The Weekly View (7/22/19)

Last Week’s Highlights:

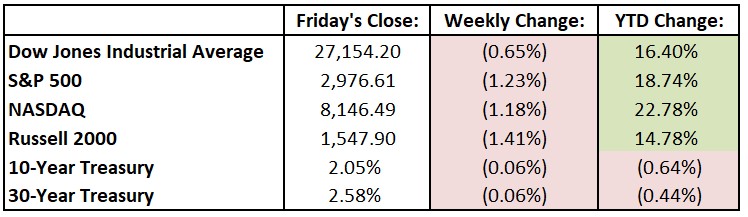

U.S. equities finished slightly lower last week, with most of Wall Street’s attention shifting to corporate earnings announcements. Bank earnings took center stage, reporting solid loan growth and low credit losses. These factors indicate a healthy consumer, boding well for the overall economy. The energy sector lagged as oil prices declined for five straight days, finishing 7% lower on global demand concerns. Netflix (NFLX) reported a decline in its U.S. subscriber numbers, while Microsoft (MSFT) released very impressive earnings results. For the week, the Dow Jones Industrial Average (DJIA) declined 177.83 points, or 0.65%, to 27,154.20, while the S&P 500 fell 1.23% to 2976.61. The tech-heavy NASDAQ lost 1.18%, closing at 8146.49. The dog days of summer are certainly upon us, even with the bevy or earnings announcements. Last week, the largest one-day move in either direction for one of the large U.S. equity indexes was a 0.74% drop for the NASDAQ on Friday, while the Dow never closed more than 0.42% away from its opening level.

Looking Ahead:

Earnings season is in full swing, with 133 S&P 500 constituents reporting financial results this week. On Monday, Halliburton (HAL), GNC Holdings (GNC) and Zions Bancorp (ZION) report financial results. The Chicago Fed releases its National Activity Index – estimates call for a 0.10 reading for June compared with May’s -0.05 print. Tuesday is jam-packed with earnings, including numbers from Coca-Cola (KO), Whirlpool (WHL), Visa (V), Lockheed Martin (LMT) and Robert Half International (RHI), among others. The National Association of Realtors releases existing-home sales for June – sales are estimated to remain flat at a seasonally adjusted annual rate of 5.33 million units from May’s 5.34 million. The U.K.’s Conservative Party is expected to announce its choice for prime minister and party leader to replace outgoing Theresa May. The two contenders are Jeremy Hunt and Boris Johnson. On Wednesday, look for earnings reports from AT&T (T), Ford Motor (F), Boeing (BA) and Facebook (FB). The Census Bureau releases new-home sales data for June – estimates call for a seasonally adjusted annual rate of 650,000 homes, up from May’s rate of 626,000. Southwest Airlines (LUV), Alphabet (GOOGL). Amazon.com (AMZN) and Bristol-Myers Squibb (BMY) report on Thursday. The European Central Bank holds its monetary policy meeting in Frankfurt – analysts forecast the bank to cut its key interest rate, which is currently at minus 0.4%, or signal a rate cut before its September meeting. The busy business week ends with earnings results from McDonald’s (MCD), Twitter (TWTR) and Colgate-Palmolive (CL) on Friday.

The Tufton Capital Team hopes that you have a wonderful week!