The Weekly View (11/23 – 11/27)

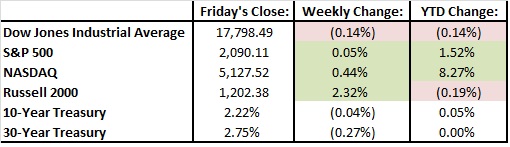

A combination of strong economic data and concerns over tensions in the Middle East left us with a flat week in the markets last week. In the short week of trading due to the Thanksgiving holiday, the S&P 500 closed on Friday at 2090.11, gaining 0.05% for the week. Stocks slid on Tuesday morning when news broke that Turkey had shot down a Russian fighter jet after it violated its airspace, but markets rebounded to finish the day as strong numbers were reported for durable goods orders and home price data. An upward revision of third quarter GDP growth also provided support to the market last week. These positive numbers helped the market to rebound towards the end of the week and demonstrate that the economy could very well be ready for a minor increase in interest rates next month. An increase in rates would be the first rise in the Fed’s official short-term rate since 2006. We saw a change in consumer habits over the Thanksgiving/Black Friday weekend. According to the National Retail Federation, more people took to their computers and smart phones than actual stores for their annual Holiday shopping sprees.

This week, Fed Chair Janet Yellen is in the spotlight. She is speaking twice this week ahead of the December Fed meeting on the 16th. While market participants will look at her comments for confirmation or denial for a rate hike, the rate liftoff seems to be all but foregone. The only thing that may derail the Fed is a truly dismal jobs report this Friday.

Abroad, OPEC has a policy meeting, at which Saudi Arabia will likely be under pressure from other members to lower output in the face of low oil prices. It’s unlikely that the Saudis will bend, however.