The Weekly View (9/25/17)

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend.

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long-term.

Over the summer, Nelson Peltz’s $12.7 billion hedge fund, Trian Partners, took aim at household product conglomerate Proctor and Gamble. His fund currently owns $3.3 billion worth of P&G shares. Peltz thinks P&G is not structured properly and believes that the company in resistant to change. He is currently in a proxy fight for a seat on the company’s board. The company says they have been actively working with Trian but is against adding him to the board. In dollar terms, P&G is the largest company to ever face a proxy fight of this nature.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

Last Week’s Highlights:

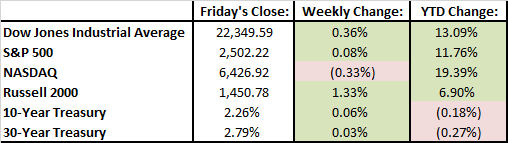

Stocks were marginally higher last week and hit record highs. The highlight of the week was the Federal Reserve’s announcement that it would begin normalizing its balance sheet in October. The Fed also stated that it would keep its federal funds rate between 1 and 1.25 percent. The announcement caused 2 and 10 year Treasury yields to increase along with the the value of the dollar.

Looking Ahead:

Investors will see how the housing market is doing this week when the Case-Shiller Index of home prices and new home sales figures are released on Tuesday. We will also get a report on consumer confidence on Tuesday and Janet Yellen is scheduled to deliver a speech. Investors are expecting her elaborate on the Fed’s plans to unwind the huge balance sheet it has amassed since the financial crisis.