The Second Quarter of 2016: Ending Where We Started

by Eric Schopf

Fireworks came early this year as the United Kingdom voted in favor of leaving the European Union. The outcome of the nationwide referendum was not what the markets expected, leading to a wild ride in the stock market and tremendous price volatility, both down and up. The outcome of the June 23 vote was not apparent until the following day. The stock market reaction was swift, with the S&P 500 declining 3.6%. After taking the weekend to digest the news, investors extended their selling mood the following Monday, resulting in an additional drop of 1.8%. When the dust settled, the S&P 500 was sitting at levels first reached in the fall of 2014.

Fixed income markets reacted in similar fashion, with the safe-haven 10-year U.S. Treasury note dropping in yield from 1.74% prior to the vote to 1.43% the following Monday. Later in the week, the realization that the immediate economic impact of the U.K.’s departure would not be calamitous had investors rushing back into the market. The final three trading days of the month provided strong gains and led to a recovery of nearly all initial Brexit-related losses. We closed June exactly where we started and are again within 1.5% of the record high set last July. The 10-year U.S. Treasury yield, however, has remained low with a month-end close of 1.47%.

The stock market posted respectable results for the second quarter, with the S&P 500 delivering a total return of 2.5%. Year to date, the total return is 3.8%. The Federal Reserve continues their accommodative stance thanks to an economy that just can’t seem to find the next gear. A weak Bureau of Labor Statistics payrolls report for the month of May combined with steep downward revisions to March and April figures kept the Fed on their back foot and appears to have eliminated any possibility of an interest rate hike in the near term. Interest rates quickly reflected the Fed’s new dovish outlook. As a reminder, the 10-year U.S. Treasury started the year at 2.3%.

Volatility in reaction to the future of the European Union will likely persist. The United Kingdom’s exit negotiations with the EU will stretch out a number of years and there is no telling the composition of the final agreement. Trading relationships, potential tariffs, and investment flows are all now in question. Consumer and business confidence will suffer until there is some clarity on these important issues. It is also difficult to project the future standing of the remaining EU members. Immigration curbs in England will place additional pressures on member countries to accommodate refugees. In addition, should the U.K. somehow manage to flourish under their EU independence, more members may defect.

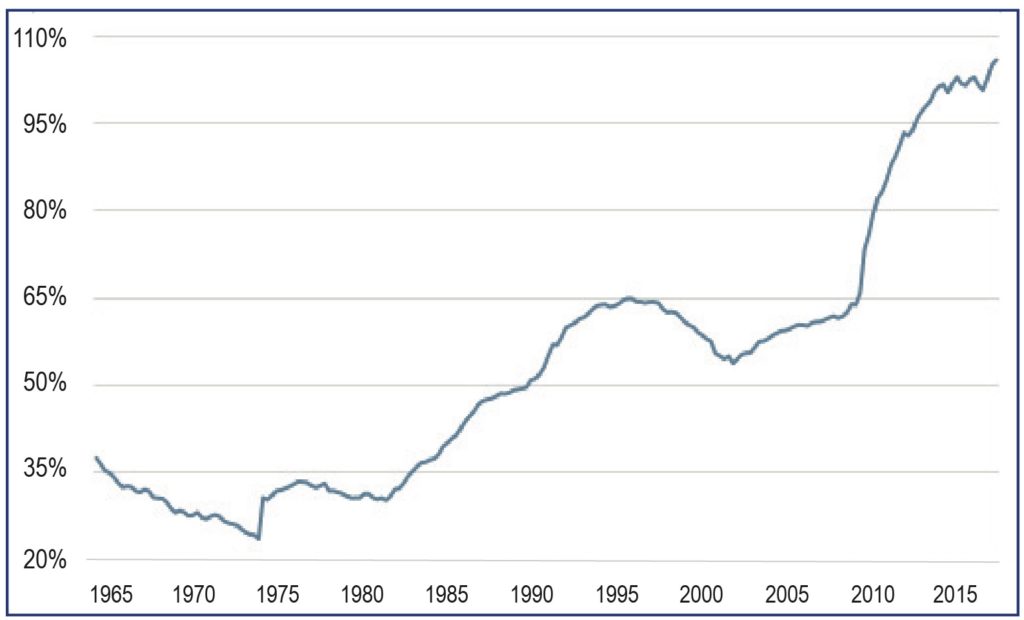

General US Government Debt as a % of GDP

The United Kingdom’s exit will not greatly impact the global economy, as the sovereign state represents less than 4% of the global gross domestic product. The EU, on the other hand, collectively represents 23% of global gross domestic product. The general health of the EU is a bigger concern than the decision by the U.K. to exit. This we do know: the U.K.’s vote to leave the EU will result in a lower standard of living vis-a-vis a lower relative currency valuation. The Pound/Euro conversion shot from .76 to .83. Prior to the vote it took .76 Pounds to buy 1 Euro. The same Euro now requires .83 pounds. That trip through the Chunnel into France will now be 9% more expensive. The same is true for conversion to the U.S. Dollar. .75 Pounds are now required for 1 U.S. Dollar, up from .67 Pounds. A trip to New York is now 12% more expensive.

