The Weekly View (6/13/16 – 6/17/16)

What’s On Our Minds:

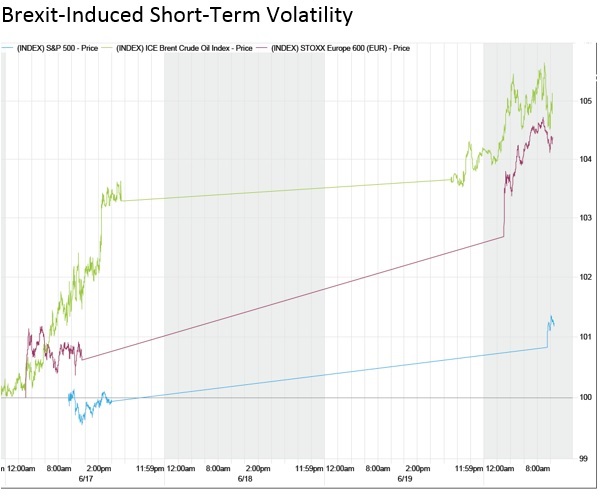

Thursday’s impending “Brexit” vote has caused notable short-term volatility and uncertainty over the past week; these market swings are not just limited to British markets, but global markets as well. Until Thursday, it appears that the only thing the market is focused on is “stay or leave.”

While we don’t rely on gambling shops (or bookies) in our investment research, it has been fun watching the odds of an EU exit change as we get closer to the vote. British gambling odds have been in favor of staying in the EU—76% of current gamblers are leaning towards a “remain” vote according to Ladbrokes—last week’s odds and polls illustrated a near 50/50 split among U.K. residents’ view on the vote, representing a slight uptick in the share of residents that felt strongly about an impending “leave” vote. The aforementioned shifts in the market are, as The Wall Street Journal has stated, a product of the markets’ complacency—investors had held comfortably to the U.K. remaining in the European Union, so the aforementioned increase in “leavers” had notable short-term effects on the markets. Supporting this sentiment, this morning’s issue of The Wall Street Journal shared that many investors “may be guilty of putting too much weight on the scenario they wish to see rather than reality.” The Federal Reserve even mentioned Brexit’s impact on its decision to keep rates low during last week’s FOMC meeting.

God-willing and the creek don’t rise, it looks like Britain will remain a member of the EU after Thursday, removing a cloud of uncertainty from global markets and regulatory bodies. While we here at Tufton feel that the Brexit debate itself will have little direct long term effect on the markets, its undeniable that a British departure from the EU would have a lasting impact on the Euro Zone; London’s role as a crucial financial center weighs heavily in the Union’s global impact from a political-economy perspective. We will be watching the markets and news regarding Brexit throughout the week. For what it’s worth, we would bet on the majority opinion.

Last Week’s Highlights:

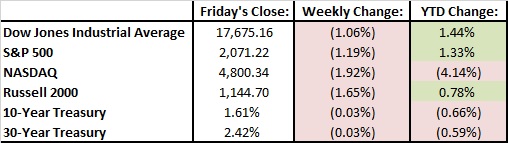

It was a tough week on Wall Street with both the Dow Jones and S&P 500 down just over 1%. Based on concerns over the state of the labor market, the Federal Reserve voted unanimously to “stay the course” on interest rates. At their meeting, they shed light on their current thinking; they will likely make make more gradual rate hikes moving forward. This was a change from the hawkish tone we heard from the Fed in March. Oil moved lower on worries of weak demand. In company news, Merck announced it would pursue an acquisition of privately held biotech company, Afferent Pharmaceuticals. Also, Microsoft announced it would acquire LinkedIn for $26.2 billion. I was a good week for LNKD shareholders as shares skyrocketed 47% on the news.

Looking Ahead:

The first official week of summer should be interesting for the markets. On Monday, President Obama is speaking at the Commerce’s US investment summit. On Tuesday, Janet Yellen will be busy in Washington, delivering a monetary policy report to the Senate Banking Committee and attending a Financial Stability Oversight Council meeting. On Wednesday existing home sales for the month of May are reported and on Thursday, new home sales numbers. Britain will vote on whether it will be leaving the European Union on Thursday. On Friday, the Russell Indexes will be re-balanced which is always one of the busiest trading days of the year.