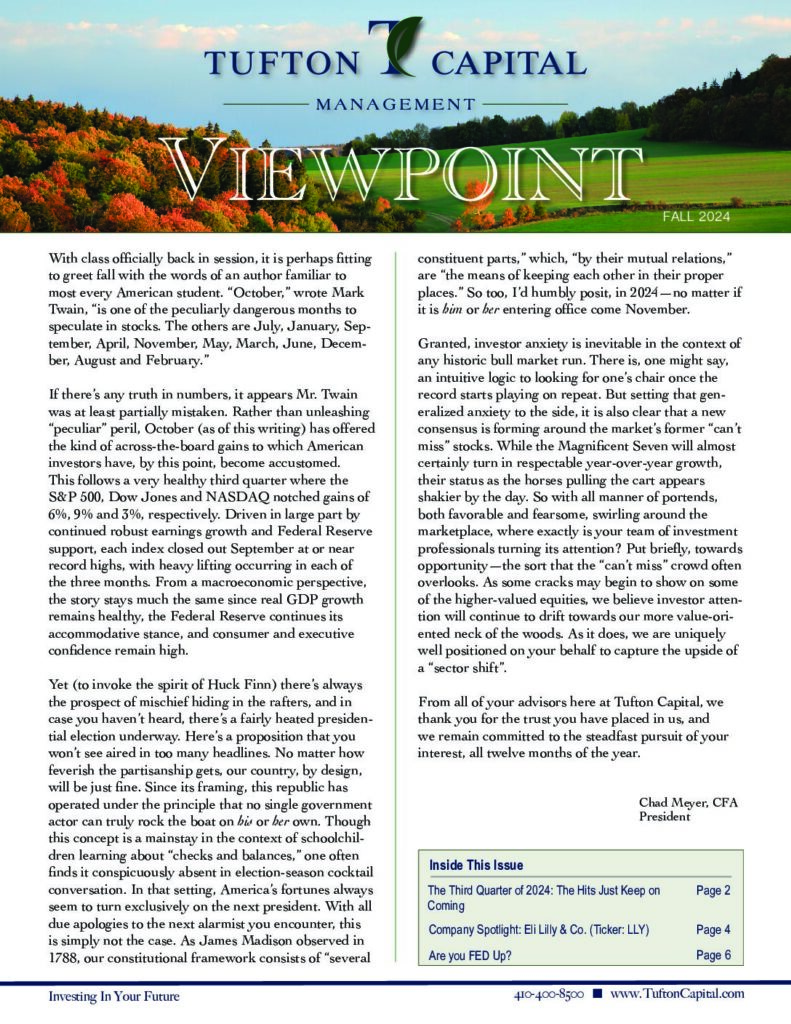

Over our twenty year history, Tufton Capital Management has followed a disciplined investment process where we focus on taking advantage of investors’ emotions and identify mispriced securities. As long-term value investors, we are happy to move against the herd and purchase securities when the market has given up on them, and later sell them when sentiment has improved. While we are fully committed to sticking with our strategy, we pay close attention to trends emerging in the money management business. One such trend is the popularity of passive investments including index funds and exchange-traded funds (ETFs), which investors have piled into since the bull market began in March 2009. While indexing may be an appropriate, low-cost option for retail investors, we believe a portfolio constructed entirely of these products is suboptimal for investors with sizable assets. Quite simply, these passive products in and of themselves are not tailored to meet a client’s specific financial objectives or risk parameters.

So why have investors (and financial advisors) moved towards passive indexing? First off, indexing is easy. You can purchase a few products and get a broadly diversified portfolio. Secondly, you don’t need to spend a lot of time or have expertise researching or monitoring the funds, as compared to the fundamental research we perform on our individual securities. Finally, most index funds and ETFs have lower management fees when compared to their actively managed counterparts. It’s no secret that only one out of five actively managed mutual funds typically beats its respective benchmark in a given year. Considering the poor performance and high fees of active funds, we consider the move towards indexing to be a logical one for small investors, but it has its drawbacks.

A fundamental flaw with passive indexing is that, by nature, the funds often buy high and sell low to mirror the performance of a specific index. For example, when a company has done well and is added to an index, typically its business has been thriving, which would likely have already propelled shares higher. On the flip side, when a company’s business has underperformed and it is removed from an index, an index fund is forced to sell and their investors have no opportunity to profit once a company’s prospects start to improve. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors – buying securities as they fall in price.

