The Weekly View (2/6/17)

What’s On Our Minds:

What’s on our minds is the same thing that’s been on everyone’s minds lately: the Trump Presidency. We are going to take off our political hats for a moment and put on the economist’s cap. What effects will the Trump White House have on the economy?

(image source: k schirmann getty images/cnn money & Gwen Sung getty image/cnn money)

The Good

There are promises for many kinds of stimulus that would help the economy grow. A “Highway Bill” or other fiscal stimulus would work differently than monetary stimulus by actually spending real dollars and putting people to work, rather than adjusting federal interest rates, etc., to influence how financial institutions borrow and lend money.

However, the difficulties that the Republican Congress has had in repealing Obamacare something that was supposed to be priority #1, may forebode a long road to serious fiscal action.

Likewise, sensible tax code reform and reduction in financial and other regulation could boost business, but getting there may be more difficult than some had imagined.

The Bad

The “Trump Effect,” whereby a presidential tweet can make or break a company, a treaty, or a trade deal, seems to have had some destabilizing effect. It would be best if the president could tone down the speed and content of his tweets.

Tariffs, too, while good for headlines, are almost universally scorned by economists. They result in a net loss for a country in financial terms. While American businesses may gain on an individual level, American consumers pay the price.

Finally, the tax code overhaul could have “debt spiral” consequences if it is overzealously applied. The results of tax reform are often complicated, and it may be unwise to push a large reform through quickly.

The Uncertain

In geopolitics there is a huge question mark. What will the country’s relationship be with Russia? Are Trump and Putin secret friend, secret enemies, or neither? Will we let Russia’s influence continue to grow in the former USSR and China to become a major world power? Or are we going to reassert ourselves as the global leader both in finance and the military?

In healthcare, Obamacare seems to be on the way out. What will replace it? Trump has said we are going to “take care of everyone,” but what does that mean? Importantly, insurance companies might be in the crosshairs, no matter which way this goes.

And what about that wall? Limiting immigration is certainly bad for the economy as a whole. Will we decide that the security gains are real and worth that sacrifice? What would the effect be on our major trading partners?

Tufton is watching all of these topics carefully. Our long term views on the stock market did not (and likely will not) change, but we continue to be vigilant in guiding our clients’ investments around any stumbling blocks.

Last Week’s Highlights:

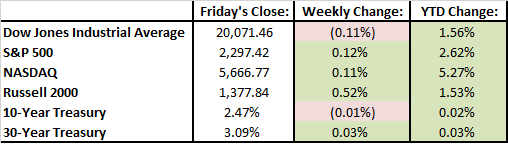

Equity indexes finished the week close to where they began. Markets sold off early in the week but rallied by almost 1% on Friday after a strong jobs report and news that President Trump signed an executive order aimed at rolling back financial regulations. The market rally was led by Financial stocks.

The US Federal Reserve left interest rates unchanged at its first meeting of 2017. The fed’s Open Market Committee noted improved consumer and consumer confidence. Currently, market participants are expecting two, twenty-five basis point increases on interest rates this year.

So far this earnings season, 65% of S&P 500 companies beat mean earnings per share estimates and 52% have turned in better than expected sales figures.

4th quarter earnings season continues this week with 84 of the S&P 500’s companies are scheduled to report earnings. Sysco reports on Monday. General Motors and BP report on Tuesday. Exelon and Allergan report on Wednesday. Thursday we will hear from Twitter and Coca-Cola and on Friday we will hear from EMC.

Lately, it appears investors are taking their cues from President Trump as everyone is focused on what his policies mean for the economy and individual companies. We expect that to continue this week.