The Weekly View (1/2/18)

What’s On Our Minds:

Happy New Year! By all measures, 2017 was a stellar year for stock markets around the globe. It appears the bull market continued to climb its proverbial “wall of worry”. For the first time since 2012, international stocks outperformed U.S. stocks. Domestic market indexes were no slouches though. The S&P 500 was up over 20% and the Dow Jones added 5,000 points, its largest ever point gain in a calendar year. The rally was fueled by resurgent economic growth, blockbuster corporate profits, and the promise of sweeping Republican tax cuts which should save corporate American billions of dollars.

After a great 2017, investors are likely asking, “so what does 2018 have in store?” Well, of course it is hard to predict but market experts seem to agree that the outlook for the new year is good but not a rosy as last year. Wells Fargo forecasts the U.S. economy will grow by an average of 2.5% each quarter in 2018 and 2019. As the labor market continues to tighten, wage growth and increased energy prices could start to squeeze corporate earnings, but expanding sales and lower corporate tax rates should also give earnings a boost. Meanwhile, if the economy continues to improve, the Federal Reserve plans to continue increasing interest rates.

If Wall Street’s predictions for the new year hold up and the bull market continues, it will put the economy on track for its longest expansion in decades.

Last Week’s Highlights:

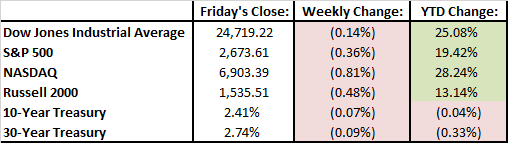

Stocks were down slightly during the final week of 2017 which was shortened by the Christmas holiday. It was reported that Russian tankers have been supplying North Korea with oil in recent months which increased geopolitical worry. The minor declines experienced last week still left investors happy with significant gains experienced across the board in 2017.

Looking Ahead:

Important economic data comes across the wire this week as we kick off 2018. Manufacturing purchasing managers index will be reported on Tuesday followed by vehicle sales and minutes from the Federal Reserve’s December meeting on Wednesday. On Friday, we will close out the week with December’s jobs report.