The Weekly View (12/28 – 1/1)

What’s On Our Minds

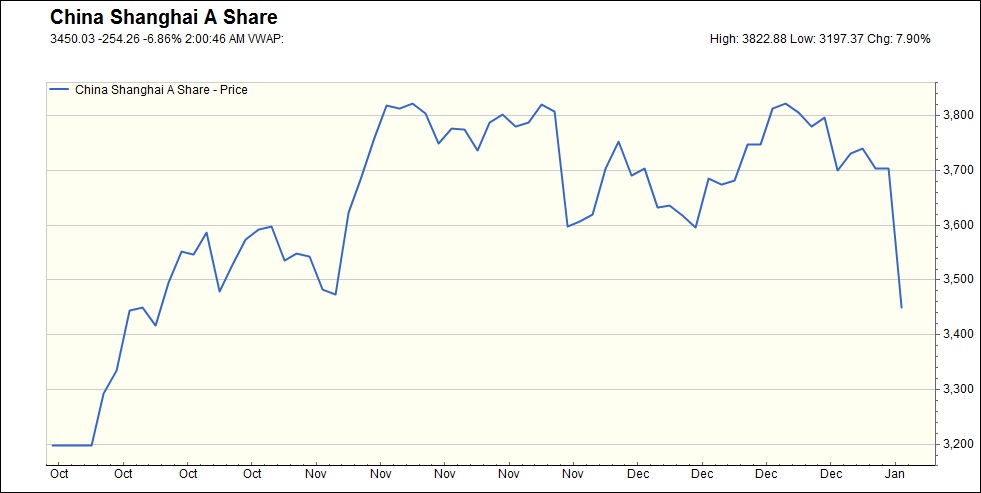

The new year started with a perhaps not-so-shocking 7% drop in the Chinese equity market. Once again, the drop in the East doesn’t seem to have to do with fundamentals so much as expectations about how the People’s Bank of China (PBOC) will juggle interest rates, foreign exchange rates, and policy. We fielded questions in the past about why the firm didn’t invest more in China and other foreign markets during their booms. This is why: countries developing their physical markets means still-developing financial markets, too.

Last Week’s Highlights

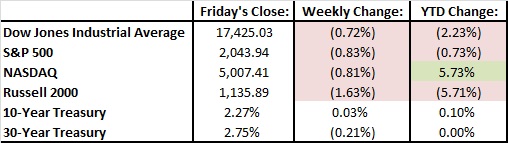

Last week was another holiday-abbreviated one that featured little in the way of news, economic or otherwise. We did get our year-end numbers (below), capping off a disappointing but not disastrous year.

Looking Ahead

On Friday, we will get the December jobs report and see how the US labor is holding up this winter. We’ll also see how the Fed thought about last month’s interest rate increase with the release of the FOMC’s minutes. However, there are likely no surprises in those minutes. Markets are still slow-moving after the holidays.