The Weekly View (4/6/20)

Last Week’s Highlights:

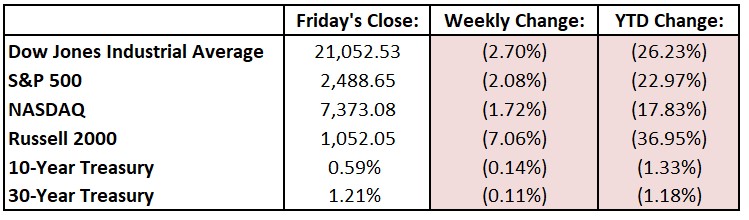

Equities declined last week amid soft economic data and the extension of social-distancing guidelines. Thursday’s jobless claims report exceeded 6.6 million, twice the week-earlier record high. Oil prices surged 32% on prospects of a global deal to cut output and support prices. For the week, the Dow Jones Industrial Average (DJIA) fell 584.25 points, or 2.7%, to 21,052.53, while the S&P 500 dropped 2.1% to 2488.65. The tech-heavy NASDAQ declined 1.7%, closing at 7373.08. Volatility continued in the markets, although at a lower level than investors have experienced in past weeks. The CBOE Volatility Index (or VIX) tumbled 29% last week, finishing below 50 for the first time since early March. While the VIX still trades at an elevated level, it’s far below the 70s and 80s levels seen in recent weeks. New York remained the epicenter of the Covid-19 crisis, with cases and deaths mounting as it neared its apex. Meanwhile, new clusters erupted across the U.S. – Louisiana, Florida, Georgia and Texas – as more states moved to shelter-at-home policies and governors pleaded for medical equipment from the federal government.

Looking Ahead:

Stock futures rallied Sunday night, a hopeful sign as Wall Street begins another unprecedented week of trading. On Monday, the Saudi Arabia-led Organization of Petroleum Exporting Countries (OPEC) holds an emergency meeting with its non-OPEC allies, notably Russia, in an attempt to stabilize oil prices. Levi Strauss & Co. (LEVI) announces quarterly results on Tuesday. The Federal Reserve reports consumer credit data for February – last year, consumer borrowing climbed 4.5%, to nearly $4.2 trillion, still below the five-year average jump of 5.6%. Costco Wholesale (COST) releases sales data for March on Wednesday. Thursday brings annual shareholder meetings for Adobe (ADBE) and Dow (DOW). The University of Michigan reports its Consumer Sentiment Index for April – economists forecast a 79 reading, a large decline from March’s 89.1 print. On Friday, the Bureau of Labor Statistics (BLS) releases the consumer price index (CPI) for March – consensus estimates are for 1.3% rise year-over-year, after a 2.3% increase in February. Equity and fixed-income markets in the U.S. are closed in observance of Good Friday.

All of us at Tufton Capital wish you a safe and healthy week!