The Weekly View (9/12/16 – 9/16/16)

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long term. Earlier this year, billionaire investors decided to take on these attacks from Washington by launching their own lobbying group to fight these attacks, The Council for Investor Rights and Corporate Accountability (CIRCA). Bill Ackman, Paul Singer, Carl Icahn, Daniel Loeb, and Barry Rosenstein are the group’s largest backers. Together, they manage over $90 billion and believe that lousy corporate performance is a drag on the US economy.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

Last Week’s Highlights:

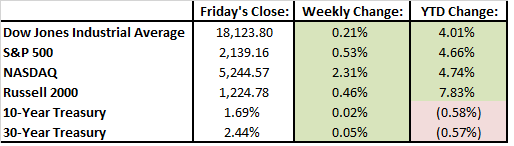

Global stock markets were mixed last week and Investors continue to fixate on central bank policy. Apple released the iphone 7 last week and shares jumped 11.4%. Because Apple is such a large company, the move accounted for a good part of broader stock market gains through the course of the week. Up until Friday September 9th, equity markets had not seen a 1% move for 59 days. This stretch of low volatility was actually pretty remarkable considering that, on average, since 1928, markets make a 1% move about once in every 4 days. So, after a pleasant summer of low volatility, 1% moves are back with speculation that the Federal Reserve will or will not increase interest rates this year. Lower August retail sales and lower industrial production numbers were released last week and are being viewed as factors that will keep the Fed from moving rates higher this week.

Looking Ahead:

All eyes will be on the Federal Reserve this week as they hold their 2 day September meeting. Janet Yellen will make an official announcement on interest rate policy on Wednesday. Right now, the market is not expecting a rate increase and is only pricing in a 12% chance of a rate hike. The sea-saw of arguments continue surrounding Fed policy. If the Fed increases rates too early, there’s a risk that the US economy won’t be able to sustain higher borrowing costs when banks abroad are easing rates. On the other hand, keeping rates low this month may push the Fed into a corner in December where they will be forced to raise rates or scrap their long term policy which was to make two increases this year.