By Rick Rubin

In response to the COVID-19 pandemic that spread across the U.S., the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed by Congress and signed into law by President Trump on March 27, 2020. The CARES Act is a $2 trillion emergency fiscal stimulus package designed to help battle the disruptive economic effects of COVID-19 for individuals, businesses, healthcare providers and state and local governments.

By Rick Rubin, CFA

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law by President Trump on December 20, 2019. The legislation is designed to allow more individuals to access workplace retirement plans and to increase retirement savings. It will impact defined contribution plans, defined benefit plans, individual retirement accounts (IRAs), and 529 plans. Many of the provisions became effective on January 1, 2020.

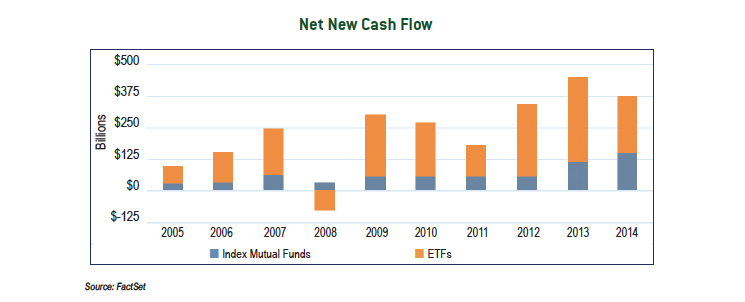

Over our twenty year history, Tufton Capital Management has followed a disciplined investment process where we focus on taking advantage of investors’ emotions and identify mispriced securities. As long-term value investors, we are happy to move against the herd and purchase securities when the market has given up on them, and later sell them when sentiment has improved. While we are fully committed to sticking with our strategy, we pay close attention to trends emerging in the money management business. One such trend is the popularity of passive investments including index funds and exchange-traded funds (ETFs), which investors have piled into since the bull market began in March 2009. While indexing may be an appropriate, low-cost option for retail investors, we believe a portfolio constructed entirely of these products is suboptimal for investors with sizable assets. Quite simply, these passive products in and of themselves are not tailored to meet a client’s specific financial objectives or risk parameters.

So why have investors (and financial advisors) moved towards passive indexing? First off, indexing is easy. You can purchase a few products and get a broadly diversified portfolio. Secondly, you don’t need to spend a lot of time or have expertise researching or monitoring the funds, as compared to the fundamental research we perform on our individual securities. Finally, most index funds and ETFs have lower management fees when compared to their actively managed counterparts. It’s no secret that only one out of five actively managed mutual funds typically beats its respective benchmark in a given year. Considering the poor performance and high fees of active funds, we consider the move towards indexing to be a logical one for small investors, but it has its drawbacks.

A fundamental flaw with passive indexing is that, by nature, the funds often buy high and sell low to mirror the performance of a specific index. For example, when a company has done well and is added to an index, typically its business has been thriving, which would likely have already propelled shares higher. On the flip side, when a company’s business has underperformed and it is removed from an index, an index fund is forced to sell and their investors have no opportunity to profit once a company’s prospects start to improve. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors – buying securities as they fall in price.

Another issue with index investing comes when indexes and ETFs are forced to trade securities only after an index’s plan to add a new stock is announced to the market. Traders can “front-run” these additions and buy shares beforehand, as they know the index funds will be buying the shares when the company is officially added to the index. An example of this occurred last year on Monday, March 16th when it was announced that American Airlines would be joining the S&P 500 that Friday. Come Friday, the stock had risen 11%. Index funds were thus forced to buy the stock at a higher price. Similar to the way high-frequency traders are able game the market, this is an example of smart money taking advantage of an index fund. Over time these events may erode the returns of investing in these low-cost products.

While riding the momentum in index funds feels great during a bull market, index investors may be left exposed from a risk perspective when the market inevitably heads south. This is because an index fund may have larger positions in companies with high valuations, and smaller positions in lowly valued companies. Thus, even though index investors are able to manage risk relative to their benchmark, they may struggle managing risk on an absolute basis. One of our goals is to provide our clients a higher return on their equities than the S&P 500 over a full market cycle, without taking any undue risk. Hence, we will stick to our guns and continue seeking to buy a dollar’s worth of assets for fifty cents.

Many financial advisors build a book of business using mutual funds for their affluent clients. Is it because funds have favorable characteristics and offer stronger investment returns? Absolutely not – mutual funds have many drawbacks!! First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills. (Please see our Tax Loss Harvesting article on page 5.) Small retail investors have few options and mutual funds may make sense for them. Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals. Please read on and you will understand why we favor our approach.

Many financial advisors build a book of business using mutual funds for their affluent clients. Is it because funds have favorable characteristics and offer stronger investment returns? Absolutely not – mutual funds have many drawbacks!! First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills. (Please see our Tax Loss Harvesting article on page 5.) Small retail investors have few options and mutual funds may make sense for them. Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals. Please read on and you will understand why we favor our approach.

Often, advisors put clients into mutual funds because they lack robust in-house research, or it simply frees up the advisors’ time to go find new business. While funds offer investors instant diversification, it’s a one-size-fits-all approach. A fund manager’s objective may be quite different from that of the investor. For example, a manager’s compensation may be linked to outperforming a benchmark with no consideration for the level of risk taken, the amount of taxes passed on (more…)