The Weekly View (5/30/16 – 6/3/16)

What’s On Our Minds:

As first quarter earnings season has wound down, investors’ eyes have been glued on economic data that could influence the Federal Reserve’s decision on whether or not to raise interest rates at their June 14-15 meetings. Last week, the markets were focused on the Nonfarm Payrolls (Jobs) Report that was released on Friday morning. Wall Street was expecting an addition of 160,000 jobs to the US economy. Unfortunately, the report showed that only 38,000 jobs were created in the month of May. Following the announcement, the markets saw a “risk-off” feel as the Dow Jones Industrial Average fell 135 points mid-Friday morning and the yield on the US 10-Year Treasury fell from 1.79% to 1.73% in a matter of minutes. In addition, the market’s view for a probability of an interest rate hike in June dropped from 20% pre-report to 3% after the report was released.

Breaking down the Jobs Report, the headline number was not as horrible as it appears. Verizon employees were recently on strike and hurt job growth by 37,000 jobs. Adjusting for Verizon, the economy added 75,000 jobs – still well below the Wall Street estimates and below the Federal Reserve’s sweet spot for raising rates (which is estimated to be monthly growth of 145,000 to 175,000 jobs.) Federal Reserve Chair Janet Yellen has stated “to simply provide jobs for those who are newly entering the labor force probably requires under 100,000 jobs per month.” Nevertheless, the May number may still be somewhat low.

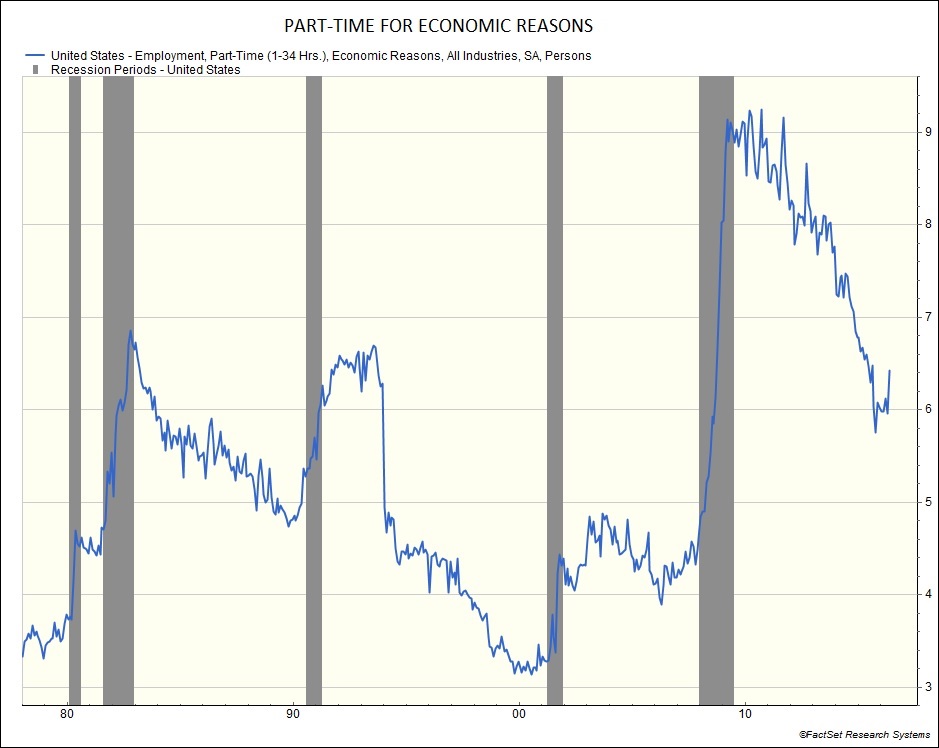

Other than the weak job growth in May, another negative trend is the rise in the amount of jobs categorized as “part-time for economic reasons” after bottoming in October of 2015. According to the Bureau of Labor Statistics, “these individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.” This implies there are still many people underemployed, leading to lower wages and thus lower spending from those consumers.

So while Chair Yellen may have a lot on her plate, many workers still do not.

Last Week’s Highlights:

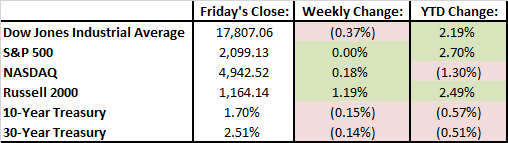

For the week of Memorial Day, the major market averages showed a mixed picture. The Dow was down 0.37%, the S&P 500 was unchanged, while the Nasdaq was up 0.18%. Year-to-date, the Dow and S&P 500 are up 2.2% and 2.7% respectively, not including dividends. With dividends, the S&P 500 Total Return Index actually hit an all-time high last week – showing the advantage of investing in dividend stocks.

With the jobs report blurring the near-term interest rate hike picture, the utility sector was the best performer while financials lagged as anticipated lower rates would continue to help the capital intensive utility companies, but compress bank net interest margins. The energy sector was also down as the OPEC countries did not agree on an oil production freeze last Thursday.

Looking Ahead:

Today, the markets are focused on Federal Reserve Chairman Janet Yellen as she speaks in Philadelphia at 12:30. Investors believe she will have a more “dovish” tone on the economic outlook, implying lower-for-longer interest rates. Investors will also gain insight on China’s economy with the release of several reports throughout the week. The Presidential Primaries will also wrap up on Tuesday with Donald Trump and Hillary Clinton both leading their respective parties in California.