What’s On Our Minds:

Tufton Capital Management would like to wish all of our clients and associates a Happy Independence Day!

Last Week’s Highlights:

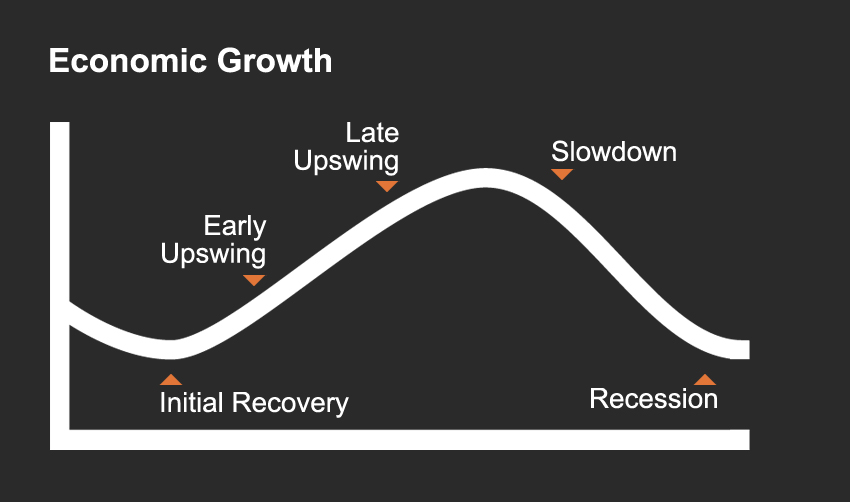

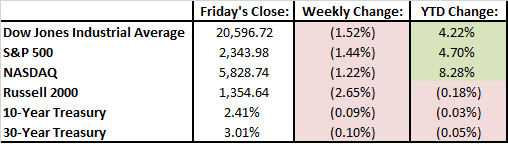

The first half of 2017 is officially in the books. Tech stocks were Wall Street’s darlings in the first half of the year but have struggled recently. Bank stocks came back into vogue in June.

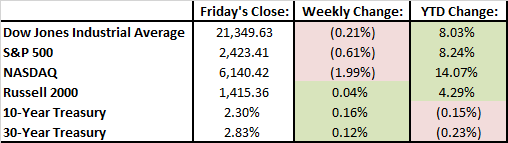

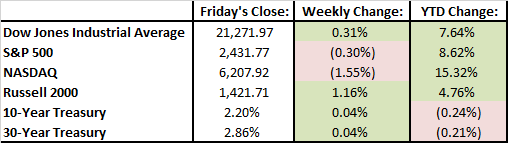

Stocks were mixed last week. The S&P was down slightly, the Dow was flat, but the NASDAQ was down 2% due to volatility in the tech sector. Financial stocks had a good week after it was reported that all 34 U.S. banks passed the Federal Reserve’s annual stress test.

Looking Ahead:

It’s a short week of trading but investors will have plenty of fresh economic data to review. The market will close at 1 PM on Monday and will be closed on Tuesday as Americans celebrate the Fourth of July. The PMI and ISM manufacturing indices and construction spending from June will be reported on Monday. On Wednesday, the Fed will release minutes from its last meeting. On Friday we will cap off the week with the highly anticipated June jobs report.

What’s On Our Minds:

One may associate the summer months with longer days, beach vacations, leisurely weekends, and a general slowdown in the business world. But instead of getting lulled into the “Summertime Blues”, at Tufton Capital, we are cranking up our research efforts with a full crew of summer interns.

At Tufton, our Investment Committee stays busy throughout the year as our five portfolio managers and two research associates conduct all the firm’s equity research in house. To stay ahead with our research efforts during the summer months, it has long been a tradition for the firm to hire highly qualified summer interns to run valuations, write reports, and present their findings to our Investment Committee. It is important work that we believe benefits both the firm and our interns as they look to get into the investment business after college. Many of the alumni from our internship program have gone on to land great jobs on Wall Street after college.

This year we are happy to have a crew of four interns joining us for the summer.

Chris Guidry is joining us from Hood College where he is majoring in Economics with a concentration in Finance. Chris is the Chief Investment Officer of the Hood College Student Investment Fund. Prior to attending Hood, Chris was a Sergeant in the United States Marine Corps.

Nick Kuchar interned with the firm in 2015 while he was at Gilman and is joining us again this summer from the University of Michigan. Nick is a member of the Michigan Interactive Investment Club where he and other students manage a $20,000 fund. Nick is also a recruiting analyst for the school’s football team.

George Sarkes is joining us for his second summer at Tufton. George recently graduated from Washington and Lee University where he majored in Accounting and Business Administration and was a member of the Beta Alpha Psi honor society.

Haley Greenspan is joining us from the University of Maryland where she is attending the Robert H. Smith School of Business and is majoring in Finance and Computer Science.

We are very pleased with our intern team’s progress thus far this summer and appreciate the hustle and bustle they bring to our office.

Last Week’s Highlights:

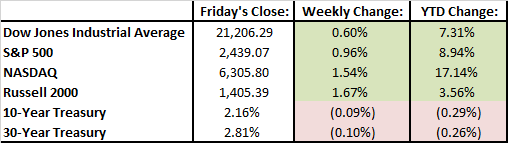

Markets were quiet last week as there were not any market moving catalysts. Senate released the long awaited healthcare bill after closed door negotiations. Details are still being figured out. Oil once again dipped in bear market territory; it lost 4.4% on the week and ended at $43.01. Banks passed the Fed’s stress tests that require them to have adequate capital levels to lend during a recession. Uber CEO, Travis Kalanick, resigned under pressure from investors amid ongoing negative PR and controversy.

In global news, tensions spiked in Syria as an American jet shot down a Syrian government jet. International stability is topic of concern for investors, and developments overseas continue to affect the markets.

Looking Ahead:

All eyes will be on Washington D.C. for the upcoming vote on Senate Republican’s alternative to Obamacare, the BCRA. The Congressional Budget Office (CBO) will issue a report on the BCRA Monday, estimating the bill’s cost/savings, along with how many individuals will be left uninsured. Five Republican Senators ranging from hard-line conservative Ted Cruz (R-TX) to moderate Dean Heller (R-NV), have openly opposed the bill in its current form. Mitch McConnell can only afford two GOP defections to pass the bill, and he plans to vote on the bill on either late Thursday or Friday, before the July 4th recess. One sixth of the US economy could be affected by the changes in the healthcare law.

