Company Spotlight: Bristol-Myers Squibb (Ticker: BMY)

by Barbara Rishel

Bristol-Myers Squibb (Ticker: BMY) is a leading biopharmaceutical company that discovers, develops, manufactures, and distributes products worldwide. Squibb was founded in 1858 and Bristol-Myers Corporation was founded in 1887, and the two came together a hundred years later in 1989 to form BMY. Today, the company generates annual revenues of $20 billion.

BMY’s product line serves several important therapeutic areas, but most important to Bristol is its oncology business. Within oncology, investors’ hopes focus on Bristol’s drug Nivolumab, marketed as Opdivo. Opdivo works as a checkpoint inhibitor, using the patient’s own immune system to combat cancer. Immune checkpoint science has been progressing in the fight against cancer for almost twenty years, but Opdivo only received FDA approval for the treatment of melanoma in 2014, making it a cutting-edge treatment. The drug is undergoing further testing in combination with other drugs to improve outcomes and expand the addressable market.

Investing in the pharmaceutical industry is high risk/ high reward. The cost to develop pharmaceutical drugs is very high and carries no guarantee of success. Although patent laws provide product protection against uses of the same drug, competitors are constantly in the lab working on new, better (or even just different) treatments. While success may bring impressive profits, it also invites scrutiny from those organizations working to drive down the cost of healthcare.

Bristol-Myers Squibb is an example of the risks facing pharmaceutical companies. BMY enjoyed great success in the 1990’s due in large part to their blood thinner Plavix. The eventual loss of patent protection and the lack of a new product pipeline resulted in the stock losing over 70% of its value in 2001 and 2002. The company began rebuilding and made a big commitment to the oncology market.

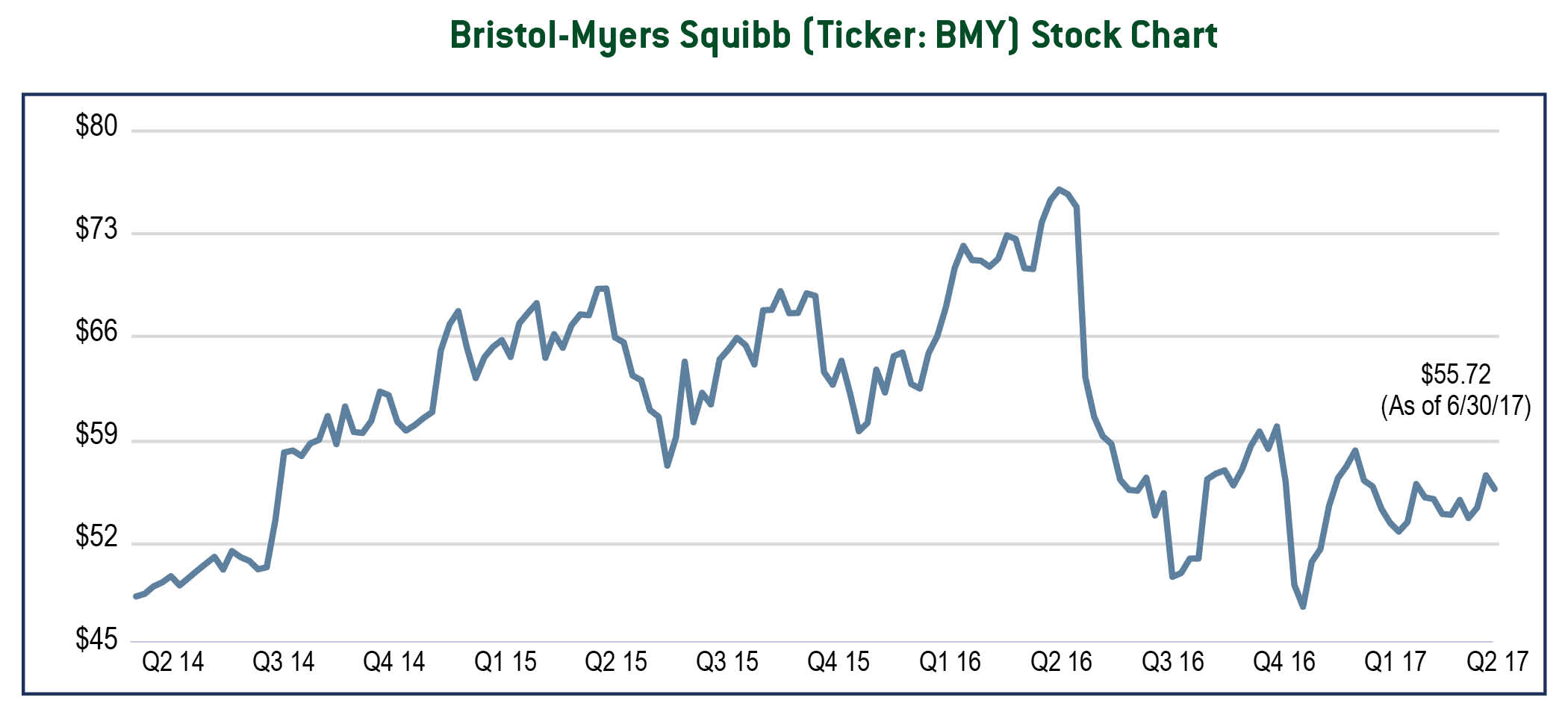

Opdivo shows great promise but is not without risk. Although BMY enjoyed a first-mover advantage, a series of clinical setbacks has allowed competitors to emerge. As a result, the stock has declined 25% over the past year. We believe the current price represents a good value given the potential for further development and success in the oncology field.