The Weekly View (10/5/20)

Last Week’s Highlights:

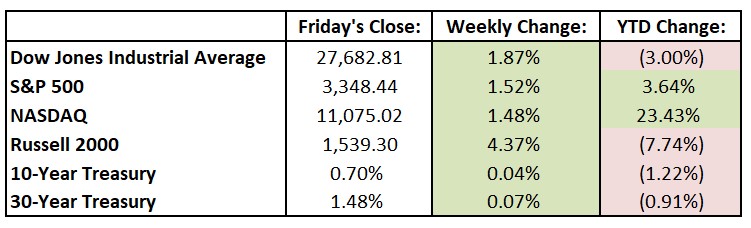

Wall Street brushed off the uncertainties around the economic recovery and finished the week higher on optimism that Congress will reach a deal on the next coronavirus-relief bill. Continued merger activity drove stocks higher much of the week before finishing lower on Friday in the wake of the president’s positive Covid-19 test. On the economic front, the U.S. economy added 661,000 jobs in September (about 200,000 short of projections), marking a slowdown in the pace of job gains. The unemployment rate, however, came in better than expected at 7.9% last month, down from 8.4%. For the week, the Dow Jones Industrial Average (DJIA) rose 509 points, or 1.9%, to 27,683, while the S&P 500 gained 1.5% to 3348, ending four-week losing streaks. The NASDAQ advanced 1.5%, closing at 11,075.

Looking Ahead:

Cisco Systems (CSCO) and Nvidia (NVDA) report quarterly earnings results on Monday. The Institute for Supply Management releases its Services Purchasing Managers’ Index for September – economists forecast a 56.1 reading, slightly below the August print. Levi Strauss (LEVI) and Paychex, Inc. (PAYX) release financials on Tuesday, and the Census Bureau announces the trade deficit for August – expectations are for a $66.6 billion trade deficit, in-line with the July data. Federal Reserve Chairman Jerome Powell gives the keynote address at the 62nd annual National Association for Business Economics meeting, which will be held virtually. Wednesday brings earnings reports from Lamb Weston Holdings (LW), and Costco Wholesale (COST) reports September sales data. The Federal Open Market Committee releases minutes from its monetary policy meeting in mid-September. Analog Devices (ADI) and Maxim Integrated Products (MXIM) hold shareholder meetings Thursday to seek approval for their proposed merger, first announced in July. The Department of Labor releases initial jobless claims for the week ending October 3rd – weekly jobless claims averaged 867,250 in September, the lowest level since February. Duke Energy (DUK) hosts a virtual ESG Investor Day on Friday.

All of us at Tufton Capital wish you a safe and healthy week.