The Weekly View (9/11/17)

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, individuals with estates totaling $5.49 million, and married couples with $10.98 million, can get a head start on generational wealth transfer and reduce the ramifications inflicted by estate taxes.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

Last Week’s Highlights:

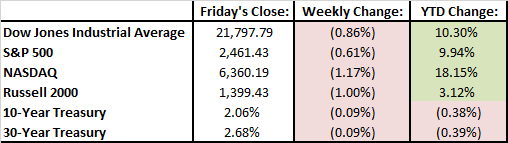

Stocks were lower last week. Political headlines and the impact of both Hurricanes Harvey and Irma weighed on investors’ minds. The Dow Jones slipped .86% and the S&P 500 shaved off .61%.

Investors were relieved last week when President Trump reached across party lines to extend the nation’s debt ceiling which will keep the government funded for the next 3 months. Although they may have only “kicked the can” on the issue, the move showed some rare bipartisan cooperation.

The monetary cost of Hurricanes Harvey and Irma will not be totally calculated for some time but the overall cost of both storms together could be in the several hundred billion dollar range. It is likely that property and casualty insurers covering Texas and Florida will see large claims in coming quarters.

Looking Ahead:

Monday is the 16th anniversary of the 9/11/2001 terror attacks.

On Tuesday, Apple will release the highly-anticipated iPhone 8. Experts are expecting the new iPhone to include “Face ID” technology that will recognize the owner’s face so that users and simply look at the phone to unlock it.

On Friday, retail sales, industrial production, and capacity utilization figures will all be reported. Also on Friday, contracts for stock index futures, stock index options, and stock options all expire on the same day. These “triple witching” days occur four times a year and can result in escalated trading activity during the final hour of the day.