The Fourth Quarter of 2024: Seeing Red

By: Eric Schopf

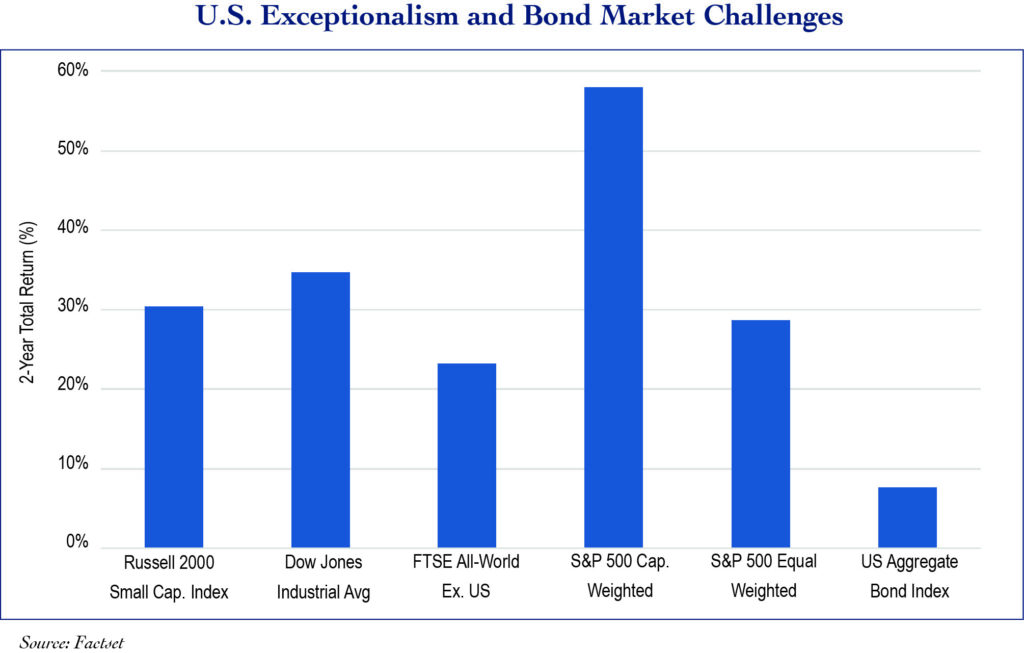

The fourth quarter capped another good year for equity investors. The Standard and Poor’s 500 gained 2.41% in the quarter and closed 25.02% higher for the year. The market had been up as much as 29.34% through December 6 before a late-year sell off. The trend of U.S. large capitalization growth stock performance continued in 2024. Most of the other equity indexes delivered more modest returns. For example, the Dow Jones Industrial Average advanced almost 15%, and the Russell 2000 Small Capitalization Index gained 11.54%. The Financial Times Stock Exchange (FTSE) All World Index, excluding the United States, which is a good proxy for international equity investments, logged a 13.27% gain. United States exceptionalism was again on full display in 2024. The exceptionalism, however, did not run deep. The equal-weighted S&P 500 was up only 13.01%, about half as much as the capitalization weighted S&P Index.

The bond market had a much rougher ride during the quarter. The US Aggregate Bond Index, a measure of the total investment grade fixed income market, declined 2.61% in the quarter, reducing the year-to-date return to just 1.82%. The real return was negative when factoring inflation at 2.7%. The shift in the yield curve, which began in the third quarter following the Fed’s first interest rate cut, accelerated in the fourth quarter. Although the Federal Reserve cut interest rates twice in the quarter, the 50 basis point aggregate reduction resulted in higher rates across the yield curve. During the third quarter, higher interest rates were felt in maturities beyond ten years. Weakness was visible in all maturities beyond one year with higher yields and lower prices.

The shift in interest rates has been challenging for fixed income investors. Cash money market funds have been about the safest investments. However, three interest rate cuts over the past four months have resulted in a big reduction in yield. Money market fund yields peaked at about 5.5% last May. Today, yields are now closer to 4.4%. Extending maturities to lock in higher rates has been fraught with risk as bond prices have dropped, reflecting the higher interest rate environment.

