The Weekly View (5/1/17)

What’s On Our Minds:

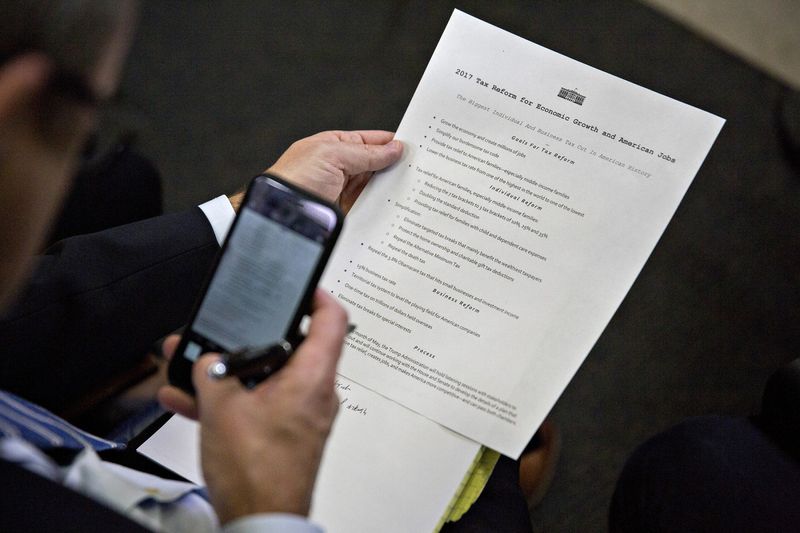

President Trump’s administration unveiled a proposal last Wednesday that was purported to be the “biggest tax cut” in U.S. history. After months of anticipation, the White House released a one-page list of bullet points that amounted to less than 250 words. The tax plan was really more of an outline that painted with very broad strokes, heavy on ambition but light on details. The major takeaway from the proposal was fewer tax brackets and fewer deductions.

If passed, the plan would cut the number of income brackets from seven to three. The plan proposes marginal tax rates of 10%, 25%, and a top line rate of 35%. The plan would also cut the corporate tax rate from 35% to 15%. To the chopping block go the alternative minimum tax and the “death tax” for wealthy individuals. Trump’s proposal to cut corporate taxes should benefit US corporations’ bottom lines significantly. We would expect reduced corporate taxes to then spur economic growth, but increased use of “pass-through” businesses could also leave plenty of room for abuse. On the individual taxpayer side, under Trump’s plan taxpayers will no longer be allowed to deduct state and local taxes from their federally taxed income. This will hurt folks in blue states like Maryland, where they pay high state and local taxes. Deductions for mortgage interest and charitable contributions are protected under Trump’s plan.

Of course, there are some big questions surrounding Trump’s tax proposal. Most importantly, “Will it make it through Congress intact?” We will have to wait and see.

The tax plan handed out before the start of a White House press briefing. Photographer: Andrew Harrer/Bloomberg

Last Week’s Highlights:

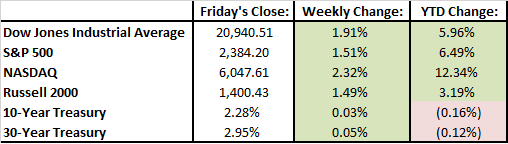

Major indexes were up more than 1.5% last week on strong corporate earnings. On Thursday, Google’s parent company Alphabet posted earnings that beat analyst expectations, helping to lift its share price by 6% for the week. Healthcare and technology stocks led last week’s rally, while telecom and utility stocks declined. Congress avoided a government shutdown by extending the funding deadline for a week.

Looking Ahead:

Earnings season continues this week with Apple reporting on Tuesday, and Facebook and Tesla both reporting on Wednesday. On Wednesday, investors are expecting the Federal Reserve to hold interest rates at current levels. On Friday, we get a highly anticipated April jobs report. Since Trump took office, unemployment has fallen from 4.8% in February to 4.5% in March. Investors will see if that trend continued with Friday’s report. Berkshire Hathaway’s annual shareholder meeting will be held Saturday. Warren Buffet will answer shareholders’ questions for six hours.