The Weekly View (12/14 – 12/18)

What’s On Our Minds

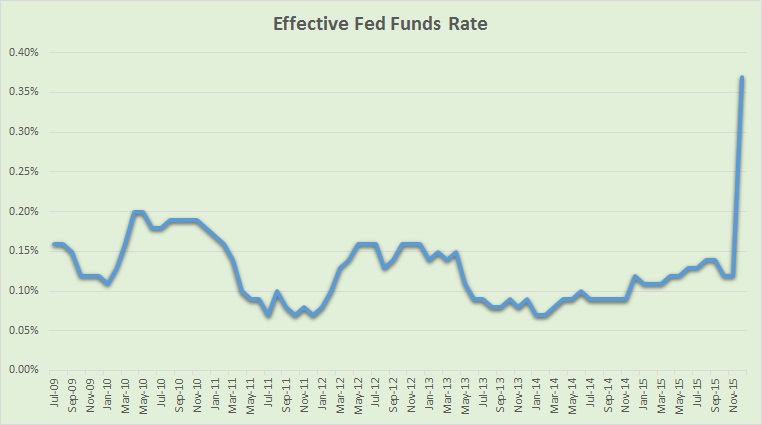

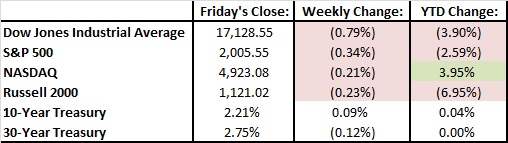

The markets had a choppy week, with the S&P 500 finishing down 0.34%. Investors kept a close eye on the Federal Reserve interest rate decision last Wednesday as well as the price of oil which continued to decline to one of the lowest levels since 2009. The Federal Reserve raised their target interest rate to 0.5%, which represented their first increase in nearly a decade. Now, creditworthy banks that are lending money that is maintained at the Federal Reserve will be charged an annual rate of 0.5% for each overnight stay as opposed the 0.07% to 0.20% range that was charged over the last six and a half years. As a result, banks will begin raising interest rates on their future and some current customers and we have already seen this occur at many financial institutions – Bank of America and Wells Fargo both raised their prime lending rate to 3.50% from 3.25%.

Looking Ahead

Looking to the week ahead, the Bureau of Economic Analysis will release their final calculation of 3rd quarter of Gross Domestic Product. The previous reading released in November estimated that the US economy grew 2% year over year. Analysts believe the economy was actually stronger than 2.0% in the 3rd quarter as tomorrow’s estimate is for growth of 2.2%.

On Wednesday, investors will be gain further insight on the American consumer with the release of data on personal income and spending for November. Growth in the month is estimated to be 0.3%, which was the same rate as last November. Though growth in economy is stronger this year, Black Friday sales were not as strong as anticipated. Black Friday sales have displayed that online spending has continued to grow as percentage of the total weekend sales with “Cyber Monday” becoming increasingly popular.

The stock market will close at 1 PM on Thursday as investors prepare for Santa. All are hoping Old Saint Nick will bring us a nice year-end market rally as we close out 2015.

Have a Happy Holiday!