The Weekly View (2/21/17)

What’s On Our Minds:

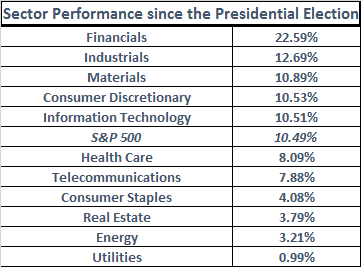

The “Trump Rally” or “Trump Bump” continued the Tuesday morning after President’s Day. Since the election, sectors that had underperformed the S&P 500 began to rally on the back of the possibility of higher interest rates, stronger economic growth and President Trump’s agendas. The Financial sector, which includes the “Big Banks”, Insurance companies, and asset managers, has led all sectors with a 23% return since President Trump’s win. In the more cyclical sectors, Industrials are up nearly 13%, while the Materials sector is up 11%. Consumer Discretionary and Technology also barely outperformed the broader index with a roughly 10.5% return from each sector. Health Care, Telecom, Consumer Staples, Energy, REITs and Utilities sectors have all underperformed after mostly leading in 2016.

Looking “under the hood,” higher interest rates will help earnings growth for the banks as their loans spreads widen, creating higher profits. Investors are also speculating that President Trump’s plans for deregulation will allow the financial companies, specifically the systematically important financial institutions, to hold less capital, which would give them the ability to lend more.

Industrial companies have rallied on speculation that President Trump’s infrastructure plan will translate into new orders for the group. Leaders include United Rentals, which is up nearly 69%. The company rents construction equipment and tools to the construction industry. Other beneficiaries of infrastructure investment would include the railroad companies as they would be utilized to transport the new orders from the industrial companies. As a result, CSX Corporation and Norfolk Southern Corporation are up 52% and 29%, respectively.

Investors also believe that the Materials sector will benefit from stronger economic growth and potential inflation. Earnings growth would be expected if further demand for their raw materials and products created price increases to their customers. Material leaders include steel manufacturer Nucor, paint maker Sherwin Williams and chemical producer LyondellBassell Industries.

Of the S&P 500 companies that have reported 4th quarter results, 68% of them have beaten on earnings. However, only 52% of the companies have beat their sales estimates, suggesting that companies are growing earnings more through cost cutting than growth of their business. The market may keep making new highs on the back of potential policy changes, but eventually, sales growth will have to follow.

Last Week’s Highlights:

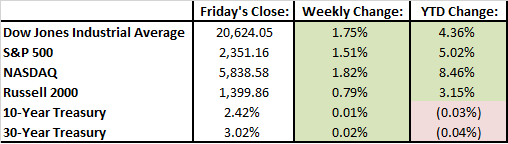

Stocks extended their winning streak last week as both the S&P 500 and the Dow Jones gained over a full percentage point. The Trump rally continues. Investors remained euphoric as most expect President Trump to reduce U.S. corporate taxes and introduce some sort of fiscal stimulus package. Strong earnings reports along with robust economic data have also helped to push indexes to record highs.

Janet Yellen took a hawkish stance last week during her testimony to Congress. Her tone increased the odds that the Fed will raise interest rates before their next policy meeting in June. Her latest stance on rates helped push the financial sector higher.

Kraft Heinz offered to acquire Unilever last week. However, over the weekend, Kraft said it “has amicably agreed to withdraw its proposal.” Unilever shares took a hit on the news.

Shares of Boeing enjoyed a 1% bounce on Friday when President Trump visited their South Carolina manufacturing plant. Shares of Campbell Soup Co. decreased 6.5% last week because second quarter profit and revenue missed.

Markets were closed on Monday for President’s Day.

This week, investors’ attention will be focused on economic data reports and minutes from the latest Federal Open Market Committee meeting.

Earnings reports from retailers will also be on tap this week. Wal-Mart, Home Depot, and Macy’s release earnings on Tuesday and Nordstrom reports on Thursday.

On Saturday, Warren Buffet will release his annual letter to Berkshire Hathaway shareholders.