The Weekly View (3/23/20)

Last Week’s Highlights:

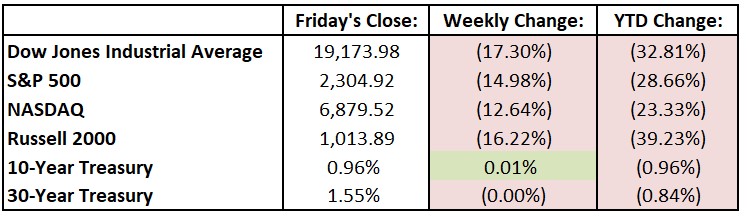

Equity markets finished sharply lower and volatility persisted as the number of coronavirus cases continued to rise globally. Central banks and governments around the globe rushed to announce support measures amid event cancellations, school closures and work-from-home arrangements. The U.S. called for a $1.2 trillion stimulus plan and European countries reported a combined $1 trillion in new fiscal spending. The Federal Reserve cut interest rates by a full percentage point and announced that it would buy $700 billion in Treasuries and mortgage-backed securities. For the week, the Dow Jones Industrial Average (DJIA) fell 4011 points, or 17.3%, to 19,173.98, while the S&P 500 dropped 15% to 2304.92. The tech-heavy NASDAQ lost 12.6%, closing at 6879.52. Stock market futures were weak Sunday night but appear to have recovered going into Monday morning on news of additional Fed stimulus.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. On Monday, the Federal Reserve Bank of Chicago releases its Chicago Fed National Activity Index for February – consensus estimates call for a -0.43 reading, in line with the January data. Nike (NKE) and IHS Markit (INFO) release quarterly results on Tuesday. The Census Bureau announces new residential home sales for February – economists expect a seasonally adjusted annual rate of 740,000 homes sold. Micron Technology (MU) and Paychex (PAYX) report earnings on Wednesday. The Federal Housing Finance Agency releases its Home Price Index for January. Thursday brings earnings announcements from GameStop (GME) and Lululemon Athletica (LULU). The Department of Labor reports initial jobless claims for the week ending on March 21st – expectations are for an annualized 2.1% rate of growth, unchanged from the second estimate released in late February. On Friday, the Bureau of Economic Analysis releases its Personal Income and Outlays report for February – personal income is expected to rise 0.3%, following a 0.6% jump in January.

All of us at Tufton Capital wish you a safe and healthy and week!