Another issue with index investing comes when indexes and ETFs are forced to trade securities only after an index’s plan to add a new stock is announced to the market. Traders can “front-run” these additions and buy shares beforehand, as they know the index funds will be buying the shares when the company is officially added to the index. An example of this occurred last year on Monday, March 16th when it was announced that American Airlines would be joining the S&P 500 that Friday. Come Friday, the stock had risen 11%. Index funds were thus forced to buy the stock at a higher price. Similar to the way high-frequency traders are able game the market, this is an example of smart money taking advantage of an index fund. Over time these events may erode the returns of investing in these low-cost products.

While riding the momentum in index funds feels great during a bull market, index investors may be left exposed from a risk perspective when the market inevitably heads south. This is because an index fund may have larger positions in companies with high valuations, and smaller positions in lowly valued companies. Thus, even though index investors are able to manage risk relative to their benchmark, they may struggle managing risk on an absolute basis. One of our goals is to provide our clients a higher return on their equities than the S&P 500 over a full market cycle, without taking any undue risk. Hence, we will stick to our guns and continue seeking to buy a dollar’s worth of assets for fifty cents.

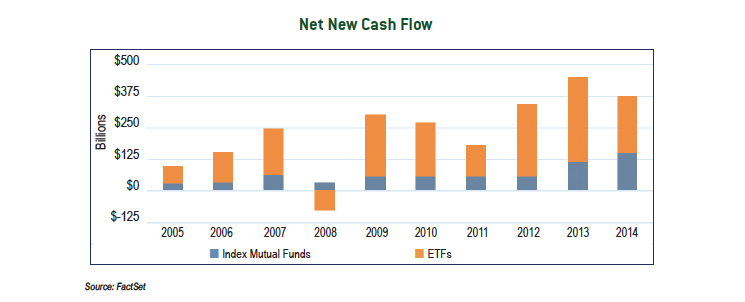

Helmerich & Payne (Ticker: HP) is a contract driller that provides well-drilling services for oil and gas exploration and production, specializing in meeting the unconventional needs of the Shale Boom. Counting some of the best oil and gas companies among its clients, HP leads the market in unconventional onshore drilling rig services, having developed a rig uniquely suited to drill horizontal shale wells with outstanding efficiency. The company primarily operates through its 343 US-based onshore rigs, though it also operates offshore and internationally in Latin America.

Since the 1990s, the rig specialist has secured a position at the forefront of the Shale Revolution through a history of principled innovation, anticipating the demands of the market to make drilling faster, safer, more adaptable, more mobile, and exploit any opportunity to increase the output on a drilling site. The company first introduced its FlexRig technology in the late 1990s to provide the market with a rig that has increased mobility and an ability to drill at a range of depths. The first two models of the FlexRig line, FlexRig1 and the FlexRig2, were designed to drill at depths between 8,000 feet and 18,000 feet. In 2001, HP introduced the FlexRig3 with enhanced safety features and an even wider range of depth capability – from 8,000 to 22,000 feet. The company next focused on increasing the efficiency of the drill site as a whole. The FlexRig4 in 2006 introduced a “skidding” feature that gave improved mobility, allowing up to 22 wells to be drilled on a single pad space. In 2011, the FlexRig5 continued this trend and facilitated long lateral drilling of multiple wells in a single location. But the most important contribution of recent years has been the FlexRig’s ability to adapt to unconventional horizontal shale wells with staggering efficiency. The rigs, in fact, are capable of fetching daily rates nearly 50% higher than their peers.

Despite uncertainty in the energy markets, Helmerich & Payne is trading at an attractive valuation. Though forecasting the sales and earnings may prove to be difficult, conventional valuations of onshore drilling companies can be calculated on the basis of the value per rig and per unit of horsepower. Given the company’s market share and the exceptional efficiency delivered by their rigs relative to competitors’, Helmerich & Payne is more than likely to command a premium rate on either basis. Previously, acquirers have paid as much as $24 million per rig in precedent transactions, according to investment bank Johnson Rice. At a valuation of $24 million per rig, Helmerich & Payne is worth $87 per share. On a basis of horsepower, acquirers have paid as much as $17,500 per unit. Based on this valuation, the company is worth nearly $97 per share.