On Wednesday, the Federal Reserve will publish its results on if big banks passed their stress tests. The stress tests, which were started because of the Dodd-Frank financial overhaul, are expected to be less strenuous because the Trump administration removed the qualitative part of the test that led to embarrassing failures for banks, such as Citigroup, Deutsche Bank, and Banco Santando.

Lastly, Blue Apron, the meal-kit company, is set to IPO Wednesday. They are expecting to raise $586 million from the IPO and are given a $3 billion valuation, making it one of the bigger IPOs of 2017.

What’s On Our Minds:

On Friday, it was announced that Amazon will make its largest acquisition to date by acquiring Whole Foods for $13.7 billion. By acquiring the 460-store grocery network, Jeff Bezos, CEO of Amazon, is planning on Amazon becoming a top five grocery retailer by 2025. Traditional grocers, like Krogers, Costco, and Walmart, saw their shares sink on Friday at the prospects of a pricing war and disruption in the industry.

This purchase should be a game changer for the grocery business. Like any merger or acquisition, there will be some winners and some losers. As Amazon continues to transform the way consumers shop, they should benefit from more grocery options and a more efficient shopping experience which should save them time and money. The deal could end up being an unfortunate scenario for Whole Foods cashiers and other minimum wage employees, as Amazon will be looking to cut costs and optimize efficiency in brick and mortar stores.

Amazon is known for waging fierce price wars and upending traditional logistics methods to cut costs. Market commentators have speculated that Amazon will look to cut costs at the pricey chain by eliminating cashiers, changing inventory, and updating the stores’ approach. As one might expect from Amazon, technology could play a large role.

Last year, Amazon released a concept called “Amazon Go” where shoppers walk into an Amazon grocery store, check in with an app on their phone, pick out what they want to take home, and then simply walk out. Amazon Go stores can track which products you take off their shelves and automatically charge your account. Amazon calls it “just walk out” technology. While it’s unclear if Amazon will apply the concept in Whole Foods stores, it’s likely we will be seeing some changes in our neighborhood Whole Foods stores.

Click here to see a video on the “Amazon Go” concept

Last Week’s Highlights:

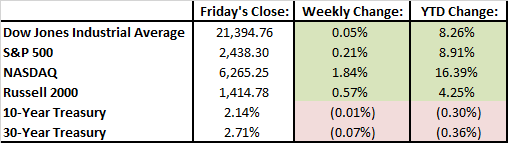

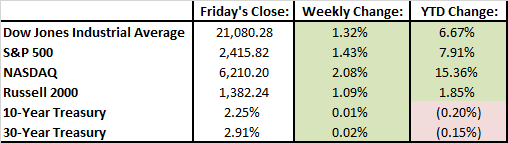

The S&P 500 finished up 0.06% last week. Technology stocks continued their slide, down 1.37% as fears continue to mount about the sector being overvalued at 2000-esque levels. Industrials (+1.13%), Real Estate (+.81%), and Utilities (+.82%) were the winners of the week with Tech (-1.37%), Consumer Staples (-1.27%), and Materials (-1.12%) being the losers.

The Federal Reserve raised its benchmark interest rate to between 1% and 1.25%. This is the second increase this year, and Fed Chair Janet Yellen suggested that it will stick to plans to raise rates three times in 2017. Yellen also laid out a plan to gradually ‘normalize’ the Fed’s $4.5 trillion balance sheet by not reinvesting the principle when the 10-year Treasury notes and Mortgage Backed Securities come due.

Travis Kalanick, the embattled CEO of Uber, announced an indefinite leave of absence as the firm agreed to recommendations to conduct an independent review into its abrasive corporate culture that has led to a series of PR disasters, mostly related to corporate sexism. With half its C-Suite empty and operating at a $607 million loss, Uber is certainly going through growing pains.

Oil prices plunged to their lowest levels in seven months after data from the International Energy Agency indicated that stockpiles of crude in America are falling by much less than had been expected, and they do not expect the global supply glut in oil to ease this year.

Looking Ahead:

Brexit talks begin today, and investors will be hungry for any information related to the extent and timing of the UK’s exit from the European Union. Many economists are hoping the new agreement will at least partly maintain the UK’s participation in the European free trading area.

The White House will be holding a tech summit this week, and the Paris Air Show will be taking place all week. The Paris Air Show is a perfect platform for Aerospace/Defense to showcase new technology, so look for market-making news to come from this event. The tech summit should give insight to the lengths the Trump administration will go to modernize the nation and partner with tech companies.

U.S. housing market data and crude oil inventory numbers will be released on Wednesday, Initial Jobless Claims report and EU consumer confidence on Thursday, and the EU leader’s summit will take place Thursday-Friday.

What’s On Our Minds:

Forget about FANG; there’s an updated group of market moving mega-cap tech stocks in 2017. The “Fabulous Five” includes Facebook, Amazon, Apple, Microsoft, and Google. The street is calling the high-flying group “FAAMG”. Combined, the FAAMG stocks have added $660 billion in market value this year and even though these companies are only 1% of the number of companies in the S&P 500, these top 5 tech stocks account for 13% of the market value weighting in the index.

Last Friday, Goldman Sachs’ research department took a shot at the FAAMG high-fliers noting that the overall return of the Nasdaq and S&P 500 is getting increasingly dependent on the FAAMG group. The report even went as far to compare the run up in these stocks to the euphoria in tech stocks before the burst of the Dot-Com bubble nearly 20 years ago. Goldman analyst Robert Bourojerdi wrote, “This out performance, driven by secular growth and the death of the reflation narrative, has created positions extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities).” For investors, Friday’s report from one of Wall Street’s top firms, was hard pill to swallow and the exuberance built in these companies’ share prices was interrupted. Facebook was down 2.27%, Amazon was down 2.95%, Apple was down 3.52%, Microsoft was down 2.39% and Alphabet was fell 2.3%.

Clearly, Goldman’s research department is a bit worried the investors are getting caught up in the game of chasing growth in this small group of names.

Even though these types of moves are exciting to follow, we urge our readers to avoid getting caught up in the day to day media hype, and remain focused on the long-term prospects of their investment portfolio. The Tufton investment team continues to diligently monitor developments throughout the market and clients’ individual portfolios.

