The Weekly View (6/26/17)

What’s On Our Minds:

One may associate the summer months with longer days, beach vacations, leisurely weekends, and a general slowdown in the business world. But instead of getting lulled into the “Summertime Blues”, at Tufton Capital, we are cranking up our research efforts with a full crew of summer interns.

At Tufton, our Investment Committee stays busy throughout the year as our five portfolio managers and two research associates conduct all the firm’s equity research in house. To stay ahead with our research efforts during the summer months, it has long been a tradition for the firm to hire highly qualified summer interns to run valuations, write reports, and present their findings to our Investment Committee. It is important work that we believe benefits both the firm and our interns as they look to get into the investment business after college. Many of the alumni from our internship program have gone on to land great jobs on Wall Street after college.

This year we are happy to have a crew of four interns joining us for the summer.

Chris Guidry is joining us from Hood College where he is majoring in Economics with a concentration in Finance. Chris is the Chief Investment Officer of the Hood College Student Investment Fund. Prior to attending Hood, Chris was a Sergeant in the United States Marine Corps.

Nick Kuchar interned with the firm in 2015 while he was at Gilman and is joining us again this summer from the University of Michigan. Nick is a member of the Michigan Interactive Investment Club where he and other students manage a $20,000 fund. Nick is also a recruiting analyst for the school’s football team.

George Sarkes is joining us for his second summer at Tufton. George recently graduated from Washington and Lee University where he majored in Accounting and Business Administration and was a member of the Beta Alpha Psi honor society.

Haley Greenspan is joining us from the University of Maryland where she is attending the Robert H. Smith School of Business and is majoring in Finance and Computer Science.

We are very pleased with our intern team’s progress thus far this summer and appreciate the hustle and bustle they bring to our office.

Last Week’s Highlights:

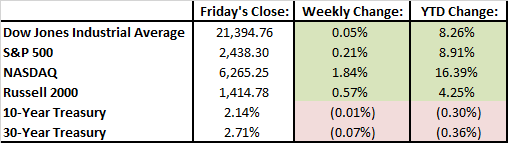

Markets were quiet last week as there were not any market moving catalysts. Senate released the long awaited healthcare bill after closed door negotiations. Details are still being figured out. Oil once again dipped in bear market territory; it lost 4.4% on the week and ended at $43.01. Banks passed the Fed’s stress tests that require them to have adequate capital levels to lend during a recession. Uber CEO, Travis Kalanick, resigned under pressure from investors amid ongoing negative PR and controversy.

In global news, tensions spiked in Syria as an American jet shot down a Syrian government jet. International stability is topic of concern for investors, and developments overseas continue to affect the markets.

Looking Ahead:

All eyes will be on Washington D.C. for the upcoming vote on Senate Republican’s alternative to Obamacare, the BCRA. The Congressional Budget Office (CBO) will issue a report on the BCRA Monday, estimating the bill’s cost/savings, along with how many individuals will be left uninsured. Five Republican Senators ranging from hard-line conservative Ted Cruz (R-TX) to moderate Dean Heller (R-NV), have openly opposed the bill in its current form. Mitch McConnell can only afford two GOP defections to pass the bill, and he plans to vote on the bill on either late Thursday or Friday, before the July 4th recess. One sixth of the US economy could be affected by the changes in the healthcare law.

On Wednesday, the Federal Reserve will publish its results on if big banks passed their stress tests. The stress tests, which were started because of the Dodd-Frank financial overhaul, are expected to be less strenuous because the Trump administration removed the qualitative part of the test that led to embarrassing failures for banks, such as Citigroup, Deutsche Bank, and Banco Santando.

Lastly, Blue Apron, the meal-kit company, is set to IPO Wednesday. They are expecting to raise $586 million from the IPO and are given a $3 billion valuation, making it one of the bigger IPOs of 2017.