More than likely, Helmerich & Payne will not be acquired, but their market position and current valuation provide a solid margin of safety for investors. Its management has proven to be prudent and conservative with their capital, distinguishing the company as one of the few in the energy universe that entered the downturn without any debt. Further, Helmerich & Payne has paid a dividend every year since 1977, and the stock is currently yielding about 5%. In a no-to-low growth world, we would be happy to be “paid to wait.”

Find your plan of attack. Read on to decode the acronyms of wealth transfer and clear the mystery.

Trust Options

There are many different types of trusts that can help alleviate the effects of gift and estate tax and direct the flow of your wealth transfer. By designing a wellplanned trust strategy, you can transfer your wealth in the most efficient way possible.

Grantor retained annuity trusts (GRATs)

A GRAT is a type of trust that makes annuity payments back to its grantor over a number of years and then transfers any remaining value to a beneficiary. When a GRAT is created, the IRS uses a set growth rate (called the 7520 rate) to estimate the trust’s future value. It then subtracts the annuity payments from the future value to determine the remainder—the only portion taxed as a gift. Because GRATs are taxed upfront, any excess growth (growth above the 7520 rate) will be not be subject to gift taxes. Therefore, grantors often select annuity payments that equal the IRS’s expected future value, creating a GRAT that incurs no gift tax and leaves all excess growth as the remainder.

Common recommendations include keeping the term length of a GRAT relatively short, depending on the time horizon, or creating several short-term GRATs rather than one long-term GRAT. The reason for this is that if the grantor dies prior to the expiration of the GRAT term, the GRAT will fail in its purpose and all assets will remain subject to estate tax. For this reason, many opt for a “rolling GRAT;” which is a series of consecutive short-term GRATs. This technique also helps to hedge some of the risk of market fluctuations. However, short-term and rolling GRATs require larger annuity payments, so if there isn’t a large amount of liquid assets available, a long-term GRAT may be more effective.

Things to keep in mind when considering GRATs:

- GRATs are still subject to income taxes.

- GRATs are irrevocable—they cannot be changed or terminated.

- GRATs are legally required to pay annuities, regardless of growth.

Grantor retained unitrusts (GRUTs)

GRUTs are almost identical to GRATs, with the only difference being in how annual payments are determined. Instead of returning a fixed amount, GRUT annuities are a percentage of the trust’s value that year. That means that the income distributions will be less stable and may be higher one year, but lower the next.

Irrevocable life insurance trusts (ILITs)

ILITs are trusts designed to hold the life insurance policy of their creator. An ILIT essentially removes your life insurance policy from your official property, thereby protecting it from estate taxes. This type of trust also provides the surviving beneficiaries with funds while not passing into their estates, which helps avoid estate taxes as well. ILITs can help grantors feel secure because they guarantee that no matter how much a grantor spends in their lifetime, their beneficiaries will still receive an income after their death from their life insurance policy.

When considering ILITs, keep in mind the following:

- It takes three years after the ILIT is created for the IRS to consider the trust as outside the grantor’s estate.

- A provision known as Crummey powers allows beneficiaries to take small gifts annually from the trust for a brief period of time (usually 30 days). This allows beneficiaries to avoid gift taxes by taking the funds out in small amounts rather than receiving the total value of contributions as a large gift once the grantor dies.

Intentionally defective grantor trusts (IDGTs)

IDGTs are trusts that make the grantor the owner of the trust for income tax purposes but not for estate tax purposes. Using a trust with the word “defective” in its name may seem counterintuitive, but this simply refers to the fact that the grantor is taxed on the income the trust receives. The “intentional” part of the trust hints at the fact that this type of taxation allows the trust itself to remain untouched, leaving more money for the grantor’s future heirs. This “defect” in the trust is what makes it such a useful tool for generational wealth transfer.

This type of trust essentially freezes assets for estate tax purposes by allowing them to grow outside of their estate without income tax reductions, as the trust income tax is applied to the grantor instead of the trust itself. Since the tax rates escalate much more quickly for trusts than for individuals, this type of trust helps to save on overall income tax by putting the taxes in a lower bracket. As of 2016, trusts that earn over $12,400 will be taxed at a 39.6 percent rate—an individual would have to make over $415,051 before he or she was subject to those same rates.

Choosing a trust to aid your wealth transfer plan can be tricky, so it’s important to work with legal and financial professionals to do so. You should consider the unique aspects of each trust and whether or not they fit with your wealth transfer plan and your family’s needs. Whether you choose one type of trust or a combination of trusts, the most important thing is that you pass on your money in a way that makes you feel secure about the future of your legacy.

