The Weekly View (12/7 – 12/11)

What’s On Our Minds

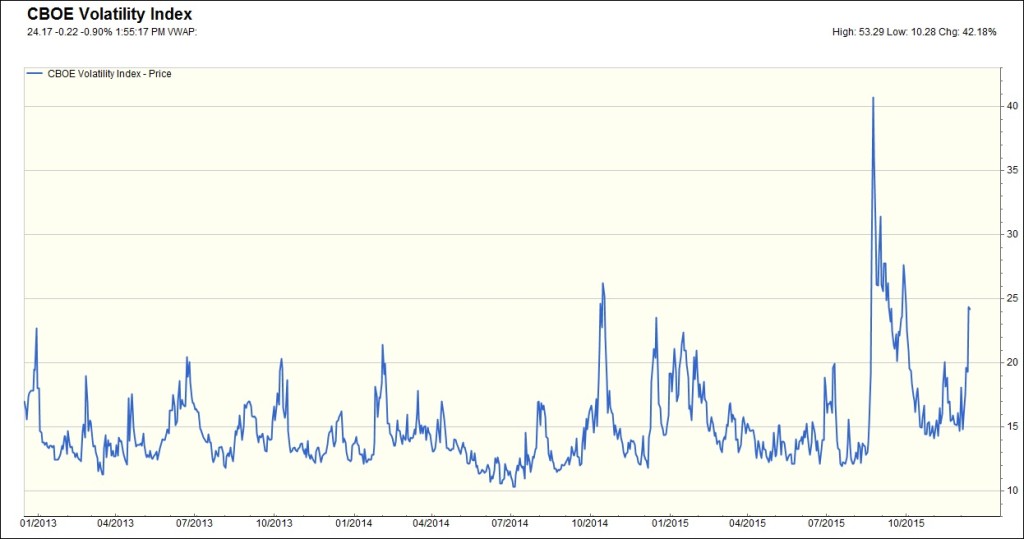

Understanding the stock market’s unpredictable tendencies is a challenge during the best of times. But what happens when price swings grow abnormally large? It is the stock market’s nature to be volatile over the short term. Staying informed, understanding risk tolerance, and sticking to long-term goals and planning is in our clients’ (and everyone’s, we believe) best interest.

Last Week’s Highlights:

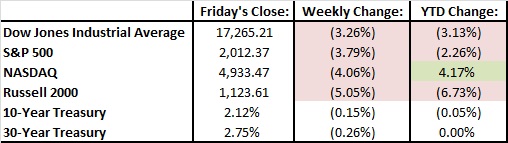

The financial markets faced a rough week last week as participants prepare for the Federal Reserve to raise interest rates this Wednesday (12/16). The Dow finished the week down 3.3% and the S&P 500 closed out the week down 3.8%, which puts the index in the red for the year. In company news, Dupont (DD) announced it would merge with Dow Chemical (DOW). After the merger, the new company plans on splitting itself into three publicly traded companies.

The pain in the oil markets continues to play out as prices dropped significantly, with crude futures falling $4.35, or 10.9%, for the week. We also saw a major selloff in Junk bonds last week. Fears in the junk bond market were exacerbated when the Third Avenue Credit fund, which owns distressed bonds and private equity holdings, closed its doors on Wednesday.

Looking Ahead:

The long awaited Federal Reserve meeting takes place this Tuesday and Wednesday, when the Fed is widely expected to raise short term interest rates by 25 basis points. Despite recent volatility, it is unlikely that the Fed will pass up a gradual increase in rates. Janet Yellen will likely emphasize the Fed’s intent to gradually raise rates going forward.