The Weekly View (12/5/16)

What’s On Our Minds:

Last week, we saw some good employment numbers as the Bureau of Labor Statistics (BLS) reported 178,000 new jobs in November and a jobless rate that ticked down to 4.6%. This has been the longest continuous streak of job growth on record. The economy has added almost 16 million jobs since 2010. All good news, right?

Hopefully, yes. But a tiny detail from the White House’s statement reminds us that all good things do come to an end. In the statement, the White House boasts that this is the lowest unemployment since August 2007, but we remember that was two months before the S&P 500 reached its peak before the financial crisis. Now, of course, we can’t point to one metric and forecast a recession, but we returned to one of our favorite charts that we put together using the St. Louis Fed’s excellent online tool.

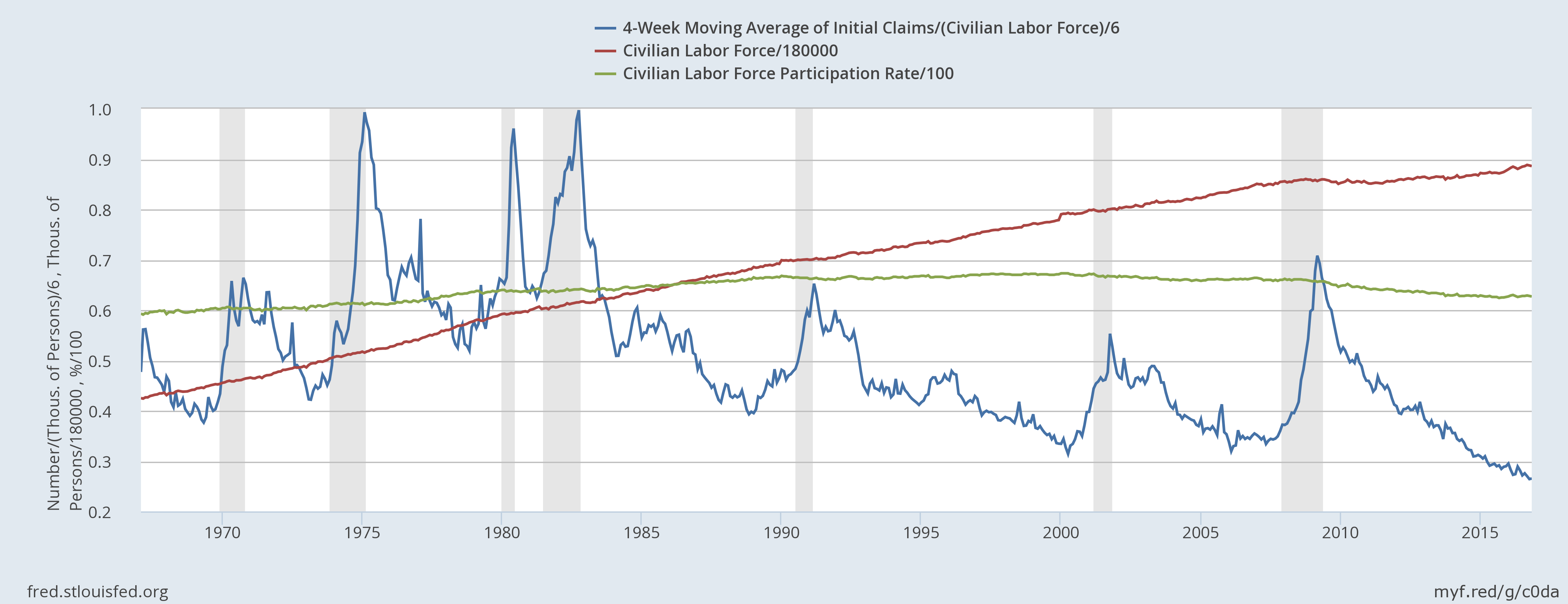

We plotted three data series. Each series we scaled down to be represented on the same axis:

- Initial claims for jobless benefits as a percentage of the civilian labor force (blue). Taking this commonly viewed number as a percentage of the labor force adjusts for the fact that we have seen an increase in the US population over time.

- The civilian labor force (red),which includes all employable persons, not just those employed, which has steadily risen over time, albeit more slowly in recent years.

- The Labor Force Participation Rate, or the percentage of employable people who either have work or are seeking work.