This article was written by Advicent Solutions, an entity unrelated to Tufton Capital Management. The information contained in this article is not intended for the purposes of avoiding any tax penalties. Tufton Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding any specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

As we look back at last year’s financial market results, it appears at first blush that we had a very quiet, uneventful twelve months in the investment world. The Dow Jones Industrial Average (DJIA) increased a mere 0.2% (including dividends), while the S&P 500 eked out a 1.4% total return. But like the proverbial duck, calm on the surface but paddling like crazy underneath, there were indeed extensive market-driving global events throughout 2015 and the volatility that ensued.

Last year’s activity began with quantitative easing (QE) from the European Central Bank, followed by a spike in bond yields. As the year continued, we experienced the Greek drama, a stronger U.S. Dollar, a continued slide in commodity (namely oil) prices, and ongoing concerns over growth in China and other emerging markets. The terrible events in Paris in November and the increased threats of global terrorism continued to dominate headlines. And let’s not forget the Fed! After months of “will they or won’t they”, Federal Reserve Chair Janet Yellen and her Committee presented us in December with the first shortterm interest rate increase in almost ten years.

What do these events mean for investors as we look into the future? The volatility we are experiencing serves as a reminder: markets “climb a wall of worry” in the long term. That is, while things can and do get very choppy, investors need to hold on and stick to their long-term goals. Part of our job at Hardesty Capital Management is to guide our clients through these turbulent times, helping them to focus and not react emotionally. Back to the proverbial duck, our role is to analyze and manage the “craziness” that exists beneath the surface. Our goal is that this allows our clients to live calmer lives and focus on other, more important things.

We begin this quarter’s Hardesty Horizons with our firm’s outlook for the economy and financial markets beginning on Page 2. As you’ll read in our investment analyses throughout Hardesty Horizons, we continue to be cautious but still positive on the equity market and are forecasting a low single-digit percentage gain for stocks this year. While we anticipate a slightly positive year for equities, we foresee another year of significant volatility in getting there.

Also included in this Horizons issue is a timely discussion starting on Page 4 of the benefits of value investing over the long term. The investment professionals at Hardesty Capital Management have long subscribed to the value philosophy, seeking to purchase a dollar’s worth of assets for fifty cents. We continue to be confident that value investing will outperform growth investing over a full market cycle.

This quarter’s Hardesty Horizons analyzes one of our favorite stock ideas for the New Year: Qualcomm (QCOM). While QCOM’s business of making semiconductors might not be overly exciting to some, the company’s prospects and stock’s valuation excite us! Finally, our article on Pages 7-8 discusses the complications of transferring wealth to the next generation and how to avoid possible pitfalls.

As we enter our third decade in business, we’re as optimistic and excited as ever about the outlook for our clients and our firm. We wish all of you a very Happy New Year, and thank you again for your continued support!

A surge in the stock market over the closing two weeks of the year allowed the S&P 500 to post a positive total return of 1.4% for 2015. This meager return is more than welcome given the market’s mid-summer swoon of 10% and an increase in volatility prior to the Federal Reserve’s decision to increase short-term interest rates in December.

Although we flip the calendar to a new year, many of the headwinds buffeting the stock market persist. The U.S. Dollar remains strong, in part because Europe, China and Japan are stimulating their economies while the Fed is taking steps to limit future inflation. In turn, the strong Dollar has a pronounced negative impact on reported revenue and earnings by those U.S. companies with extensive international exposure. Further, the highly valued Dollar keeps a lid on energy and other commodity prices. Lower energy prices will reduce output in America, leading to slower economic growth in the short term. The impact of a strong Dollar and weak overseas markets can be seen in returns from the different major stock market indexes. The industrial-rich Dow Jones Industrial Average has now underperformed the S&P 500 and the NASDAQ for the fourth consecutive year.

The economic windfall provided to consumers from lower energy prices has not fully percolated through the economy. Instead, savings rates have increased. Expectations were for savings at the pump to be spent in other areas. Higher savings rates may portend a lack of confidence in our economy – a troubling development. Similarly, the popularity of Donald Trump may be a reflection of a loss in confidence and the dissatisfaction with the status quo.