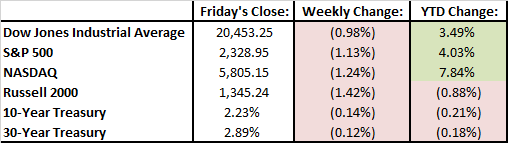

Last Week’s Highlights:

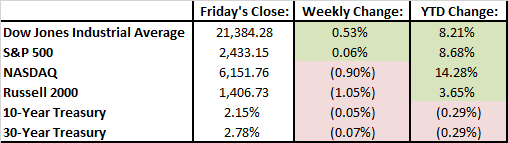

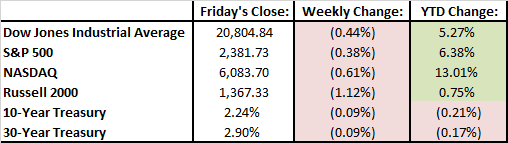

While financials had a great week due to a Dodd Frank repeal moving through the House of Representatives, a move Friday by technology stocks drove the S&P and NASDAQ into the red. NASDAQ was pushed lower by note by Goldman Sachs that suggested investors are overestimating the stability and strength of many recent outperformers in the Tech space. This led to a quick selloff and profit taking across the board in tech, and ended with the Technology Select Sector SPDR ETF (XLF) slumping -2.47%. Energy stocks had a volatile week, dropping in value midweek, but recovered on Friday. The price of WTI oil moved to its lowest level since November, on higher than expected inventory levels, as supply and demand forces continue to duel it out causing uncertainty in the energy sector.

Political forces continued to drive the narrative and influence the markets, but last week, economic forces took the wheel in moving the needle. The Comey testimony before Congress did not reveal anything particularly material or surprising, and markets reacted positively. In other news, Nordstrom is seeking to take itself private, GM sided with management against activist investor David Einhorn’s proposals, and Alibaba surged on raised guidance.

Looking Ahead:

All eyes will be on the Federal Reserve this week when they decide Wednesday whether to raise short term interest rates. The Street is expecting the Fed to increase rates by 25 basis points. Janet Yellen will also hold a press conference afterwards, which will be closely followed, because it could shed light on the state of the US economy, future Fed rate hikes, and if they will start to unwind the Fed’s $4.5 trillion balance sheet.

The Producers Price Index (PPI) and the consumers price index (CPI) will be reported Tuesday and Wednesday respectively. Both are measures of inflation and it is estimated that each increased between 0.2% and 0.5% this past month.

To wrap up the week on Friday, the stock market will likely see increased volume because it is a ‘triple-witching’ day. Triple witching days happen four times a year in March, June, September and December. It is a day when contracts for stock index options, stock index futures, and stock options all expire on the same day, and the stock market is flooded by arbitrage traders seeking to exploit price disparities.

What’s On Our Minds:

At Tufton, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was ‘filling the buckets” by picking what they believed were the best funds for each category. It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets with negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 50 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

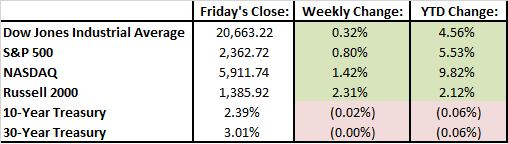

Last Week’s Highlights:

Stocks had a strong week as investors remain optimistic that improving economic statistics and corporate earnings will continue to gain positive momentum. Even though it was a strong week overall, individual sectors of the market did not all move higher. Energy and financial stocks declined last week, while telecom shares led the market higher.

On Friday, the May jobs report showed that the U.S. added only 138,000 jobs in May. The disappointing number did little to upset investors though, and stocks reached all-time highs on Friday. Some investors believe that the disappointing number will persuade the Federal Reserve to hold off on increasing interest rates later this month. Thus, the anemic number may actually have been a positive for equities. Since 2010, the U.S. economy has added 16 million jobs and the unemployment rate currently sits at 4.3%.

Looking Ahead:

There are numerous important events that will test the stock market this week.

The following economic data will be released this week:

- Monday: non-farm productivity, unit labor costs, ISM non-manufacturing data, factory orders and durable goods.

- Tuesday: labor turnover survey results and job openings

- Wednesday: consumer credit figures

- Thursday: results from the quarterly services survey.

- Friday: wholesale inventory numbers.

On Tuesday, the Business Roundtable (an association of chief executive officers from America’s leading companies) will release its 2017 CEO Economic Outlook Survey. The survey should indicate what companies are expecting in regards to sales, hiring, and capital spending.

On Thursday, the European Central bank will issue its latest statements on monetary policy. On top of that announcement, Britain will be holding elections. An upset of conservative Prime Minister Teresa May would certainly upset Brexit plans.

It will also be a busy week in Washington. Congress is expected to vote on the Financial Choice Act, which is a plan to roll back banking industry reforms that were made after the Great Recession. On Thursday, former FBI director James Comey will testify on allegations that President Trump’s campaign had improper contact with Russian officials.

What’s On Our Minds:

Are mounting Student Loans the next bubble?

Many Americans—specifically Millennials—are being crushed under the weight of student loans; currently, outstanding student loan debt in the United States totals more than $1.3 trillion. The average graduate from the Class of 2016 has over $37,000 in student loan debt. Stemming from this, there are concerns that student loan debt could represent the next “bubble” for the economy — even drawing comparisons to the housing market collapse that led to the Great Recession. Just how does the current state of student loan debt compare to the collapse of the housing market?

Understanding the student loans crisis

It is no secret that the cost of college is rising at a seemingly unsustainable rate. Since 1980, college-related costs have increased tenfold, while inflation itself has only tripled. Additionally, wage growth has only kept pace with inflation. Rapidly increasing tuition costs paired with low wage growth means that students must go further into debt while generally not benefiting from proportional salary growth.

Aside from the debt itself, the default rate on student loans is among the highest it has been in decades. In fact, the percentage of Americans who were in default on their student loans increased by more than 150 percent from 2003 to 2013. Given these factors, it is easy to understand the concern that some have regarding how the student loans crisis may affect the economy.

Comparing student loans to the housing market collapse

Of the many possible contributing factors to the housing market crisis, there is one that sticks out as being remarkably similar to the current economic conditions surrounding student loan debt: loan accessibility.

In the late 1990s and early 2000s, the American government enabled low- and middle-income families to access mortgages more easily than before. Between the American Dream Down payment Assistance Act and HUD Secretary Andrew Cuomo announcing a 10-year plan to make $2.4 trillion available to low-and middle-income families, mortgages were made available to more people. According to US Census data, the median price of a home doubled between 1992 and 2006 from $121,500 to $246,500.

The accessibility of student loans through the Federal Direct Student Loan Program (FDSLP), passed in 2010, mirrors the proliferation of mortgages in the early 2000s. This program provided aid to many students who otherwise may not have had access to student loans.