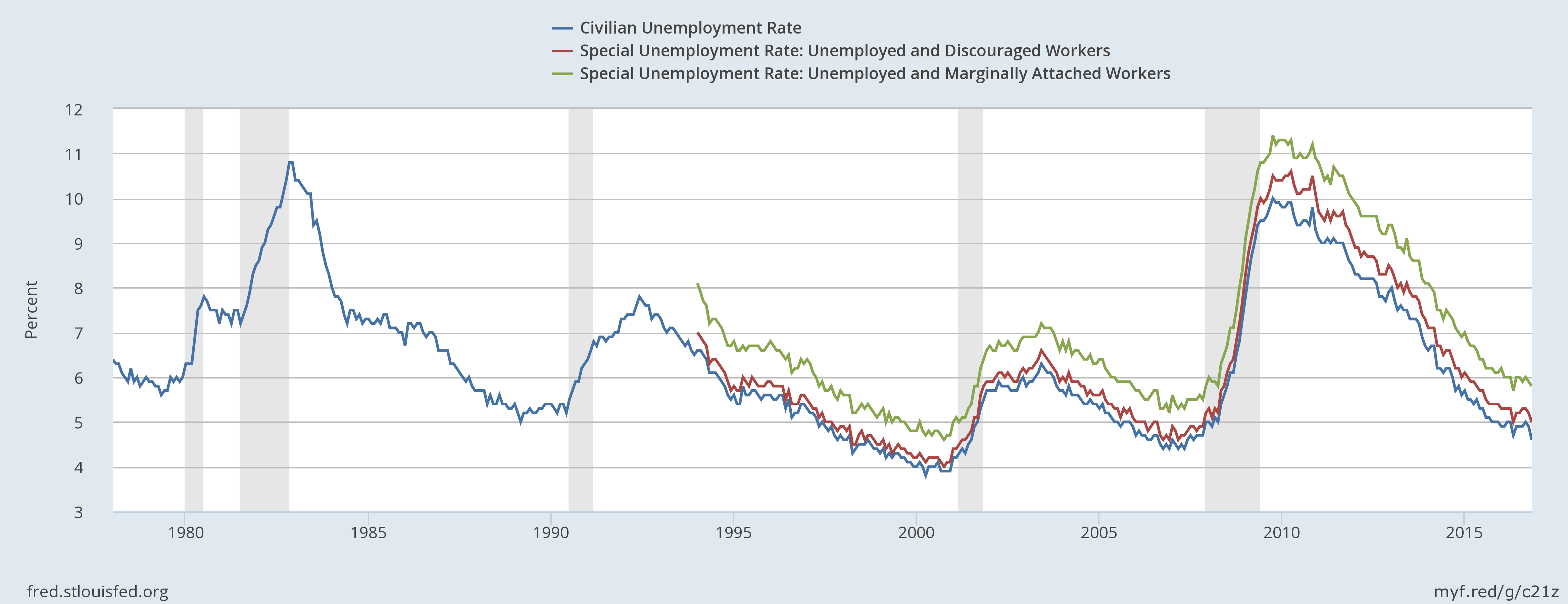

The level of initial claims is at the lowest it’s been since records are available. We also see that the labor force participation rate, green, has been declining in recent years. The factors causing this are likely varied, and a combination of automation and workforce changes which lead to discouraged workers, or those who have removed themselves from the workforce. This is a sort of “shadow unemployment,” meaning that these people might want more work, but have given up their search. There are also those who would like full-time positions but who have only been able to find part-time work. To account for these underemployed people, the BLS provides several employment measures that add back discouraged and otherwise marginally attached workers:

This graph looks significantly different from the previous graph, in that the current employment situation does not appear from these data to be as overheated.

We continue to monitor both of these graphs. We also keep in mind that the character of the American workplace has changed dramatically, where the Internet has enabled companies to produce much more output with drastically fewer employees. It is possible that there is a new, higher equilibrium unemployment rate, or a “natural rate of unemployment”. Determining that exact (and unobservable) number will prove to be difficult even for the crack economic team at Tufton Capital.

Last Week’s Highlights:

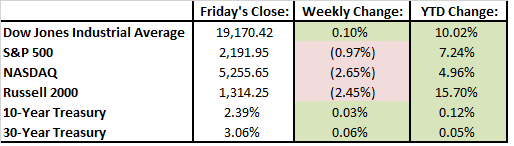

Stocks were mixed last week as investors sold technology stocks, bought financial services stocks, and the energy sector rallied on news that OPEC agreed to cut production levels. Overall, the Dow Jones was flat, the S&P 500 fell a bit, and the NASDAQ was down over 2.5%.

We had a strong jobs report last week and we are nearing full employment levels. The jobless rate fell to 4.6%, leading many to believe that the fed will raise interest rates later this month.

In politics, President-elect Donald Trump made a few important appointments last week. He chose former Goldman Sachs banker Steven Mnuchin as Treasury Secretary and billionaire Wilbur Ross as Commerce secretary. These appointments had financial stocks on the move higher as many believe these two will decrease regulations on the industry. Over the weekend, Trump tweeted warnings to companies planning on outsourcing business abroad saying they should be prepared to face “retribution”. On the other side of aisle, house Democrats re-elected Nancy Pelosi as their leader.

Looking Ahead:

News out of Italy could have international investors on high alert this week. Early on Monday, Prime Minister Matteo Renzi said that he would resign following defeat in a referendum on constitutional reform. That being said, polls had predicted a “no” on the referendum so the fallout should be muted.

On Monday, the ISM nonmanufacturing index for November is reported. On Tuesday, Bob Evans, Michaels and Toll Brother report their quarterly results. On Wednesday, H&R Block, lululemon, and Vera Bradley report their earnings. On Thursday, Broadcom, Liberty Tax, and Ceina report earnings and Baker Hugh should discus merger plans with GE’s energy division during their investor meeting.