Federal Reserve actions will also continue to impact the markets. We continue to believe the Fed will move slowly and deliberately. William McChesney Martin, Jr., the Chairman of the Federal Reserve from 1951 to 1970, once said that the Fed’s job is to take the punch bowl away just as the party gets going. From the depths of the recession in 2009 through the first half of 2015, average annual real gross domestic product growth in the U.S. has been just over 2%. This doesn’t exactly constitute a party. Although the first few rate hikes may remove a few hors d’oeuvres, the punch is still flowing.

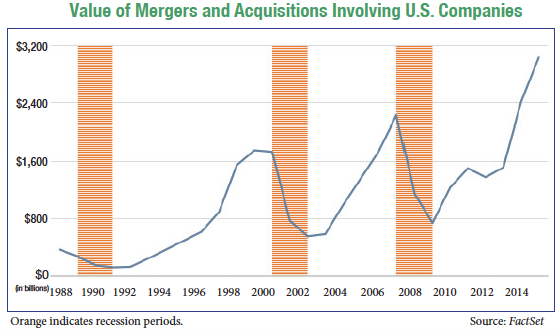

A few additional areas of concern have emerged during the course of the year. The value of merger and acquisition activity involving U.S. companies has reached $3 trillion. Prior peaks of $2.25 trillion in 2007 and $1.75 trillion in 1999 preceded recessions. The lack of organic growth has companies turning to M&A to provide the growth that investors expect.

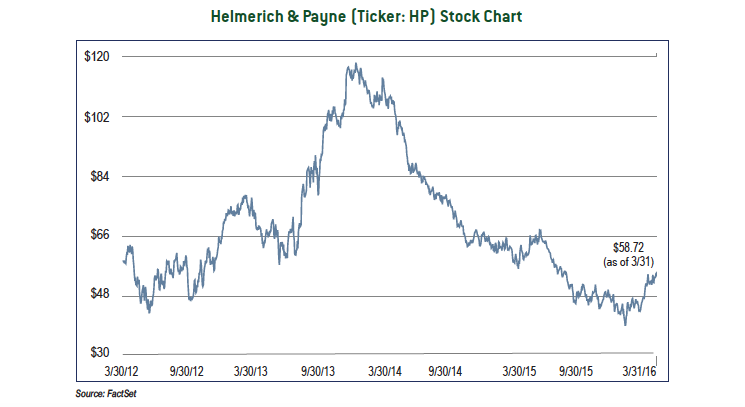

The compression of interest spreads in U.S. Treasury yields has also entered our radar screen. The Fed’s decision to begin raising short-term rates has had little impact on the 10-year Treasury. While the Fed has great sway over short-term rates, longer-term rates are controlled by the market and expectations for growth. A critical level for the spread is at the point of inversion, which occurs when the short-term rate actually exceeds the longerterm rate. The scenario is a good indication of a looming recession. We are not close to inversion yet, but the spread contraction is something we monitor very closely.

The upcoming presidential election will certainly begin to shape the investment landscape. It is difficult to handicap the race, especially for the Republican Party. However, with the left and the right pulling further apart, gridlock may be the end result. In any case, we continue to monitor the candidates and their platforms to determine the impact on your portfolios.

Not to be completely overshadowed, the economy continues to expand and the employment ranks grow. A late-year budget deal included increased government spending without raising taxes, which should boost our GDP by as much as 0.5% next year. Equity valuations are not cheap, but at the same time they are not excessively high. We anticipate below-average equity returns for 2016 with the S&P 500 delivering a total return of around 3%. We remain cautious but opportunistic in our equity investments.

The bond market has also experienced gyrations this year. Most of the action has been in the high-yield area. Many energy companies, having incurred high amounts of debt to build infrastructure to capture abundant deposits, have fallen on hard times as both oil and natural gas prices have collapsed. Bond prices have fallen and liquidity is now a concern. Investors who entered the space in a hunt for yield may precipitate further weakness as they head for the exit. Our investment-grade strategy has held up well. We own bonds for their stability and steady income. Equities are the asset class for risk-taking.

Given our outlook for modest interest rate increases, our primary concern is credit risk, not interest rate risk. Credit risk reflects the issuer’s ability to make interest and principal payments. Interest rate risk reflects price changes due to movements in interest rates. As interest rates move higher, the price of a bond with a fixed rate of return will move lower. Although interest rates are still at very low levels, we have started to extend maturities as rates have crept higher from the depths reached in 2012.

