The Weekly View (9/14/20)

Last Week’s Highlights:

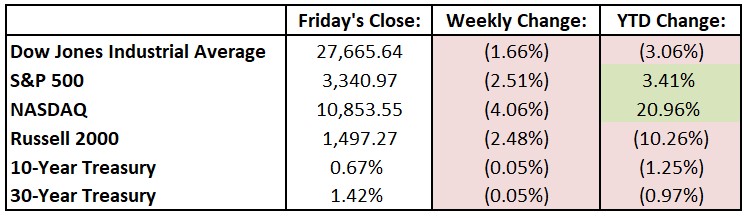

Wall Street closed out its worst week since June with another volatile trading day on Friday, as big technology stocks continued to weaken after their huge gains in recent months. Shares of Apple (AAPL), Facebook (FB), Microsoft (MSFT) and Alphabet (GOOG) fell 4% or more last week, weighing on the broader market. The swings in tech stocks have been especially alarming because of their outsize influence on the stock market’s gains this year. The market’s climb over the summer was largely fueled by a handful of tech companies that are expected to benefit from the stay-at-home economy created by the coronavirus pandemic. For the week, the Dow Jones declined 468 points, or 1.7%, to 27,666, while the S&P 500 fell 2.5% to 3341. The NASDAQ lost 4.1%, closing at 10,854. Oil prices fell to their lowest level since June.

Looking Ahead:

Most S&P 500 components are done with their Q2 earnings releases, so the week ahead will be especially focused on economic data rather than company-specific results. Lennar (LEN) reports quarterly earnings results on Monday, and Pfizer (PFE) hosts a two-day virtual investor day to discuss its pipeline of drugs. Adobe (ADBE) and FedEx (FDX) release financials on Tuesday. The Bureau of Labor Statistics (BLS) reports export and import prices for August – economists forecast a 0.4% month-over-month rise in export prices, compared with a 0.8% gain in July. On Wednesday, The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the Committee is expected to stand pat with interest rates near zero. Thursday brings the Department of Labor’s report of initial jobless claims for the week ending on September 12th – weekly jobless claims remain elevated historically but have fallen from an average of 1.5 million in June to 992,250 in August. The University of Michigan releases its Consumer Sentiment Index for September on Friday – expectations call for a 75.5 reading, slightly ahead of August’s 74.1 print.

All of us at Tufton Capital wish you a safe and healthy week.