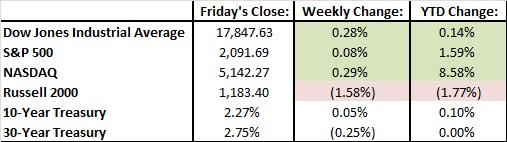

The Weekly View (11/30 – 12/4)

What’s On Our Minds

Oil continues its downward slide, and is now at levels not seen since ’09. A lot of people wonder what that means at the pump: how low could gas prices get? We’ve seen a few stations with sub-$2 gas recently, but gasoline can’t get too cheap- they still have to pay to refine it and ship it to the station. Even if the cost of a barrel of West Texas Crude were $0, it would still cost almost a dollar to get it to us.

Last Week’s Highlights

Are we done talking about the Fed yet? Well, the board itself is: Fed members are about to enter their quiet period ahead of next week’s meeting. Given Chair Janet Yellen’s comments, the market has baked in a hike at this point. The stellar jobs report on Friday was the final nail in the coffin. Yellen had earlier commented that it would take a new-jobs number of around 100,000 or less to change the Fed’s views, and the report came in with a higher than expected 211,000. Add to that the fact that unemployment remained unchanged at 5%, and we are ready for liftoff.

Looking Ahead

Looking ahead, there isn’t much going on this week. There will be some Chinese economic data being released throughout the week, but none of it should be too earth-shattering.