The Weekly View (6/27/16 – 7/1/16)

What’s On Our Minds:

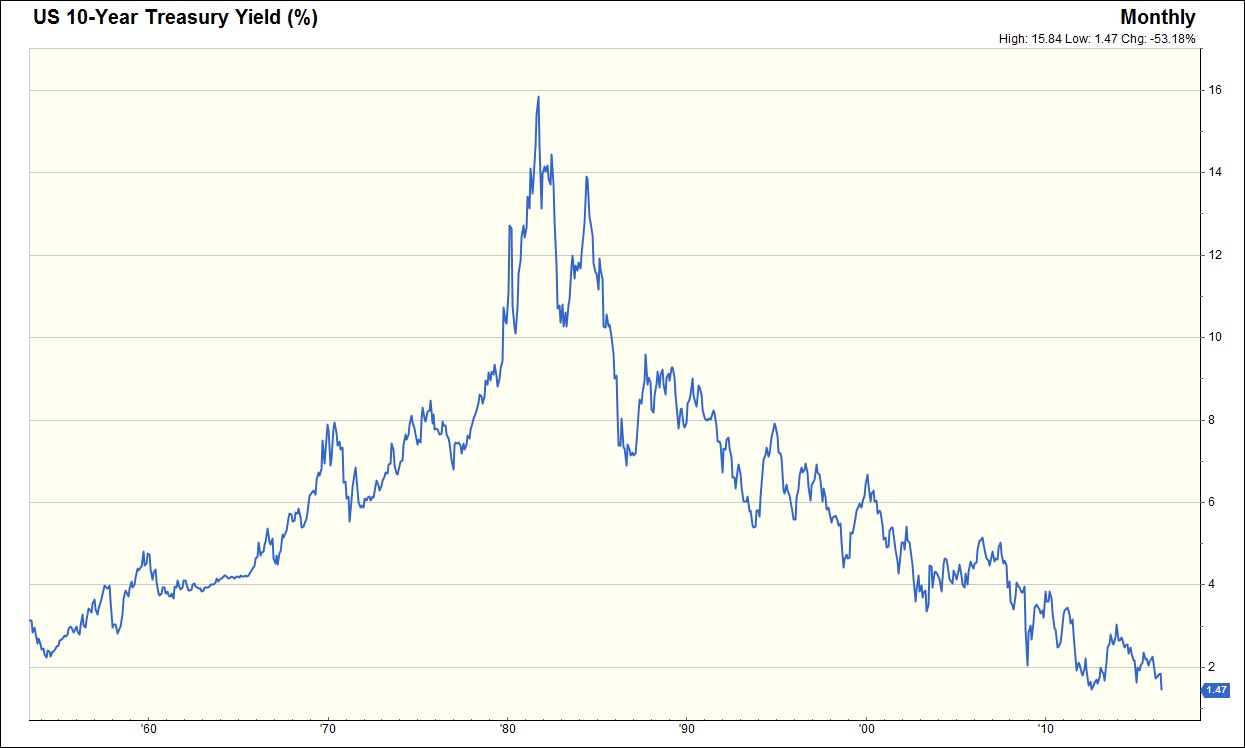

The search for yield continues as the yield on the 10-Year Treasury hit a record low this morning. With government bonds overseas offering negative yields, it appears foreign buyers are scouring the globe to find anything that may offer them investment income. Last week, investment in High Dividend Yield ETFs led ETF flows while the high yielding Utility and REIT ETFs also gained investor interest. In addition, value stocks (that have typically yielded more than the market recently) have also been in favor.

On the bond side, investors are flocking to US Corporates and Treasuries. Not long ago, there were many more options for those seeking investment income. From 2011 to 2013, initial public offerings of the high-yielding Master Limited Partnerships (MLPs) averaged more than 1 per month while oil and gas producers continuously issued bonds with well-above average interest rates. Emerging Market debt also offered attractive returns.

In the second half of 2014, oil crashed and the MLPs and energy debt followed suit. Now, many oil and gas producers and service companies have filed for bankruptcy. Some energy survivors have also slashed or even cut their dividend. Most MLPs can no longer access the debt markets and have turned to issuing more stock/ units, diluting the stock/unit value of their current investors. Emerging Markets also took a dive, but have since started to recover.

With the German 10-Year Bund offering -0.18%, the Switzerland 10-Year bond offering -0.62%, and the Japan 10-Year bond offering -0.25%, it seems investors have flocked to “the best house in a bad neighborhood”: The United States.

Hopefully this party will end without broken windows, but at this point, we’re not too sure who’s on the guest list.

Last Week’s Highlights:

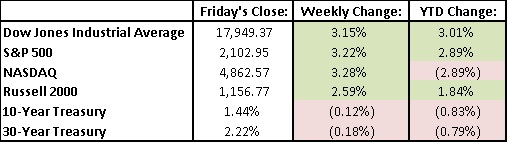

For the week before the holiday, investors were able to shrug off the Brexit jitters as the Dow Jones Industrial Average and S&P 500 rallied 3.15% and 3.22% respectively. While stocks recovered, the bond market did not display much of the same “risk-on” feel. The yield on the US 10-Year Treasury ended the week at 1.47%, well below the pre-Brexit yield of 1.74%.

Year-to-date, the S&P 500 is up 2.89% and the Dow Jones is up 3.01%, not including dividends. The Nasdaq is just the opposite of the S&P, actually down 2.89%. The Nasdaq continues to be weighed by the technology constituents, particularly Apple, which is down 10% this year.

Looking Ahead:

This week, the markets will be focusing on a variety of economic data. On Wednesday, the final reading of the Purchasing Managers Index for June will be released at 8:30 AM providing investors a status of the private sector. At 2 PM on Wednesday, the minutes from the most recent Federal Open Market Committee meeting will be released. Investors will look for hints on the direction of interest rates. Friday is “Jobs Day” as employment numbers for June will be released at 8:30 AM. Next week, prepare for second quarter earnings with Alcoa kicking off the season after the closing bell on Monday.