This Time It Is Different

By Randy McMenamin, CFA

The five most dangerous words to a portfolio manager are “This time it is different”.

Inflation is a hidden tax which only stays hidden for so long. When inflation rears its ugly head and is visible to consumers, business people and politicians, there is a problem.

What causes inflation? Today’s inflation is caused by too much money chasing too few goods and services. The annualized CPI (Consumer Price Index) for December 2021 was up 7% from a year earlier – the fastest increase since June 1982. This time was different because very strong money supply growth and generous government stimulus gave rise to this high level of inflation.

U.S. inflation reached its peak in the 1980-1981 period at 14% plus (see chart). The trend from that peak was lower highs over the next thirty years, 6% plus in the early ‘90s and approximately 5.5% in the late 2000s. Many people do not remember the destructive effects of inflation in the ‘70s and early ‘80s when prices were increasing by 10% every ten years. In order to stop these soaring inflation rates during this period, the Federal Reserve pushed short-term interest rate to 20%.

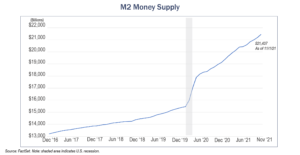

M2 is the measure of U.S. currency and coins as well as checkable deposits, savings less than $100,000 and retail money market funds. The M2 measure of money is up 40% since February of 2020, growing substantially faster than the pre-Covid trend. It is the key difference between the current situation and the circumstances in the aftermath of the financial crisis of 2008-09. During the first round of quantitative easing and government spending by President Bush, the M2 measure remained subdued because the Fed kept banks from lending in part by raising capital requirements. Banks ended up holding excess reserves and the money supply remained calm. This recent Covid rescue by the Fed funded loans to businesses and provided direct payments to individuals. As a result, the Fed bought $80 billion in U.S. Treasury obligations per month. This process of monetizing the debt occurs when the Federal Reserve purchases government debts following the liquidation of individual holdings. The purchases increase the banking system’s reserves, and eventually, the supply of money. Another process known as monetary financing happens when the government borrows money from the Federal Reserve to finance public spending instead of selling bonds to investors. This practice is known informally as printing money or money creation.

The cycle of rising inflation starts with government stimulus and extended unemployment benefits (spending inordinate amounts of money) to support a depressed economy or to avert a recession. In the first quarter of 2020, a recession resulted from country-wide shutdowns. As the stimulus funds flowed through the system, demand began to pick up. The acceleration of demand depended on the amount of stimulus and its duration. For this pandemic-induced recession, the initial stimulus programs were well founded and helped avoid a major long-term economic collapse. The economy healed faster than anticipated, but additional stimulus was still approved. As a consequence, demand surged and supply capacity was overwhelmed.

This time was different in another way. The economic downturn caused by Covid was different than past declines because spending on services (restaurants, movies, etc.), which usually holds up well during downturns, cratered. When a recession arrives, spending on goods (cars, appliances, etc.) usually takes a big hit. People easily defer these big-ticket items. This time, consumer spending on services contracted dramatically (people stayed at home) while spending on goods skyrocketed. The supply side of the economy was unable to meet the increased demand, and supply chain bottlenecks surfaced. For example, semiconductor shortages held up auto production and drove up prices for both new and used cars and trucks. Capacity constraints in the semiconductor industry contributed to the inability to meet increased demand. As a general rule, when demand increases and supply is unable to meet the new demand, prices rise. During the pandemic recovery, there continued to be a variety of shortages, including labor, transportation, shipping and manufacturing. All the costs associated with these shortages contributed to the rise of inflation.

Some prices of the components of CPI are transitory and could begin to decline later this year, but others may give rise to increasing inflation. Housing rents, held down last year by limits on evictions, could be a source of future inflation. Limits on evictions are now over, and the rental value of real estate is expected to rise quickly.

There is no perfect hedge against inflation. Gold, TIPS, REITs, commodities and balanced portfolios may be considered possible hedges against inflation. Gold is a physical asset that holds value. However, it pays no income, and its market value is susceptible to rising interest rates which central banks use to fight inflation.

TIPS (Treasury Inflation-Protected Securities) are sold by the U.S. Treasury and are indexed to inflation to protect investors from inflation. TIPS provide very modest interest rates relative to current levels and are issued in five, ten or thirty-year maturities. There are tax implications associated with TIPS.

Commodities are also deemed a defense against inflation. Commodities include foreign currencies, natural gas, oil, precious metals, orange juice and grain. The prices of commodities are very volatile, and a slight change in the supply/demand relationship of the commodity can result in adverse pricing.

Balanced investment portfolios can effectively guard against rising prices. A balanced portfolio will most likely underperform the results of an all-equity portfolio or an equity index. The common stock portion of the balanced fund should provide rising dividend income and increasing market values over the long term.

Real Estate Investment Trusts (REITs) invest in income producing properties. During rising inflationary periods, there is an upsurge in real estate and rental levels. Think of the rise of real estate prices over the past twelve months. However, REIT prices can get knocked down as the Feds use rising interest rate to counter inflation.

The emergency support provided by the Federal Reserve and the U.S. Government to businesses and individuals was an appropriate response to blunt the extreme shocks created by the pandemic. The economy healed faster than expected, but it has expanded excessively for far too long.

The Fed recognized that monetary stimulus was too generous and are in the process of making corrections. Tapering of the bond purchase program began in the fourth quarter of 2021 and will wind down by March of this year. In addition, the Fed is expected to begin raising interest rates, possibly as early as March 2022.

Over the past few years, the Fed has missed its objective of generating an inflation rate of 2%. We believe that the inflation rate for 2022 will average above this former goal with a higher rate in the first half and a declining percentage in the second half.