The Weekly View (12/2/19)

Last Week’s Highlights:

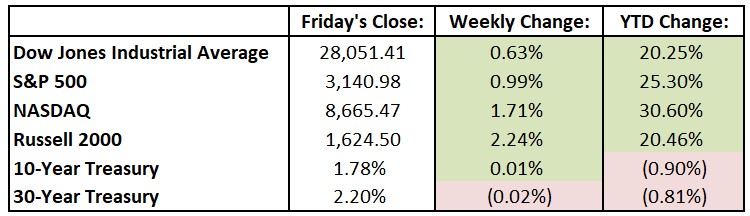

Friday was the last trading day of November, and stocks closed out their best month since June. A strong third-quarter earnings season and hints that a “phase one” U.S.-China trade deal is in its final stages have contributed to the recent market strength. For the holiday-shortened week, the Dow Jones Industrial Average (DJIA) rose 175.79 points, or 0.63%, to 28,051.41, while the S&P 500 advanced 0.99% to 3140.98. The tech-heavy NASDAQ was up 1.71%, closing at 8666.47. Black Friday results hinted at a very strong upcoming holiday shopping season. Online sales on Friday hit $7.4 billion according to Adobe Analytics. This is a 19.6% increase from last year and the second largest online shopping day ever. Walt Disney’s (DIS) release of Frozen 2 set a box-office record for an animated debut, with $358 million of ticket sales globally. Tesla (TSLA) remained in the headlines, as Elon Musk claimed that the company had 250,000 preorders for its electric truck. Merger mania continued with announced unions between Charles Schwab (SCHW) and TD Ameritrade (AMTD), LVMH (LVMUY) and Tiffany (TIF) and Novartis (NVS) and Medicines (MDCO). eBay (EBAY) also announced a deal to sell StubHub to Swiss ticket reseller Viagogo for $4 billion.

Looking Ahead:

The Institute for Supply Management releases its Manufacturing Purchasing Managers’ Index for November on Monday – economists forecast a 49.3 reading, up from October’s 48.3 print. General Electric (GE) holds an investor day in Chicago to discuss its health-care division. Bank of Montreal (BMO), Workday (WDAY) and Salesforce.com (CRM) report earnings on Tuesday. Wednesday brings financial results from AutoZone (AZO), H&R Block (HRB), Royal Bank of Canada (RY) and Slack Technologies (WORK). Microsoft (MSFT) hosts its annual meeting of stockholders via a live webcast. ADP releases its National Employment Report for November – estimates call for a gain of 140,000 private-sector jobs, up from October’s 125,000 increase. Brown-Forman (BF), Dollar General (DG), Kroger (KR) and Ulta Beauty (ULTA) announce financial results on Thursday. On Friday, the Bureau of Labor Statistics (BLS) releases the jobs report for November – expectations are for a 186,500 rise in nonfarm payrolls. The unemployment rate is expected to be unchanged at 3.6%.

Tufton Capital Team hopes that you have a wonderful week!