Each new year presents uncertainty and unique challenges, and 2016 will be no different. We appreciate your support and confidence as we work hard to add prosperity to your New Year.

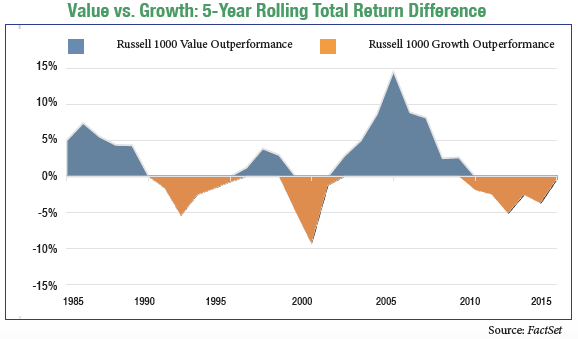

Generally speaking, there are two schools of investing: growth and value. Growth investors look to invest in companies that are normally growing their sales, earnings, and perhaps customers at a rate well above the typical company. A successful growth company firing on all cylinders and achieving the above factors often leads to the company’s stock outperforming the broader market. However, when the markets start to decline and overall growth is anticipated to slow, growth stocks frequently decline more than the market. On the other side of the spectrum lies value investing. Often, value investors are more risk-averse and first look for the downside scenario that might face a company. With the downside determined, value investors attempt to buy the company’s stock at a discount to the estimated intrinsic value. While the company’s earnings may not grow at a rate faster than or even matching the broader market, the expected downside in the company’s stock price is limited during periods of stock market volatility. As a result, value investing has proven to outperform growth investing over the long term.

The investing styles move in and out of favor depending on what investments are perceived to deliver the best returns. Since the beginning of this bull market in 2009, growth investing has been en vogue as investors have sought companies that are actually growing in a no-to-slow-growth economic environment. 2015 was no exception as Facebook, Amazon.com, Netflix, and Google were among the S&P 500’s best performers. Often known by the acronym FANG, these four companies held up the S&P 500 from further declines during the year, while the average stock in the index was down 18% from its 52-week high.

A handful of stocks leading the market is nothing new to Wall Street. In the late 1960s and early 1970s, investors were enamored with “the Nifty Fifty” which included companies such as IBM, Walt Disney, Coca-Cola & McDonalds. All came crashing down when the bear market arrived in 1974. A similar craze occurred in the late 1990s and early 2000s with several technology stocks, such as Microsoft and Intel, leading the market. Once the “tech bubble” burst, some overvalued technology stocks lost more than 80% of their value. A share purchased in Microsoft or Intel early in the 2000s would, even today, not have made an investor a single dollar.

At Tufton Capital, we practice the value investing philosophy, looking to outperform in bear markets while performing adequately in bull markets. There is no telling when the next bear market will arrive, but one thing is definite – we are currently in the second longest bull market of all time. Our style will come back into favor. Until then, we will maintain our discipline, be patient, and continue to focus on finding a dollar’s worth of assets trading for fifty cents.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

We recently welcomed LaShawn Jenkins back to the Hardesty Capital team as an Account Administrator.

LaShawn has over 20 years of experience working as an administrative and customer service professional. She began her career as a receptionist at Prudential Securities, followed by positions at A.G. Edwards & Sons and M&T Bank. LaShawn worked at Hardesty Capital Management from 1996 through 2001 and returned to the firm in 2015. Just prior to rejoining Hardesty, she worked as a Gift Entry Coordinator at Kennedy Krieger Institute.

LaShawn is involved in fundraising and raising awareness for the Cystic Fibrosis Foundation. She is also actively involved in fundraising efforts for the Kennedy Krieger Institute. LaShawn lives in Parkville with her daughter, Amaya.

Help your descendants help themselves by learning about these common wealth transfer problems.

Money can make even the closest family relationships turn ugly. Anticipating the emotional issues attached to wealth transfer can help you avoid them altogether or deal with them more efficiently if they do arise.

Sudden wealth syndrome

Coming into a large amount of money unexpectedly seems great from an outside perspective. However, if an heir receives this money without being adequately prepared for the responsibilities that come with it, he or she can experience something similar to what lottery winners often feel. This instant gratification is often called “sudden wealth syndrome.” Because the heir did not have to work to gain the money and/or may not have talked with his or her predecessor about the work that went into earning the money, it may result in a lack of motivation. The person may find it hard to develop skills like delayed gratification and thrift. Therefore, an heir is more likely to spend the windfall and blow through most of the inheritance. Heirs in this situation often experience frustration, feelings of failure or a false sense of entitlement. They may avoid accountability or withdraw from others, sometimes even developing serious social disorders.