Per the Government Accountability Office, state funding for public colleges decreased by 12 percent from 2003 to 2012. Over this same timeframe, tuition increased by about 55 percent across all public colleges. It is worth noting that a significant portion of these shifts took place from 2010 to 2012, which is the timeframe directly following the passing of the FDSLP.

States have largely decreased funding to public universities and the onus has been shifted to families — either pay for education out-of-pocket, with federal loans, or some combination of the two. Though the decline of state funding and the increase in federal funding may not have a direct causation link stemming from the FDSLP, there is an observable correlation on a similar timeline.

The differences between the two

Though both mortgages and student loans represent a huge portion of our national debt, the total amount of debt varies widely between the two. In the midst of the housing market collapse, mortgages comprised nearly 75 percent—or about $9.25 trillion—of all debt in the United States. Around that time, the delinquency rate on mortgages peaked at about 11.5 percent. Comparatively, student loans represented about 10 percent—or $1.3 trillion—of debt in the United States in 2016. Currently, the delinquency rate on student loans is about 11.4 percent. In terms of direct economic impact, student loans represent a far smaller portion of the total debt in America than mortgages did nearly a decade ago. Though the delinquency rates are similar, the total monetary value of debt for student loans is far lower than either mortgages today or at the height of the housing bubble.

The effect of high student loan defaulting could, however, create a ripple of economic and financial events. Much like how mortgage defaulting significantly affected many more aspects of the economy than just the housing market, student loan defaulting could create unforeseen issues in the economy. Though the circumstances surrounding the housing market collapse and the student loan crisis may not be the exact same, there are definite similarities between the two.

The ubiquity of individuals obtaining student loans, as well as the life-changing impact they have on the life of an average American, evokes flashbacks to what preceded the Great Recession. It seems unlikely, however, that a similar default rate on student loans would have a comparable impact on the economy. Only time will tell how the student loan crisis is handled. In the meantime, the rate at which Americans are going into debt with student loans appears to exhibit no signs of slowing.

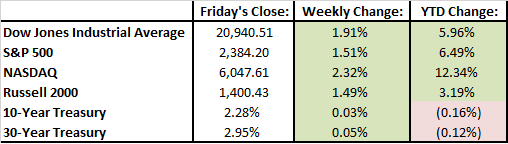

Last Week’s Highlights:

It was a strong five days for U.S. equity markets. U.S. large cap stocks experienced significant gains upwards of 1.5% last week following the previous week’s apprehension regarding President Trump’s relationship with Russia and the firing of James Comey. From where we sit now, the S&P 500 is up nearly 8% for the year, thanks to a sense of faith in the Trump administration’s policies on infrastructure spending and tax reform.

Investors were happy to hear that U.S. GDP was revised up from 0.7% to 1.2% for the first quarter thanks to strong consumer spending.

On the international side, markets have been improving rapidly. Developed-market equities (EAFE) have seen gains above 12% this year. Emerging-market stocks have increased 18% since the beginning of the year.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. Even though it’s an abbreviated week, there is plenty of economic data coming across the wire this week. On Tuesday, we will hear results from the Conference Board’s Consumer Confidence Survey. On Wednesday, investors will be examining pending home sales data. Vehicle sales and construction spending data will be released on Thursday. To wrap up the week, on Friday, we will get May’s jobs report. Investors are expecting 175,000 job gains and wage growth of 2.7% year-over-year in May.

What’s On Our Minds:

Last week, volatility returned to the markets so this week we will forgo our usual “Last Week” section and focus on last week’s news and the market’s emotional response.

After months of remarkably low stock market volatility, we got our fair share last week. Markets took their biggest hit of the year on Wednesday when investors turned bearish as President Trump fired FBI Director James Comey and it was reported that Trump had asked him to drop an investigation into former National Security Advisor Michael Flynn’s dealings with Russian officials. Traders got anxious on the news, seeing it as a threat to Trump’s policy initiatives. After hovering around its lowest level for weeks, the CBOE Volatility Index (VIX) surged 46% on Wednesday.

While the 24-hour news cycle may have suggested that the sky was falling on Wednesday, investors refocused on the stock market’s improving fundamentals Thursday and Friday. By the end of the week, it was clear that the emotional reaction to Wednesday’s market drop was more severe than the actual potential economic damage that the revelations may cause.

Recent political events (Brexit, China devaluing their currency, the night of the US election, and North Korea concerns) have not been able to interrupt the 8-year-old bull market. In times like these where political events can cause media hysteria and drive the market one way or the other, it’s important to remember that the market reflects the future expected earnings of companies. Seeing that S&P 500 companies posted 14% earnings growth during the first quarter of 2017, the labor market is strong, the housing market is close to cycle highs, and industrial production has picked up recently, it’s not surprising to see resilience in the current market. Too put it another way, it’s not all about President Trump.

Furthermore, given the flat market we have been experiencing lately, last week’s volatility may have seemed like a big deal, but it shouldn’t surprise investors as this type of move is really not unusual. As JPMorgan pointed out last week, stocks have averaged a drop of 14.1% at some point in each calendar year since 1980 and have finished in the green 28 of those 37 years.

Moral of the story last week? Don’t get caught up in the hype and stay focused on the long term.

Looking Ahead:

This week, as earnings season is coming to an end, investors will shift their focus from individual companies’ first quarter results to macroeconomic data coming across the wire. Preliminary Manufacturing PMI numbers will be released on Tuesday. Investors will be looking for continued improvement in this number. Investors will also look to the Federal Reserve’s May meeting minutes which are being reported on Wednesday. On Friday, consumer sentiment data will be reported along with the durable goods number.

What’s On Our Minds:

Have you ever asked yourself, “Will I have enough saved up to fulfill my retirement dreams? Will Social Security be enough to sustain me?”

Unfortunately, the answer to the latter question is “probably not.” Government assistance is not designed to sustain you through retirement, so you must be proactive in saving for your future. The good news for you is that with smart investing, you will be better equipped to plan for a successful retirement.

Investing for a Sound Future

Retirement is expensive, there is no doubt about that. Many experts estimate that you will need 70 percent of your pre-retirement income (90 percent or more for lower earners) to maintain your standard of living when you stop working. It’s time to take charge of your financial future today. Below are some tips on how to maximize your retirement savings:

- Invest in your employer’s pre-tax savings plans, such as a 401(k). Contribute as much as you are financially able to responsibly, and use the automatic deduction feature to place money into your retirement account at every pay period. Over time, compound interest and tax deferrals will make a big difference in the amount you will accumulate.