Bond market weakness and the late-year stock market sell-off reflect the uncertainty of the incoming administration. Gains by Republicans left the party in control of the Senate and the House of Representatives. President-elect Trump has articulated an aggressive agenda and appears to have the votes to bring his vision to fruition. He will use executive orders extensively to ensure that his policy initiatives are met. The initiatives, with the goal of making America great again, have made Wall Street skeptical, and the stakes are high given the bloated budget deficits and the level of federal debt.

In hindsight, inflation at the household level may have been the undoing for the Democrats. Fiscal policy was unconstrained. The American Rescue Plan, the Build Back Better Act and the Inflation Reduction Act cost nearly $6 trillion. When combined with the quantitative easing policy at the Federal Reserve and their accumulation of $9 trillion in assets by June 2022, it was only a matter of time before inflation became a problem. Inflation and high interest rates may persist if President Trump’s plan doesn’t work. With federal debt now at $34 trillion and equal to 123% of gross domestic product, there is little room for error.

The President-elect has shown little appetite for a reduction in spending. Additionally, he campaigned on a platform of extending tax cuts that he ushered in during his first term in 2017 and are set to expire later this year. He doubled down by promising no income taxes on tips, overtime pay or social security benefits. The gap between revenue and expenditures is to be filled by revenue collected through tariffs and greater tax revenue from a buoyant economy that is more U.S.-centric. The assumption is that exporting countries will eat the tax and accept lower profits or shift production to other locations, preferably the United States. Detractors point to the current unemployment rate of 4.1% and question the labor source for operations relocated to the U.S., a situation that would be exacerbated by strong rhetoric on closing the borders and deporting illegal immigrants. There is also some question as to whether exporters will simply pass the cost of tariffs on in the form of higher prices. We should expect our trade partners to retaliate through tariffs of their own on imported goods which might neutralize the entire exercise. There are also some questions as to the net impact of tariffs. The total value of all imports in 2023, the last full year of data, was $3.8 trillion. A 20% across the board tariff on all imports would only generate $760 billion. The extra revenue falls well short of current budget deficits and doesn’t even cover the nation’s annual interest payment of $1.126 billion. There is a slim possibility that an optimal tariff level is reached and the benefit of higher tax revenue will offset higher prices. Miscalculations, however, could easily result in sustained inflationary pressure, higher interest rates and slower economic growth.

Inflation never decreased to the Fed’s target rate of 2%, even prior to their interest rate cuts. Given the potential for greater inflation triggered by economic policies, future rate cuts are now in doubt. Higher rates impact corporate profitability due to higher funding costs, and they also factor into equity valuations in discounting future cash flows. Recent volatility in the stock and bond markets is likely to persist until the impact of implemented policies becomes evident.

President Trump only has one term to leave his mark and will undoubtedly instigate for change, but success is not guaranteed. For example, he is keen on revving up the domestic energy industry to reduce imports, increase exports and improve our economy through job expansion. He seems poised, through executive order, to overturn drilling bans enacted by President Biden. However, with energy exploration and production now consolidated in the hands of fewer, fiscally rational players, their willingness to “drill-baby-drill” may fall short of expectations. The jury is still out on cost-saving initiatives implemented by the newly created Department of Government Efficiency, which will be co-led by Elon Musk. A similar undertaking, the President’s Private Sector Survey on Cost Control, established by executive order during the Reagan administration, was unsuccessful. Musk, the chief executive officer and chief technology officer of SpaceX, has put people into space. He also successfully introduced affordable electric vehicles to the world. We will see if he has the same success wrangling control of the federal government.

Economists and politicians have been warning about the dangers of deficits and extended debt levels since the beginning of the republic. From the Revolutionary War in 1775 through the Covid-19 pandemic, the federal government has borrowed money to see the nation through hard times. The printing of excess money creates the opportunity to accumulate wealth. Austerity measures implemented to rectify fiscal imbalances pose a risk to that wealth. Thanks to the giant tax cuts implemented by President Reagan, President George H.W. Bush was confronted with yawning budget deficits and mounting debt when he took office in 1989. Although we read his lips as he pledged no new taxes, he reneged on that promise. The loss of consumer confidence along with restrictive monetary policy to help reduce inflation resulted in an eight-month recession.

History doesn’t always repeat itself but sometimes it rhymes. We at Tufton are closely monitoring the changing of the guard in Washington. We will continue to preserve and grow our clients’ portfolios by maintaining a disciplined and well diversified approach to investing.