The Weekly View (6/1/20)

Last Week’s Highlights:

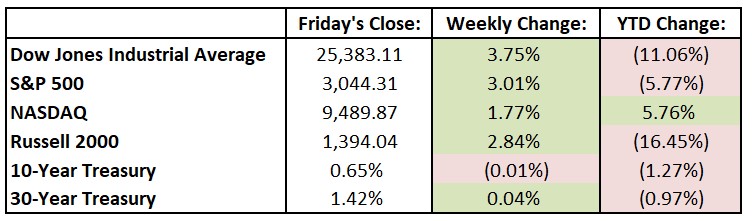

U.S. equities notched a second consecutive week of strong gains, as the S&P 500 recorded its best two-month performance in over ten years. Investors continue to be encouraged recently by signs of states and businesses around the country reopening, helping stocks rebound from their March lows. For the week, the Dow Jones Industrial Average (DJIA) rose 917.95 points, or 3.8%, to 25,383.11, while the S&P rallied 3.0% to 3044.31. The tech-heavy NASDAQ advanced 1.8%, closing at 9489.87. For the month of May, the S&P and DJIA both climbed by over 4%, building on April’s robust rally when the indexes posted their best monthly percentage gains since 1987. A market rotation has occurred in recent days, as market leadership has shifted from the tech giants (including Microsoft (MSFT), Amazon.com (AMZN) and Facebook (FB)) to industries that should benefit as the economy continues to rebound. These industries and their companies, led by the financials and the energy sector, have outperformed recently as this rotation continues.

Looking Ahead:

Monday is June 1st (rabbit! rabbit!). The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for May – economists forecast a rebound to a 43 reading from April’s 41.5 print. Tuesday brings earnings results from Dick’s Sporting Goods (DKS) and Zoom Video Communications (ZM). Campbell Soup (CPB) announces financials on Wednesday. Alphabet (GOOG), Biogen (BIIB), Comcast (CMCSA) and Walmart (WMT) hold their annual shareholder meetings. ADP releases its National Employment Report for May – private-sector employment is expected to decrease by 9.5 million after 20.2 million jobs were lost in April. Broadcom.com (AVGO), Gap (GPS) and Slack Technologies (WORK) hold conference calls on Thursday to discuss quarterly results. The Department of Labor announces initial jobless claims for the week ending May 30th – weekly claims continue to fall from their unprecedented levels. On Friday, the Bureau of Labor Statistics releases the jobs report for May – estimates call for a seven-million drop in nonfarm payrolls after April’s record 20.5 million decline. The unemployment rate is expected to rise to 19% from April’s 14.7%.

All of us at Tufton Capital wish you a safe and healthy week.