- Place your money into an Individual Retirement Account (IRA). When you open an IRA, you have two basic options—a traditional IRA or a Roth IRA. In general, traditional IRA contributions are not taxed until the time of withdrawal, whereas Roth IRA contributions are taxed immediately but not taxed at withdrawal. Keep in mind, the after-tax value of your withdrawal will depend on inflation, your tax bracket and the type of IRA that you choose.

- Avoid dipping into your retirement savings, as you will lose principal and interest, and may lose tax benefits. If you change jobs, consider rolling over your savings directly into an IRA or to your new employer’s pre-tax retirement plan.

- Start saving early—the sooner you are able to start saving, the more time your money has to grow. Devise a savings plan, stick to it and set goals for the future.

- Take advantage of employer matching funds if you are able. Most employer-sponsored plans require the employer to match a certain percentage of your income. This may be the closest thing to free money, so take advantage!

- Study your investment choices carefully. The more you know about investing, the more likely you will choose wisely.

- Learn as much as you can about your plan’s administrative fees, investment fees and services fees to avoid reducing the amount of your retirement benefits unnecessarily.

Investing a predetermined amount on a regular basis through your company 401(k), a Roth IRA, etc. makes solid retirement sense. For more information, contact us to learn more about how our solutions can help you prepare for your future.

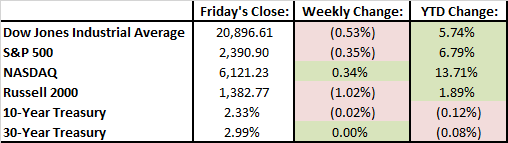

Last Week’s Highlights:

Economic data, drama in Washington D.C. and corporate earnings had the market moving up and down last week. By Friday afternoon, the S&P 500 was off 0.35% and the Dow Jones was down 0.53%.

Stateside, the consumer price index and retail sales figures disappointed investors last week while President Trump fired embattled FBI Director James Comey. Abroad, investors are betting big on Europe: according to Bank of America, a record $6.1 billion was added to funds focused on European stocks last week. Finally, we note a development that affects the whole world: computer hacking. On Friday, a global cyberattack hit dozens of countries. The “ransomware” locks up a Windows computer, and demands a $300 ransom to free it.

There were some big deals announced last week. Verizon agreed to buy Straight Path Communications for $3.1 billion, Sinclair Broadcast Group agreed to buy Tribune Media for $3.9 billion and Coach said it would acquire Kate Spade for $2.4 billion.

Over the weekend, Russia and Saudia Arabia agreed to jointly extend oil production cuts until March 2018. Oil prices posted strong gains Monday morning.

Looking Ahead:

Earnings season is slowing down but a few important companies report this week. Retail behemoth Wal-Mart will report its first quarter results on Thursday, and on Friday Deere & Co. will report their results.

The IPO market will be busy this week. On Monday, compact loader manufacturer ASV Holdings will go public. 3.8 million shares are being offered at $7 each. On Wednesday, cancer treatment biotech company G1 Therapeutics goes public with 6.25 million shares being offered at $16 each.

What’s On Our Minds:

Over the weekend crowds of investors flocked to Omaha, Nebraska for Berkshire Hathaway’s annual shareholder meeting where Warren Buffet, a.k.a. the “Oracle of Omaha,” and his longtime business partner Charlie Munger spent hours talking shop with 35,000 of their faithful shareholders. Berkshire is currently America’s sixth largest company by market capitalization, behind Apple, Alphabet (Google), Facebook, Amazon, and Microsoft. The company currently has $86 billion of cash on hand which constantly has investors asking, “What will they buy next?”

Buffet and Munger spent their Saturday discussing a changing investment landscape that has made them buyers of airline stocks and Apple, and a seller of IBM. They also discussed the recent fake-account scandal at Well Fargo, which happens to be one of their largest holdings. Buffet blamed executive level management for the scandal, as he believes they didn’t react to whistleblowers. Buffet was also critical of the bank’s incentive system that, in his words, “incentivized the wrong kind of behavior”.

The pair also fielded questions on technology and autonomous driving. Buffet had mixed opinions on the idea of self-driving vehicles and said, “Autonomous vehicles widespread would hurt us. My personal view is that it will come but I think it will be a long way off. If they make the world safer it is going to be a very good thing, but it won’t be good for our auto insurers.” Buffet and Munger also talked about how they missed the opportunity to invest in Google back when it was a fledgling new company.

Towards the end of the meeting, Buffet underscored the importance of finding a capable successor to take over the day-to-day management of Berkshire. Seeing that Warren (86) and Charlie (93) are both getting up there in age, this continues to be the looming “elephant in the room” for the company.

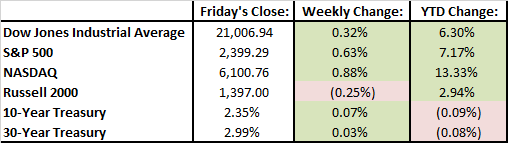

Last Week’s Highlights:

The market was up slightly last week, but has been unusually flat over the last eight trading days. Major indexes haven’t moved by more than 0.4% during that period. Major indexes are currently siting near all-time highs, thanks to a mix of strong corporate earnings and economic data that has shown a healthy domestic job market.

Last Wednesday, the Federal Reserve announced it would hold interest rates steady at 0.75%-1.00%. The House of Representatives narrowly passed a new healthcare bill that seeks to replace Obamacare.

Over the weekend, news broke that Hunt Valley-based Sinclair Broadcast Group is close to buying Tribune Media for $3.9 billion. This comes just weeks after the Federal Communications Commission voted to ease the limit on TV-station ownership in the U.S.

Looking Ahead:

Earnings season begins to slow down this week. On Monday, Sturm Ruger reports their earnings followed by Disney and News Corp. on Tuesday, Snapchat and Wendy’s on Wednesday, Kohl’s and Macy’s on Thursday, and JCPenney on on Friday.

On the economic front, it will be a light week with retail sales and inflation data being released on Friday.

