The Weekly View (6/19/17)

What’s On Our Minds:

On Friday, it was announced that Amazon will make its largest acquisition to date by acquiring Whole Foods for $13.7 billion. By acquiring the 460-store grocery network, Jeff Bezos, CEO of Amazon, is planning on Amazon becoming a top five grocery retailer by 2025. Traditional grocers, like Krogers, Costco, and Walmart, saw their shares sink on Friday at the prospects of a pricing war and disruption in the industry.

This purchase should be a game changer for the grocery business. Like any merger or acquisition, there will be some winners and some losers. As Amazon continues to transform the way consumers shop, they should benefit from more grocery options and a more efficient shopping experience which should save them time and money. The deal could end up being an unfortunate scenario for Whole Foods cashiers and other minimum wage employees, as Amazon will be looking to cut costs and optimize efficiency in brick and mortar stores.

Amazon is known for waging fierce price wars and upending traditional logistics methods to cut costs. Market commentators have speculated that Amazon will look to cut costs at the pricey chain by eliminating cashiers, changing inventory, and updating the stores’ approach. As one might expect from Amazon, technology could play a large role.

Last year, Amazon released a concept called “Amazon Go” where shoppers walk into an Amazon grocery store, check in with an app on their phone, pick out what they want to take home, and then simply walk out. Amazon Go stores can track which products you take off their shelves and automatically charge your account. Amazon calls it “just walk out” technology. While it’s unclear if Amazon will apply the concept in Whole Foods stores, it’s likely we will be seeing some changes in our neighborhood Whole Foods stores.

Click here to see a video on the “Amazon Go” concept

Last Week’s Highlights:

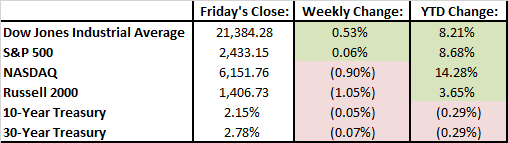

The S&P 500 finished up 0.06% last week. Technology stocks continued their slide, down 1.37% as fears continue to mount about the sector being overvalued at 2000-esque levels. Industrials (+1.13%), Real Estate (+.81%), and Utilities (+.82%) were the winners of the week with Tech (-1.37%), Consumer Staples (-1.27%), and Materials (-1.12%) being the losers.

The Federal Reserve raised its benchmark interest rate to between 1% and 1.25%. This is the second increase this year, and Fed Chair Janet Yellen suggested that it will stick to plans to raise rates three times in 2017. Yellen also laid out a plan to gradually ‘normalize’ the Fed’s $4.5 trillion balance sheet by not reinvesting the principle when the 10-year Treasury notes and Mortgage Backed Securities come due.

Travis Kalanick, the embattled CEO of Uber, announced an indefinite leave of absence as the firm agreed to recommendations to conduct an independent review into its abrasive corporate culture that has led to a series of PR disasters, mostly related to corporate sexism. With half its C-Suite empty and operating at a $607 million loss, Uber is certainly going through growing pains.

Oil prices plunged to their lowest levels in seven months after data from the International Energy Agency indicated that stockpiles of crude in America are falling by much less than had been expected, and they do not expect the global supply glut in oil to ease this year.

Looking Ahead:

Brexit talks begin today, and investors will be hungry for any information related to the extent and timing of the UK’s exit from the European Union. Many economists are hoping the new agreement will at least partly maintain the UK’s participation in the European free trading area.

The White House will be holding a tech summit this week, and the Paris Air Show will be taking place all week. The Paris Air Show is a perfect platform for Aerospace/Defense to showcase new technology, so look for market-making news to come from this event. The tech summit should give insight to the lengths the Trump administration will go to modernize the nation and partner with tech companies.

U.S. housing market data and crude oil inventory numbers will be released on Wednesday, Initial Jobless Claims report and EU consumer confidence on Thursday, and the EU leader’s summit will take place Thursday-Friday.