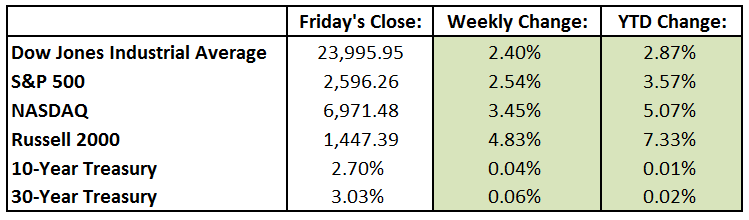

U.S. equities continued their winning ways last week, as the Dow Jones Industrial Average (DJIA) rose 562.79 points, or 2.4%, to 23,995.95, while the S&P 500 advanced 2.5% to 2596.26. The tech-heavy NASDAQ gained 3.5% for the week to 6971.48, capping off its largest three-week increase since 2011. Investor appetites for stocks have returned recently as data suggesting that the U.S. economy is still growing and a rebound in energy prices have increased market optimism. Indications following three days of U.S.-China trade talk in Beijing suggested that both sides are eager for a peaceful resolution, adding to last week’s upbeat tone. The government shutdown, now the longest in U.S. history, staggered on. Democrats continued to block President Trump’s demands for wall money, while he threatened to veto any funding bill without it. Amazon.com (AMZN) became the world’s most valuable company for the first time, replacing Microsoft (MSFT) on Monday, when AMZN’s market cap hit $797 billion.

Earning season unofficially kicks off on Monday with reports from the major U.S. banks. Citigroup (C) is the first up, reporting its fourth-quarter numbers before the market open. Tuesday is packed with more earnings, as we’ll see reports from Delta Air Lines (DAL), Wells Fargo (WFC), JP Morgan Chase (JPM) and First Republic Bank (FRC). British lawmakers vote on Prime Minister Theresa May’s Brexit deal. The Bureau of Labor Statistics releases the producer price index (PPI) for December (consensus estimates call for a slight decline of 0.1%). Wednesday is busy with more earnings, including results from Bank of America (BAC), BlackRock (BLK), Goldman Sachs Group (GS), PNC Financial (PNC) and Alcoa (AA). On Thursday, the Federal Reserve Bank of Philadelphia releases its Manufacturing Business Outlook Survey for January. Expectations are for a 10 reading, up from December’s 9.1, which was the lowest since August of 2016. Earnings continue with numbers from American Express (AXP), BB&T (BBT), Morgan Stanley (MS) and Netflix (NFLX). The busy week concludes with the release of the Consumer Sentiment Index for January and earnings releases from Kansas City Southern (KSU), State Street (STT) and SunTrust Banks (STI).

The Tufton Capital Team hopes that you have a wonderful week!