What’s On Our Minds:

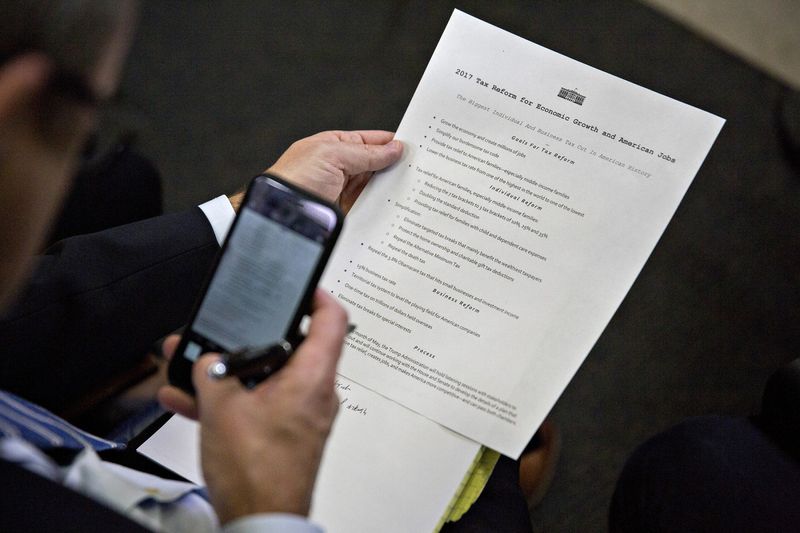

President Trump’s administration unveiled a proposal last Wednesday that was purported to be the “biggest tax cut” in U.S. history. After months of anticipation, the White House released a one-page list of bullet points that amounted to less than 250 words. The tax plan was really more of an outline that painted with very broad strokes, heavy on ambition but light on details. The major takeaway from the proposal was fewer tax brackets and fewer deductions.

If passed, the plan would cut the number of income brackets from seven to three. The plan proposes marginal tax rates of 10%, 25%, and a top line rate of 35%. The plan would also cut the corporate tax rate from 35% to 15%. To the chopping block go the alternative minimum tax and the “death tax” for wealthy individuals. Trump’s proposal to cut corporate taxes should benefit US corporations’ bottom lines significantly. We would expect reduced corporate taxes to then spur economic growth, but increased use of “pass-through” businesses could also leave plenty of room for abuse. On the individual taxpayer side, under Trump’s plan taxpayers will no longer be allowed to deduct state and local taxes from their federally taxed income. This will hurt folks in blue states like Maryland, where they pay high state and local taxes. Deductions for mortgage interest and charitable contributions are protected under Trump’s plan.

Of course, there are some big questions surrounding Trump’s tax proposal. Most importantly, “Will it make it through Congress intact?” We will have to wait and see.

The tax plan handed out before the start of a White House press briefing. Photographer: Andrew Harrer/Bloomberg

Last Week’s Highlights:

Major indexes were up more than 1.5% last week on strong corporate earnings. On Thursday, Google’s parent company Alphabet posted earnings that beat analyst expectations, helping to lift its share price by 6% for the week. Healthcare and technology stocks led last week’s rally, while telecom and utility stocks declined. Congress avoided a government shutdown by extending the funding deadline for a week.

Looking Ahead:

Earnings season continues this week with Apple reporting on Tuesday, and Facebook and Tesla both reporting on Wednesday. On Wednesday, investors are expecting the Federal Reserve to hold interest rates at current levels. On Friday, we get a highly anticipated April jobs report. Since Trump took office, unemployment has fallen from 4.8% in February to 4.5% in March. Investors will see if that trend continued with Friday’s report. Berkshire Hathaway’s annual shareholder meeting will be held Saturday. Warren Buffet will answer shareholders’ questions for six hours.

What’s On Our Minds:

Writing a post about French elections and the structure of the European Union might be a bit overdone, but that is what’s on not just our but everyone’s minds this week. Last July, we wrote about Brexit in our quarterly newsletter. Undoubtedly we’ll talk more about Europe in the next one, as well. For now, let’s do a quick refresher on how France’s elections seem to mean so much for Europe- and the US.

Centrist candidate Emmanuel Macron pulled ahead in the weekend’s primary election results, signaling his likely win in the runoff election. The markets responded overwhelmingly positively, with the Euro’s value rising 1.8% on Sunday against the dollar. Macron was so warmly welcomed by the markets because his opponent, far-right candidate Marine Le Pen, would mean further nationalist tumult in the EU and another step toward its breakup.

The European Union is flawed, to be sure. We are not the first to point out that a monetary union (everyone uses the Euro) without a fiscal union (not everyone treats the Euro the same in their budget) means that some countries (i.e. Germany) feel that they are subsidizing the bad financial habits of others.

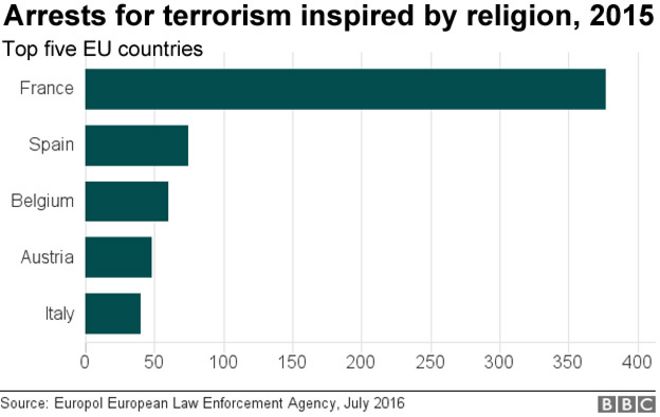

Also stirring Europe’s electorate is the rise of nationalism, not just in the EU but around the world. France is especially pressured by these thoughts, with the country having had far and away the most religiously-motivated terrorist activity in the recent past. The BBC shared the top five countries for terrorist arrests:

However, the EU is, at least for now, the law of the land. A disruption would call into question important trade agreements, investment flows, tariffs, and more. It’s not certain if each tradeoff would be good or bad for the US in the long run, but that’s one thing the markets really hate: uncertainty.

Last Week’s Highlights:

It was a choppy week in the markets as investors processed political headlines and first quarter earnings reports from various companies. By the end of the week, major indexes were in the green. Investors are hanging in there, even with tensions in North Korea, the French election, and some doubts over whether President Trump can deliver on campaign promises. On Friday, stocks bounced off session lows when Trump announced he will make a “big announcement” on tax policy this Wednesday.

Looking Ahead:

Investors are preparing for the busiest week of first quarter earnings season. More than 190 S&P 500 constituents report this week, including large components Alphabet and Microsoft. Housing data, including new and pending home sales, will be reported on Tuesday and Thursday. Along with earnings and economic data, investors are also anticipating big news on tax reforms from President Trump on Wednesday. Then on Friday, first quarter GDP will be reported. Analyst and traders will be busy digesting all the information which could lead to another choppy week in equity markets.

What’s On Our Minds:

Tufton Capital is committed to helping our clients implement financial plans that will help keep them on track during their retirement years. By establishing a financial plan, you will determine how your investment assets will fund your financial needs, wants, and wishes. Seeing that saving enough for retirement is the most important part of the planning process, review our 10 Tips for Saving for Retirement Below.

