The Weekly View (12/10/18)

Last Week’s Highlights:

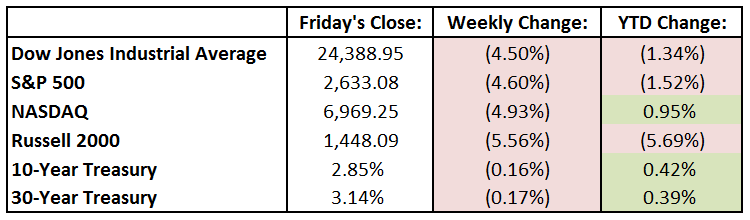

Recession fears took center stage on Wall Street, leading to a tough week for equity investors. The yield curve showed signs of inversion, an indicator of a possible economic slowdown, as the gap between short-term and long-term treasury yields narrowed. The Dow Jones Industrial Average (DJIA) fell 4.5%, the S&P 500 fell 4.6%, and the tech-heavy NASDAQ dropped 4.93%. The Russell 2000, which contains small capitalization stocks, fell the most, declining 5.56% for the week. On the economic-front, Construction Spending declined 0.1% in October versus estimates for 0.4% growth. Domestic Auto Sales also came in below consensus, with 4 million vehicles being reported. Friday was “Jobs Day” as Nonfarm Payroll Jobs rose 155,000 in the month of November. Wall Street was estimating 196,000. Average Hourly Earnings rose 0.2%, coming in below the estimate of 0.3% growth. The Unemployment Rate remained steady at 3.7%.

Looking Ahead:

Earnings season is winding down for the largest companies in the market. A few retail names will report this week. On Tuesday, the footwear distributor DSW Inc. (DSW) releases earnings before the opening bell. After the market closes, American Eagle Outfitters (AEO) will provide its quarterly results. Several cloud providers will also report this week, including Adobe (ADBE) after the bell on Thursday.

The economics calendar is a busy one this week, and inflation levels will be on investors’ minds. Growth of the Producer Price Index (PPI) will be released on Tuesday. Wall Street is estimating that growth was essentially flat month-over-month due to the decline in gasoline prices. On Wednesday, results from the Consumer Price Index (CPI) will be released. As with expectations for PPI results, investors believe that growth will be flat month-over-month. Consensus estimates reflect an inflation reading that rose 2.2% year-over-year, which is right around the Federal Reserve’s 2% target. On Friday, data on Retail Sales will be released. Investors are expecting growth of 0.2% for the month of November.

The Tufton Capital Team hopes that you have a wonderful week!