The Weekly View (3/6/17)

What’s On Our Minds:

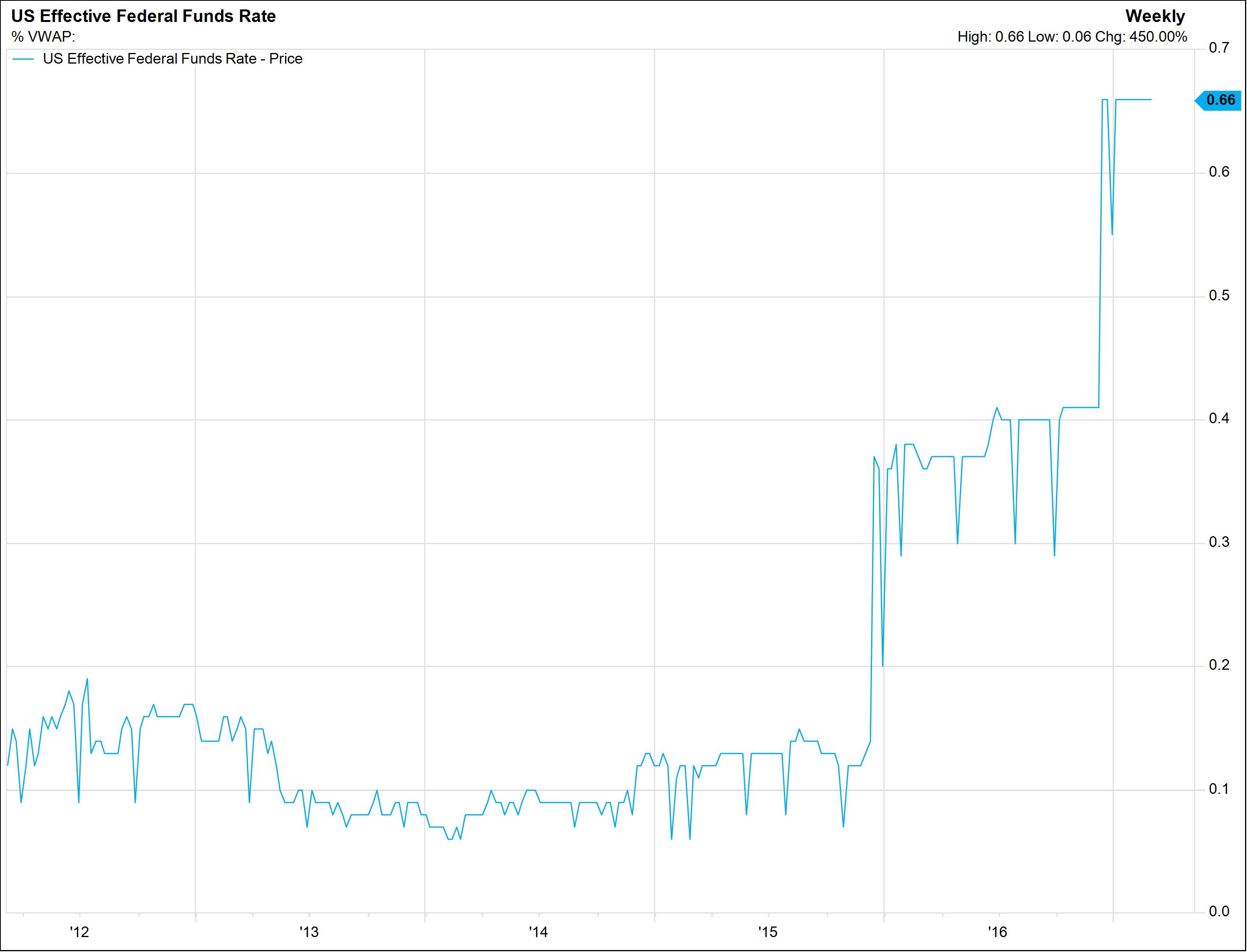

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects. We’ve tried to break down these levers without getting too granular or using financial jargon.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rate raise, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for me to want to buy its stock now for a $10 million valuation. But if interest rates are higher, I’d be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

When Janet Yellen and the Fed meets this month, they have to think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are fairly stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. And…

This gives rise to the “pushing on a string” phenomenon that was one of our founder Jim Hardesty’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash. This illustrates, in part, one of the major limitations of monetary policy (setting interest rate, money supply, etc.) vs. fiscal policy (where and how the government spends their money). But fiscal policy is a topic for another post.

Last Week’s Highlights:

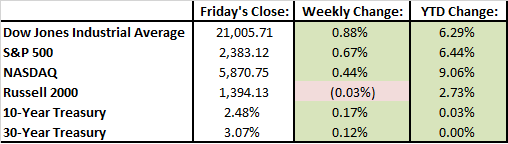

For the fourth straight week, stocks increased and closed at record highs on Wednesday. Donald Trump laid out an optimistic vision of the country during his address to Congress on Tuesday evening. Economic data was strong last week. Consumer confidence reached a new high and the ISM Non-manufacturing index, which measures business activity and employment trends, rose to a level last seen in October of 2015.

Warren Buffet shared that Berkshire Hathaway had taken a larger position in Apple stock earlier this year. It’s now one of their largest equity holdings.

Target shares had a rough week as they decreased 14% in value after the company announced it had missed earnings expectations. The company reduced profit targets and said they are focusing on investing in stores and lowering prices to bring back customers.

Snapchat went public on Thursday. Shares surged from their $17 IPO price to as high as $26.05. The company is now worth about $33 billion even though it lost $515 million last year.

Companies continue releasing earnings reports this week. Armstrong Flooring and Korn/Ferry International report first quarter results on Monday. On Tuesday investors will hear from Dick’s Sporting Goods and Navistar International. Breakfast chain Bob Evans Farms reports results on Wednesday.

February’s jobs report will be released on Friday. A surprise to the upside would likely increase prospects for the Fed to raise interest rates after their 2-day policy meeting on March 15th.

On Friday, the Department of Labor will issue a report detailing the status of its new fiduciary rule. President Trump has mentioned he might cancel the new rule’s implementation.