Start now: It’s a simple fact that the earlier you begin saving for retirement, the more time your money has to earn interest and grow. If you’ve put off saving until your 30s or later, make up for lost time now by stashing away 10 to 15 percent of your salary.

Plan your retirement needs: If you want to retire at 55 and travel the globe or work for as long as you can but stick close to home, how much money you need to retire is unique to you. Rather than relying on figures that suggest you’ll need 80 percent of your pre-retirement income to live comfortably later in life, talk with your spouse and portfolio manager to settle on an amount to save that’s tailored to you.

Learn about and contribute to your employer’s plan: If your employer offers a tax-sheltered plan, contribute at least enough to get the employer match. Your employer can provide you with a summary plan description, which recaps your plan and vesting eligibility, as well as an individual benefits statement.

Consider saving “on the side”: If you don’t have access to an employer-based plan, contributing to a traditional or Roth IRA allows you to get similar tax benefits for your retirement savings. Even if you do contribute to an employer-based plan, an IRA can supplement those savings.

Make saving as easy as possible: Eliminate the need to move money from one account to another by setting a monthly savings goal and automating a deposit to that amount. By making savings routine, you are more likely to see your retirement nest egg grow. To help boost your regular savings, funnel any extra cash windfalls, such as from a bonus or inheritance, directly to your retirement savings.

Increase savings as your near retirement: Your income will likely rise with age and experience, so it makes sense to save more as you earn more. After age 50, you will also be eligible for catch-up contributions, which allow you to contribute beyond the set limit. For 401(k)s, you can contribute an extra $6,000, while for IRAs you can contribute an extra $1,000.

Be an active participant in your retirement plan: Automating your retirement savings and amount doesn’t mean you should “set it and forget it.” Examine your quarterly statements to ensure you are on track to meet your goals. Can you afford to contribute more? Are your investments still appropriate? Do you need to lower your exposure to risk? By taking active control now, you take control of creating the best retirement lifestyle possible.

Decide on your Social Security strategy: Social Security benefits may be available at age 62, but up until age 70, your retirement benefit will increase by a fixed rate (based on your year of birth) each year you delay retirement. Waiting means you may be able to take advantage of some extra cash. If you are married, you may also be able to receive spousal benefits, which boost the amount you and your spouse receive in Social Security as a couple. To learn more, visit www.socialsecurity.gov.

Be a savvy investor: It’s important to be smart about not only the amount you save but also how you save. Keep tabs on how your investment accounts are performing and keep in touch with your portfolio manager. The more intentional you are about how your assets are invested, the more secure you can feel about them.

Don’t touch your savings until retirement: Dipping into your retirement savings is a last resort. In addition to harsh penalties, you lose principal, which in turn depletes interest earnings and tax benefits. Also, if you switch jobs, rollover your retirement account rather than “cashing out.” Preserving your retirement savings may be difficult when funds are tight, but will benefit you when you truly need it most.

Last Week’s Highlights:

In an abbreviated week of trading due to Friday’s holiday, stocks declined roughly 1% in the face of global tensions with Syria, Russia, and North Korea. Because of the international drama, we saw a dip in bond yields as investors “flew to safety” and put more money into U.S. Treasuries. Along with geopolitical pressure, earnings season kicked off and investors weighed earnings reports from large U.S. banks. Wells Fargo shares fell 3.3% after reporting a slowdown in their mortgage banking business. Warren Buffet’s Berkshire Hathaway said it was forced to sell more than 7 million shares of Well Fargo’s stock in order to keep their ownership stake in the bank below 10%. The move to cut its stake keeps Berkshire from having to become a bank holding company.

Looking Ahead:

Investors will be examining first quarter earnings reports this week and working through anymore geopolitical turmoil that may arise. Netflix and United Airlines report their first quarter results on Monday. On Tuesday, we will hear from Goldman Sachs, Bank of America, and IBM. On Friday, Samsung will release their new Galaxy S8 mobile phone.

What’s On Our Minds:

After you have achieved your goal of owning a home, you may be itching to jump into the real estate game again by buying a second home. While interest rates are low, it might make sense to buy a house to use as a vacation home, a rental property, or a home for retirement. The process of buying a second home is similar to the process you already undertook when you bought your first home, but the mortgage and tax implications will be different. Below we will discuss some of these differences.

Financing the House

At this point in your life, you may have more cash to put toward a down payment or may even be able to buy a second home outright. While rates are still historically low, it may make sense to finance a portion of the home. That being said, mortgages for second homes are often more difficult to qualify for and require stricter terms:

- Interest rates: Expect your interest rate to be half a point to one point higher than it would be if you were buying a principle residence.

- Down payment: For a principle residence, most mortgage lenders prefer 20 percent down, but don’t require it. For a second home, plan to put 20 to 25 percent down in order to qualify for financing.

- Credit score: Typically, you must have a credit score of at least 730 or 740 to get the best loan terms. Some lenders will require an even higher score for second home mortgage applicants.

- Debt ratio: The debt ratio (the ratio of your debt payments to your monthly income) that your second mortgage lender requires will probably be the same as for your first mortgage—typically no higher than 36 percent. However, when calculating the ratio for your second mortgage, you’ll have to include house payments, property taxes and insurance for two houses instead of just one.

Tax Implications

Your second home expenses will include additional property taxes. If you’re renting it out, you also need to pay income tax on your rent earnings, but you could be eligible to deduct operating costs. The sale of a second home is also subject to different capital gains tax rules than a primary residence.

- Property taxes: The taxes you pay on either of your houses will depend on where they’re located, how much land you own, and how many improvements the house has had. If you buy a run-down house with plans to make improvements, expect your property tax bill to increase. Similarly, if you buy a house that has seen major improvements since the last tax assessment, be prepared for it to increase after you buy it. You can write off your property taxes as a tax deduction, just as you can with a first home..

- Income taxes: If you rent your house out for more than 14 days and use it for personal reasons for less than 14 days of the year, you must pay income tax on your rent earnings. However, when you claim rental income on your taxes, you can also deduct rental expenses you incur from maintaining the property, finding tenants, etc.

- Interest deduction: You can also deduct your mortgage interest payments on your second house if you itemize your tax return. If the total value of both mortgages is below $1 million, you can deduct your interest in full.