How to fix it

The most important thing to remember to avoid giving your children sudden wealth syndrome is to take the time to communicate to your family the values that allowed you to accumulate your wealth. Children who understand and empathize with the struggle that their parents may have gone through to attain their wealth will feel more of an emotional attachment to this money and will be less likely to spend it all at once. If you feel that your children are not emotionally ready to handle this wealth, consider setting up trusts or placing an age restriction on when your future heirs can inherit their money. This sets up a longer time line and gives the next generation time to mature.

Leadership voids

A leadership void can occur when a family business owner dies suddenly before training the next generation. If it’s not clear who should step up to take responsibility of the business, power struggles can occur among the remaining heirs. Even if financial wealth or the entire business isn’t lost, the vision for the business often is.

How to fix it

If a business is among your assets, one of the first things your wealth transfer plan should establish is how that business will function after you are gone. Will your family continue to run the business, or will it pass through sale to a third party? If you choose to keep it within the family, you will want to set specific role designations for your future heirs. It’s important to remember that “fair” is not always “equal.” For example, if you have two children, one who has worked alongside you in the business for years and understands your business plan and ethics, and one who has shown no interest in the business and knows little about your business practices, you may not want to split the business equally between these children. When making these choices, it’s important to discuss your rationale with your family ahead of time so that your future heirs understand why they are placed in their roles and what is expected of them in those roles.

Trustee-beneficiary relationships

Difficult trustee-beneficiary relationships can occur when families adhere to the “nothing revealed until death” principle of estate planning. If trustees and beneficiaries are not kept in the loop during the planning process, the beneficiaries suddenly find themselves inheriting an unexpected amount of wealth at an already emotional time in their lives. If they haven’t talked to the grantor about the idea of a trust before the grantor’s death, they can feel as though the trustee is standing between them and what they are “rightfully entitled” to.

How to fix it

It’s important to consider who you name as trustee and why. For example, it can be common practice to name a child as a trustee. However, what if you die before your spouse and your spouse then has to ask your son or daughter for principal distributions from a trust? This can create an uncomfortable family situation. It’s important to consider the possible ramifications of who you name as trustee and whether or not they will be able to handle the difficult decisions left to them. Depending on your family situation, it may be best to name a trustee who is impartial to family dynamics.

Property squabbles

Depending on how specific you are in your wealth transfer, there may be certain items that are “up for grabs” in your estate. These items may have emotional value to one of your descendants, or may be culturally significant, such as prominent works of art. This can lead to arguments among family members over who gets to keep what, especially amongst siblings or descendants who may already be prone to fighting.

How to fix it

Depending on the personalities within your family, it might be wise to avoid leaving property division decisions to your descendants. You have the option to try to be as specific as possible in your estate planning documents, or you can name an impartial executor to divvy up your property. If you do choose to leave property division to yourself, make sure you are open and honest with your future heirs about how and why you chose to leave certain things to certain people. Also, you should avoid promising the same piece to more than one person—a tactic that some people use to try to avoid conflict in the moment. Unfortunately, this usually leads to enlarged conflict later on.

Communication is key

Even if you set up a beautifully planned wealth transfer with a variety of financial strategies and your financial planner executes it perfectly , it still has the potential to fail if you don’t have your future heirs on board. Beyond preserving your wealth, communicating money values and generational wealth transfer plans in the most open way possible can also help your children to become more knowledgeable and responsible with their finances.

This article was written by Advicent Solutions, an entity unrelated to HardestyCapital Management. The information contained in this article is not intended to be tax, investment, or legal advice, and it may not be relied on for the purpose of avoiding any tax penalties. Hardesty Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

The volatility that we’ve experienced in the global markets in recent months serves as a great reminder: although markets generally “climb a wall of worry” over the long run, they don’t do so in a straight line. While the first half of 2015 resulted in a flat S&P 500, this year’s third quarter brought the much-anticipated correction that we (and much of Wall Street) had been patiently awaiting.

The volatility that we’ve experienced in the global markets in recent months serves as a great reminder: although markets generally “climb a wall of worry” over the long run, they don’t do so in a straight line. While the first half of 2015 resulted in a flat S&P 500, this year’s third quarter brought the much-anticipated correction that we (and much of Wall Street) had been patiently awaiting.

