The Weekly View (5/15/17)

What’s On Our Minds:

Have you ever asked yourself, “Will I have enough saved up to fulfill my retirement dreams? Will Social Security be enough to sustain me?”

Unfortunately, the answer to the latter question is “probably not.” Government assistance is not designed to sustain you through retirement, so you must be proactive in saving for your future. The good news for you is that with smart investing, you will be better equipped to plan for a successful retirement.

Investing for a Sound Future

Retirement is expensive, there is no doubt about that. Many experts estimate that you will need 70 percent of your pre-retirement income (90 percent or more for lower earners) to maintain your standard of living when you stop working. It’s time to take charge of your financial future today. Below are some tips on how to maximize your retirement savings:

- Invest in your employer’s pre-tax savings plans, such as a 401(k). Contribute as much as you are financially able to responsibly, and use the automatic deduction feature to place money into your retirement account at every pay period. Over time, compound interest and tax deferrals will make a big difference in the amount you will accumulate.

- Place your money into an Individual Retirement Account (IRA). When you open an IRA, you have two basic options—a traditional IRA or a Roth IRA. In general, traditional IRA contributions are not taxed until the time of withdrawal, whereas Roth IRA contributions are taxed immediately but not taxed at withdrawal. Keep in mind, the after-tax value of your withdrawal will depend on inflation, your tax bracket and the type of IRA that you choose.

- Avoid dipping into your retirement savings, as you will lose principal and interest, and may lose tax benefits. If you change jobs, consider rolling over your savings directly into an IRA or to your new employer’s pre-tax retirement plan.

- Start saving early—the sooner you are able to start saving, the more time your money has to grow. Devise a savings plan, stick to it and set goals for the future.

- Take advantage of employer matching funds if you are able. Most employer-sponsored plans require the employer to match a certain percentage of your income. This may be the closest thing to free money, so take advantage!

- Study your investment choices carefully. The more you know about investing, the more likely you will choose wisely.

- Learn as much as you can about your plan’s administrative fees, investment fees and services fees to avoid reducing the amount of your retirement benefits unnecessarily.

Investing a predetermined amount on a regular basis through your company 401(k), a Roth IRA, etc. makes solid retirement sense. For more information, contact us to learn more about how our solutions can help you prepare for your future.

Last Week’s Highlights:

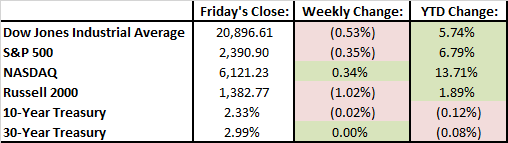

Economic data, drama in Washington D.C. and corporate earnings had the market moving up and down last week. By Friday afternoon, the S&P 500 was off 0.35% and the Dow Jones was down 0.53%.

Stateside, the consumer price index and retail sales figures disappointed investors last week while President Trump fired embattled FBI Director James Comey. Abroad, investors are betting big on Europe: according to Bank of America, a record $6.1 billion was added to funds focused on European stocks last week. Finally, we note a development that affects the whole world: computer hacking. On Friday, a global cyberattack hit dozens of countries. The “ransomware” locks up a Windows computer, and demands a $300 ransom to free it.

There were some big deals announced last week. Verizon agreed to buy Straight Path Communications for $3.1 billion, Sinclair Broadcast Group agreed to buy Tribune Media for $3.9 billion and Coach said it would acquire Kate Spade for $2.4 billion.

Over the weekend, Russia and Saudia Arabia agreed to jointly extend oil production cuts until March 2018. Oil prices posted strong gains Monday morning.

Looking Ahead:

Earnings season is slowing down but a few important companies report this week. Retail behemoth Wal-Mart will report its first quarter results on Thursday, and on Friday Deere & Co. will report their results.

The IPO market will be busy this week. On Monday, compact loader manufacturer ASV Holdings will go public. 3.8 million shares are being offered at $7 each. On Wednesday, cancer treatment biotech company G1 Therapeutics goes public with 6.25 million shares being offered at $16 each.