- Capital gains taxes: When you sell your primary residence, you won’t be taxed on capital gains up to $500,000 (if you’re married) or $250,000 (if you’re single). With a second home, those limits don’t apply. Instead, you’ll be taxed on the entirety of your capital gains. To avoid paying high capital gains taxes, you must have lived in your home for at least two years before selling. If you’re selling a house that you used as a rental property or vacation home, consider making it your primary residence for two years before selling to reap the tax benefits.

While owning a second home comes with added expenses, the tax benefits provided by taking on a mortgage and potential appreciation of the home’s value can make it a sound investment strategy.

Last Week’s Highlights:

While stocks lost only a few points last week, there was no absence of market moving news. The Federal Reserve’s meeting minutes were released last week which revealed that the Fed is beginning to determine when and how it will reduce the size of its balance sheet (its ownership of bonds it purchased as part of its quantitative-easing stimulus strategy). The 10-year interest rates fell to as low as 2.32% last week, receding from the 2.60% level reached in March after the Fed announced its second rate hike in the span of three months. On Friday, we saw a weak jobs report that showed that the economy added only 98,000 jobs in March. The Street had expected 185,000 new jobs. Investors are blaming the weak job report on bad weather in March.

Looking Ahead:

After being stuck in a state of suspended animation for the past few weeks, the stock market will finally have its moment of truth as corporate earnings begin rolling out this week. JPMorgan Chase and Citigroup will kick things off on Thursday. Earnings report will reflect President Trump’s first quarter as President so investors will be crunching the numbers to see if they support the post election rally. The bond market will close early on Thursday in advance of Good Friday. On Friday, equity markets will also be closed.

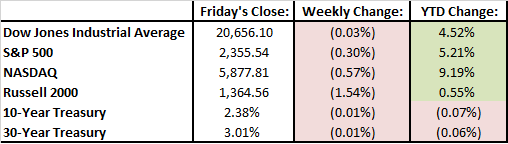

What’s On Our Minds:

Market cycles represent fluctuations in stock, bond and investment markets. These cycles are closely tied with large-scale economic business cycles and have an important impact on investment, financial, cash flow and personal planning.

Market Cycles Versus Business Cycles

Market cycles and business cycles may sound the same, and are indeed very similar, but are slightly different. A market cycle typically refers to different phases in the stock market, whereas the business cycle is an underlying fundamental change in economic business activity as measured by real Gross Domestic Product (GDP) percent change (an important measure of the level of business activity in the economy), unemployment rates, manufacturing data and more.

The difference can be more clearly seen in the terminology; market cycles are defined by bull and bear markets, while business cycles are defined by economic growth and recession. A typical definition for bear market is a downturn of at least 20 percent over longer than a two-month period in either the S&P 500 for Dow Jones Industrial Average (DJIA). This is not to be confused with a correction, which is a short-term downtrend in stock markets. The length of market cycles also is important to note. If market analysts believe that stock appreciation will be a short-term trend, then it is referred to as cyclical. Long-term trends longer than a few months in duration are referred to as secular.

Business Cycle Stages

Not all phases of the business cycle can be easily separated, and the stages of the business cycle may only be able to be identified in retrospect. Still, it is useful to define the five stages to business cycles, as follows:

- Initial recovery: usually a short period in which the economy comes out of a recession. Unemployment remains high and consumer confidence will most likely be suppressed. At this point in the business cycle, open market activities to reduce interest rates or governmental policies, such as stimulus efforts, are enacted.

- Early upswing: confidence recovers and the economy gains some momentum. This is a very healthy period in time, where productive capacity is still able to keep pace with growing demand and there is no sign of significantly higher inflation.

- Late upswing: although confidence is high and unemployment is low, inflation is starting to pick up and offsets nominal economic growth.

- Slowdown: as a result of rising interest rates, the economy starts to slow. Investors reduce risk and shift stock allocations to bonds. Although there is a slowdown in activity, inflation is still likely to rise during a slowdown.

- Recession: typically defined as two consecutive quarterly declines in GDP; consumer spending contracts. Once the recession is confirmed, central banks start to cautiously increase the supply of money to spur growth. Recessions may be highlighted by bankruptcies, fraud or a financial crisis.

Although forecasting upcoming business cycles is particularly challenging, it helps to know how these cycles tie into market cycles and, ultimately, the performance of your investment portfolio.

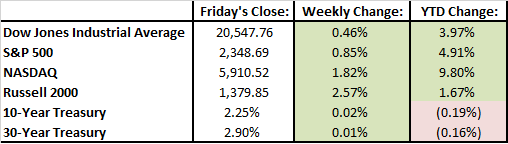

Last Week’s Highlights:

Stocks rebounded last week as both large and small caps made a move higher. The S&P 500 was up .8% and the Dow Jones was up .32%. Over the past two weeks we’ve seen some volatility return to equity markets that we haven’t seen in some time. Investors were spooked after Trump failed to repeal and replace Obamacare but last week’s rally shows that investors remain confident that he will be able to deliver on his promises of sweeping tax reform, regulatory relief and infrastructure spending.

Looking Ahead:

There’s a heap of economic data coming across the wire this week including vehicle sales on Monday, the Federal Reserve’s March meeting minutes on Wednesday, and the March Jobs report on Friday. Investors will be looking at these numbers closely as many believe equity markets have been running hot and these numbers will either confirm or refute those beliefs.

As always, Tufton portfolio managers remain focused on managing accounts for the long term as opposed to getting caught up in pundits’ hype.

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, wealthy families can get a head start on generational wealth transfer.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

Last Week’s Highlights:

Stocks were lower last week and bonds were higher. It was the worst week for stocks since last November’s election. Tuesday was a particularly tough day for stocks as investor angst grew over doubts that Republicans would successfully get their health care bill through congress. Tuesday’s 1.2% decline accounted for most of the week’s losses. On Friday afternoon, Republicans pulled their healthcare bill, which was meant to overhaul the Affordable Care Act. This was viewed as a major setback for the president. On Friday, the president also mentioned his administration would now focus on getting “big tax cuts” through Congress.

Media pundits have taglined the bearish sentiment as the “Trump Slump” even though the economy continues to improve and it’s been a strong year for stocks thus far.

Looking Ahead:

Stocks opened at six-week lows Monday morning after President Trump failed to push through his healthcare bill last Friday.

Fed chair Janet Yellen will deliver a speech on Tuesday where she may shed some light on the Fed’s plans for interest rates moving forward. We will also get some important economic data this week with the Case-Shiller index and consumer confidence figures on Tuesday and pending home sales on Wednesday. On Thursday we will see fourth quarter GDP numbers and weekly jobless claims. On Friday, we will close out the week with personal income and spending data.