The Weekly View (1/3/17)

What’s On Our Minds:

It’s official: the bull market continued in 2016! While investing with a “rear-view mirror” mindset is rarely a lucrative strategy, with the benefit of hindsight, a quick look back at 2016 helps set the stage for the year ahead.

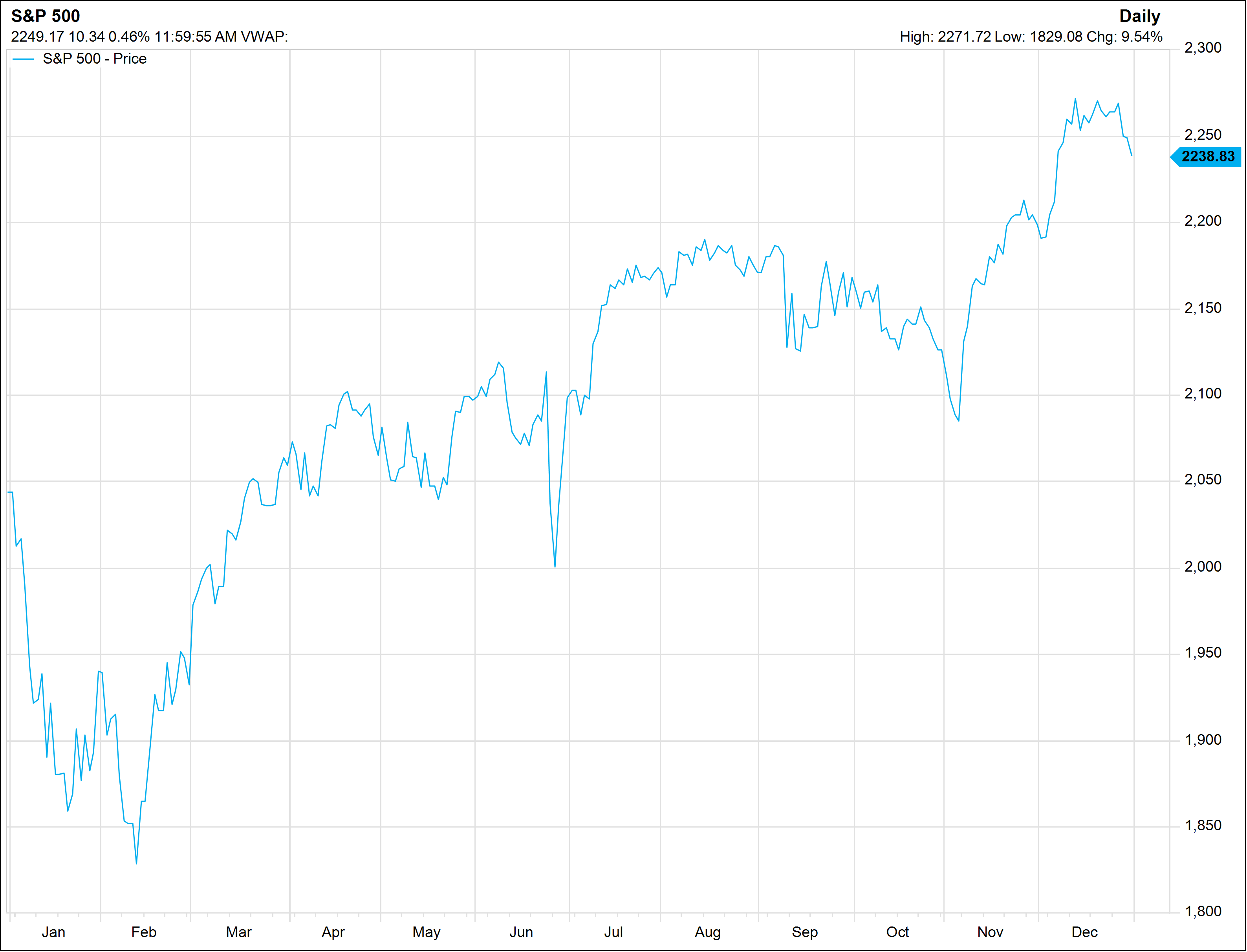

A main take away from 2016 is that sticking to a disciplined investment process was extremely important. With a bull market that may have felt a bit long in the tooth, it was crucial to remain invested. Markets had a horrendous start to the year; stocks fell by 11% between Jan. 1 and Feb. 10th. At the time, many thought the U.S. economy may have been headed for a recession. With all the pessimism, it may have felt like a good time to take money off the table. However, this was a great time to get out your shopping list; stocks were on sale!

In June, the market sold off by 6% when panic was induced following Britain’s Brexit referendum. Yet again, gloom had taken over on Wall Street. The market didn’t stay down for long though. Stocks recovered the 6% over the next two weeks. In the rear-view mirror, the Brexit episode was yet another great buying opportunity. Over the summer, things calmed down as investors waited to see how the election would pan out.

Not many were expecting the Trump win in November, and stock market futures were down big overnight on news that he was going to win. Clearly, the market had priced in a Clinton win. To the surprise of many, by the time the opening bell rang the next morning, markets actually opened in the green. It is likely that most investors will remember this surprise election result as the highlight of the year as it showed how uncertainty can effect investor sentiment. The market continued its “Trump Rally” through the end of the year with hopes that Donald Trump will cut taxes, decrease regulations, and pass some sort of infrastructure spending program.

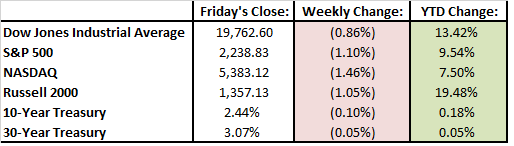

By the end of the year, the S&P 500 was up 9.54% and the Dow Jones was up 13.42%. Looking back, it wasn’t a bad year.

Last Week’s Highlights:

It was a quiet week on Wall Street last week as the Trump Rally lost a bit of its steam during the abbreviated week of trading. The S&P 500 lost just over 1% on light volume. We hope all of our clients and friends had a wonderful holiday season!

Looking Ahead:

Markets were closed on Monday for the New Year’s holiday. On Tuesday, Congress heads back to work and the ISM manufacturing index for December will be reported. On Wednesday, Ford Motors reports its sales from December and the Fed will release minutes from its December meeting. Thursday, we will see earnings results from Walgreens and Monsanto. On Friday, November’s import/export numbers will be released by the Commerce Department.