But while corrections are no fun for investors, they are a normal and necessary component of the long-term market cycle. Moreover, market pullbacks give value investors like us opportunities to put our expertise to work. Our firm has been finding value in stocks such as Emerson Electric (EMR), which now trades at 12 times next year’s earnings while offering a 4.4% yield (please see our EMR analysis on Page 7). And with companies such as Procter & Gamble (PG) and Chevron (CVX) yielding 3.7% and 5.5%, respectively, good investments become even better ones in down markets. So while corrections (more…)

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

The month of August showed the return of volatility in the financial markets. The S&P 500 dropped 11% in the span of seven days and the VIX, widely known as “the Fear Index,” hit an intraday high of 53 – a level not seen since the financial crisis. In one day of trading, the Dow Jones Industrial Average opened down more than 1,000 points within the first hour, causing a “Flash Crash” as many ETF investors attempted to run for the exits. All of this chaos resulted in the >10% correction we had been long awaiting.

Throughout this volatile time, I received texts and calls from relatives asking if they should sell or trim their portfolios. My response often was “What? Why would you? I’m buying!” As we have mentioned in previous articles, >10% corrections are common and have occurred about every two years since 1957. Selling or trimming your portfolio during these corrections is one of the (more…)

Hardesty Capital Management spends a considerable amount of time searching the universe of publicly traded companies for undervalued stocks to purchase in our clients’ accounts. Aside from research roles, our portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Hardesty Capital Management spends a considerable amount of time searching the universe of publicly traded companies for undervalued stocks to purchase in our clients’ accounts. Aside from research roles, our portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, and with the end of the year quickly approaching, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must (more…)

Many financial advisors build a book of business using mutual funds for their affluent clients. Is it because funds have favorable characteristics and offer stronger investment returns? Absolutely not – mutual funds have many drawbacks!! First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills. (Please see our Tax Loss Harvesting article on page 5.) Small retail investors have few options and mutual funds may make sense for them. Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals. Please read on and you will understand why we favor our approach.

Many financial advisors build a book of business using mutual funds for their affluent clients. Is it because funds have favorable characteristics and offer stronger investment returns? Absolutely not – mutual funds have many drawbacks!! First, they limit an advisor’s ability to customize a portfolio and manage risk effectively. Second, they add an additional layer of fees, which reduces an investor’s returns. Third, they are inefficient for investors who want to manage their tax bills. (Please see our Tax Loss Harvesting article on page 5.) Small retail investors have few options and mutual funds may make sense for them. Fortunately, our clients enjoy a customized approach to managing their money. We invest in a diversified portfolio of individual stocks and bonds to meet your goals. Please read on and you will understand why we favor our approach.

Often, advisors put clients into mutual funds because they lack robust in-house research, or it simply frees up the advisors’ time to go find new business. While funds offer investors instant diversification, it’s a one-size-fits-all approach. A fund manager’s objective may be quite different from that of the investor. For example, a manager’s compensation may be linked to outperforming a benchmark with no consideration for the level of risk taken, the amount of taxes passed on (more…)

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

The global economy is as weak as it has been since the Great Recession. A slowing of the Chinese economy is the latest cause of indigestion. It is difficult to overemphasize the importance of the second largest economy in the world. With reported annual average GDP expansion rates in excess of 7% for many years, the Chinese economy has been the global growth driver. As Chinese production has slowed, the prices of raw materials for that (more…)

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Although the Fed is nearing an inflection point, we do not see near-term rate actions negatively impacting the economy. In the Fed we trust: we believe any rate increases will be slow and measured. (more…)

Many investors are riding high and feeling great as we continue to see gains in one of the longest bull markets since the 1940s.

Many investors are riding high and feeling great as we continue to see gains in one of the longest bull markets since the 1940s.

As we know, the bull market will only last so long: sooner or later, we are going to see a correction. We are monitoring the market’s higher valuation very closely. No one knows when it will come or how large the dip will be, but we do know it is coming. What’s important is staying strong in your investment strategy and fighting the urge to sell.

Retail investors (those who trade their portfolios non-professionally) have performance that significantly lags the market overall. This dynamic occurs because they tend to act on emotion, selling at the bottom and missing the large early gains of a recovery. (more…)