The Weekly View (9/19/16 – 9/23/16)

What’s On Our Minds:

Colleges and Universities typically rely on their endowment funds to cover about 10% of their operating budgets. Thus, in order to maintain quality of life on campuses, folks running endowments need to come up with decent long term returns. Though many people do not think of schools as investing powerhouses, a few university endowments have an enviable legacy of successful investing. Some endowment managers have been so influential that Wall Street investors have attempted to copy them and strategies have emerged such as “the Yale Model” and “the Harvard Approach”.

When you consider that over the past 10 years, the S&P 500 has returned 7.42% annually and the average college endowment has returned 5.1% annually, not all endowment managers are hot shot investors. One of the most noteworthy endowment manager is David Swensen at Yale. In New Haven, his strategy has been to play “quarter back” where he allocates funds to various outside money managers that he believes can outperform. During his tenure, he has increased allocations towards hedge fund and private equity strategies. He manages $25.4 billion for the Bulldogs and has been able to achieve returns of 8.1% annually over the past ten years. When you consider the size of Yale’s endowment, 68 basis points of outperformance is pretty good and surely has made a difference for the University. Last week, Yale reported that its endowment earned 3.4% for the fiscal year ending June 30th. While he didn’t beat the S&P 500’s 3.99% over the same time frame, he did beat arch rival Harvard’s 2% loss. According to Cambridge Associates, a firm that manages about $9 billion in foundation and endowment assets, the average endowment returns, over the same times frame, was a loss of 2.7%.

It may seem tempting to try and mimic David Swensen’s strategy at Yale, but it’s important to remember that he has a few distinct advantages over wealthy individuals and families that makes his returns virtually impossible to copy. First, Universities have a boundless time horizon, which means they can take much riskier investments than what would be prudent for an individual. Another consideration is that due to the size of endowments that utilize numerous complex strategies, they enjoy lower fees than even the wealthiest private investors. Lastly, Universities don’t have to worry about Uncle Sam. Tax free exemption is by far the biggest advantage that endowments have over everyday investors. With long term capital gains taxed at 15-20%, a school’s tax free status makes a huge difference in returns each year.

While some investors may find success focusing on complex strategies, and other are better off using more simple approaches, we believe that being smart about your personalized strategy is the key for each investor.

Last Week’s Highlights:

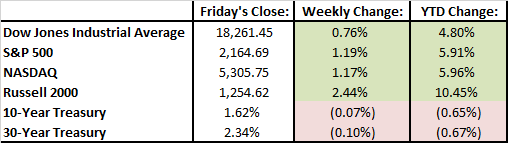

The Fed didn’t raise rates last week and is most likely holding off until December. Stocks rallied on the announcement but then pulled back some of their gains on Friday. We saw a lot of price movement in oil towards the end of the week. Oil prices surged on Friday on speculation that Saudi Arabia was going to agree to trim production and Iran was going to agree to cap its output, but prices came back down when a Saudi official said nobody should expect a deal coming out of next week’s meeting.

Looking Ahead:

Headlines this week will likely revolve around the presidential debate scheduled for Monday night, OPEC’s meeting in Algiers through the middle of the week, and the releases of consumer and manufacturing data that could show us whether or not the economy is struggling. The market hasn’t reacted to the pending election very much this year but Monday night’s debate could shake things up a bit. Another political worry is that congress won’t be able to reach a budget deal by Sept. 30th. If they don’t, congress could “shut down” the federal government.