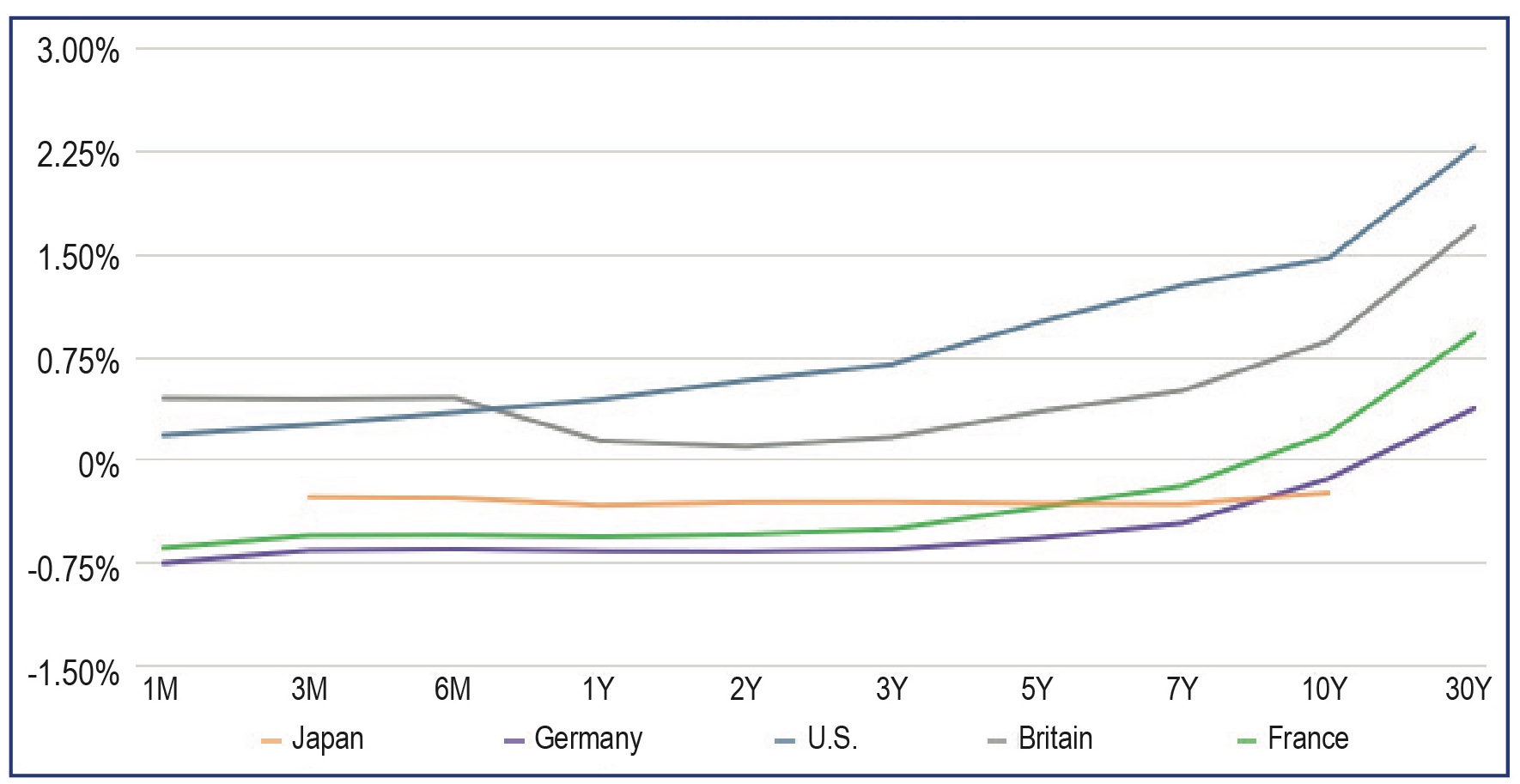

Back home, the Federal Reserve continues to greatly influence the fixed income and equity markets. The steady drumbeat of bad news from around the world has the Fed looking beyond the U.S. economy when making interest rate decisions. Brexit and its potential to disrupt economic activity in the short term are just the latest obstacles. Slow growth in China and Japan, uneven growth throughout the Eurozone, and sickly economies in South America have central bankers working overtime implementing monetary policy. The European Central Bank expanded their asset purchase plan in June to include corporate bonds. The massive bond purchases have pushed interest rates into negative territory throughout Europe. That’s right – bond holders, instead of receiving interest payments, are actually paying creditors for the privilege of holding their debt. The Fed is in no position to increase interest rates in the current global environment. The beneficiary of current monetary policy has been shareholders. Equities become more attractive as interest rates fall. The most disconcerting aspect of the whole exercise is the fact that economic growth has been so anemic despite the extraordinary monetary efforts.

It appears that there may be limits to the effectiveness of monetary policy. The Federal Reserve has noted on numerous occasions that fiscal policy plays an equally important role in influencing the economy. The government’s tax and spend policies, however, have been capped due to government debt reaching its permissible levels relative to the size of our economy. It was just five years ago when sequestration reentered our financial lexicon. The automatic budget cuts were a way of reducing the federal budget without being directly tied to the legislature. Unless the new administration is willing to alter fiscal policy to generate more growth, we may continue to be stuck in our current low interest rate environment.

The investment environment continues to be challenging. Corporate profit growth has slowed, and interest rates remain low. The upcoming presidential election promises to keep investors on edge. Regardless of the environment, we continue working hard to find attractive investments worthy of your portfolio while maintaining suitable balance to reduce risk.

Global Yield Curves