The Weekly View (3/21/16 – 3/25/16)

What’s On Our Minds:

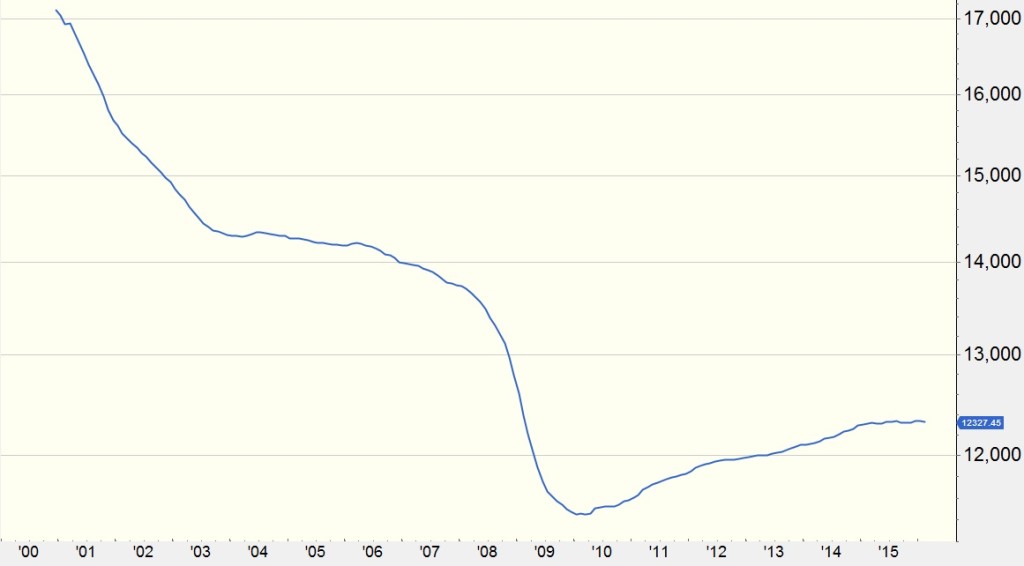

We try not to get political on this blog. But something that perhaps all of us can agree on: politicians don’t understand economics. Or at least, they say a lot of misleading things about the economy. One example in the headlines is trade protectionism: the “protect our jobs” argument. Here’s a non-partisan fact: those manufacturing jobs aren’t coming back. How can we say that? Because we can bring (and have brought) manufacturers back to the U.S., but we have become so good at automation that we don’t bring the factory workers’ jobs back with them. It’s not China taking those jobs. It’s our own technology.

What we should produce is based on our comparative advantage, as we economists call it. We have a comparative advantage in things like technology and services. The concept behind comparative advantage is simply that if each country specializes in what they are especially good at, every country is better off. This is true even if one country is better at everything. That far superior country (ours, of course) should specialize in what they’re good at making, since they can produce larger amounts of valuable stuff and trade for the rest.

But that arrangement creates problems for politicians who have voters to answer to. We might be able to import a million HDTVs a year from, say, Mexico and save ourselves $50 on each one- our consumers gain $50 million. But that comes at the expense of a factory that employs 50 people at $50,000 a year each, or $2.5 million per year. The net gains are a whopping $47.5 million a year- but the 50 factory workers who just lost their jobs are going to make a much bigger fuss to their congressman than the people who might not be able to buy a cheap TV.

We are not taking a political stance, but only hope that with a greater understanding of these concepts we might be able to better prepare for the future.

U.S. Manufacturing Jobs (thousands), as reported by ADP

Last Week’s Highlights:

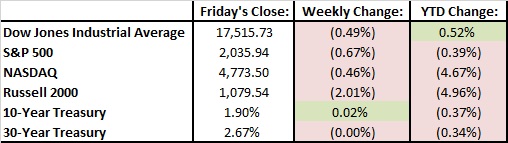

The S&P 500 and the Dow Jones fell about half a percent last week. Overall, we are still about flat for the year. The US economy continues to show signs of improvement. Oil is finally pulling back some after surging about 50% over the last few weeks (trough to peak).

Looking Ahead:

The first of April will be an important day for USA economics- we’ll see both manufacturing PMI numbers and the March jobs report. Until then, things are quiet as we await earnings season being kicked off on April 11 by Alcoa.