The Weekly View (7/18/16 – 7/22/16)

What’s On Our Minds:

The International Monetary Fund (IMF) announced last week a cut to its global growth estimate; the Fund cut this year’s estimate by 0.1%, bringing the estimated figure to 3.1%. Not surprisingly, the decision to cut growth approximations was Brexit-induced, but the IMF also cited other factors—growing political instability, nationalism, and terrorism to name a few—as chief reasons for the decrease, stating that these issues could even further stymie growth. Shocking.

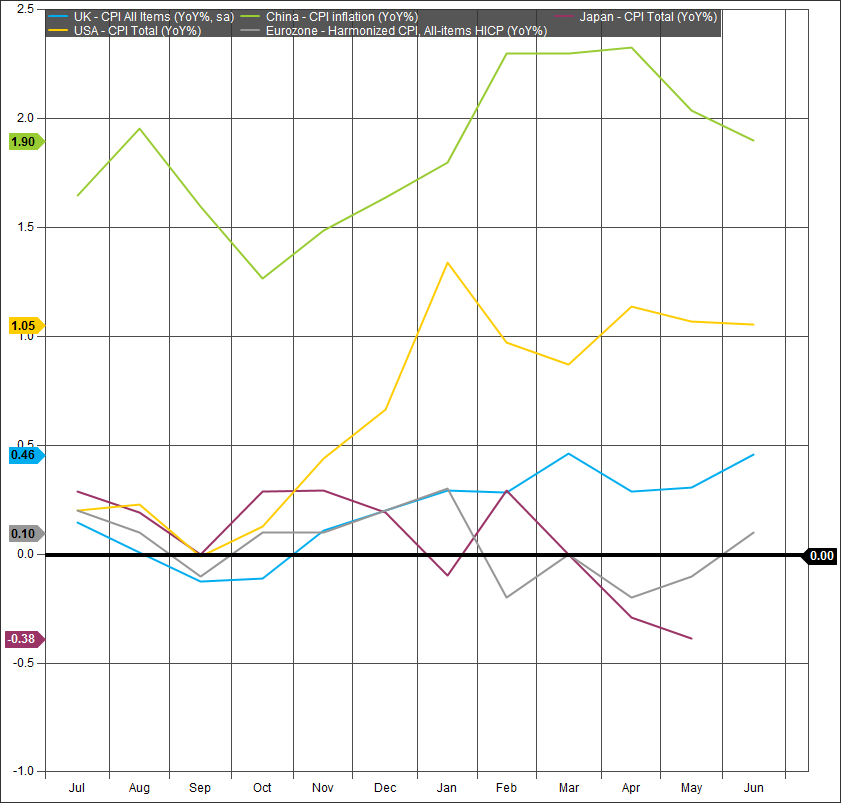

In a message targeted at G-20 nations, the IMF stressed that continued lackluster growth should incentivize nations to keep access to cash “cheap”, utilizing all fiscal and monetary policies at their disposal. This requested targeted our home front—the IMF stated that while the United States economy is set to take off on a (much needed) upward trajectory, the Fed needs to be cautious with rate-hikes (an evaluation intended to spur-off the potential for a September rate increase), citing the negative effects of a stronger dollar amidst global disinflationary and deflationary struggles.

Year-Over-Year CPI Inflation Trends of Major Economies

Global periods of slow growth—or as the academics of the world dub it: “secular stagnation”— plus the implications of Brexit place relatively strong economies, like the United States, between a rock and a hard place: increase rates and be the cause of a potential macro mess, or move along with trepidation hoping that European turmoil does not burst and put us deeper in the rut from which we are (slowly) climbing out. Now those are some choices!

Like those before them, these IMF revisions have not changed the strict and conscientious approach taken by Tufton’s research and investment teams. We continue in remaining anchored to our disciplined long-run approach to investments.

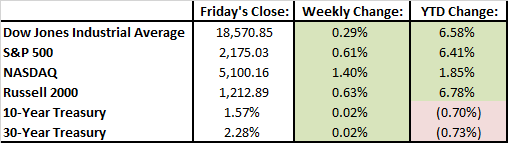

Last Week’s Highlights:

Equity markets were up, continuing a four week winning streak. The Dow Jones added 0.3% while the S&P 500 and Nasdaq both rose 0.5%. Companies reported strong second quarter earnings numbers which helped propel indexes higher. Boston Beer (SAM), the maker of Samuel Adams beer, posted big results and its stock gained 15% on the news. Burrito chain, Chipotle, has had a rough year so far but posted strong results last week which send its stock up 6%. Nintendo shares have skyrocketed since the release of the Pokemon Go game earlier this month, but the company has warned that the impact the game will have on the company will be “limited”.

Looking Ahead:

Earnings season gets exciting this week with some headline grabbers reporting. Under Armour reports earnings Tuesday morning. Apple reports after the closing bell on Tuesday afternoon. Apple has been under performing the market this year and analysts are expecting that iPhone sales declined during the quarter. Facebook is currently trading near all-time highs and will report earnings on Wednesday afternoon. Then on Thursday, Amazon will report results. Alphabet (still referred to as Google by most) also reports on Thursday afternoon. It will be interesting to see if these four big tech companies can pick up their momentum. Ford reports on Thursday. The company has been selling their F-series pickup trucks like hot cakes so far this year but the stock is off 2%.